Last updated: July 27, 2025

Introduction

Naftifine hydrochloride (HCl) is an antifungal agent widely used in topical treatments for dermatophytic infections, candidiasis, and seborrheic dermatitis. Its growing prevalence in dermatology, combined with expanding global markets and regulatory developments, influences its market dynamics and price trajectory. This analysis explores current market conditions, demand drivers, competitive landscape, regulatory environment, and projects future pricing trends for Naftifine HCl.

Market Overview

Therapeutic Applications and Market Demand

Naftifine HCl primarily serves dermatological conditions. Its efficacy against dermatophytes such as Trichophyton and Microsporum species, alongside efficacy in seborrheic dermatitis and candidiasis, positions it as a vital component of topical antifungal therapy.

The global dermatology market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5% from 2022 to 2030, driven by increasing prevalence of skin infections, rising ophthalmic and dermatological conditions, and demographic shifts toward aging populations.[1] Naftifine's share within this market is expected to expand, especially as formulations improve and new markets open.

Geographical Market Distribution

- North America: Dominates due to high healthcare standards and widespread dermatology clinics, with a significant share of prescription and OTC sales.

- Europe: Presents substantial growth owing to rising dermatological conditions and evolving healthcare regulations encouraging topical antifungal use.

- Asia-Pacific: The fastest-growing segment, buoyed by large population bases, increasing urbanization, and improving healthcare infrastructure.

Production and Supply Chain Dynamics

Naftifine HCl manufacturing relies on advanced chemical synthesis processes with key production centers in Europe and Asia. The supply chain is sensitive to raw material availability, geopolitical factors, and manufacturing regulations. Recent supply chain disruptions, such as those caused by the COVID-19 pandemic, have temporarily impacted availability and pricing.

Competitive Landscape

Major Players

The market features a mix of generic manufacturers, dermatology specialist companies, and compounded pharmaceutical suppliers. Leading companies include:

- Bausch Health: Known for branded formulations like Lamisil (terbinafine) but also involved in generic antifungals.

- Zhejiang Hisun Pharmaceutical Co., Ltd.: Offers raw materials and generics.

- Mundipharma: Engages in topical antifungal formulations.

Patent Status and Market Entry Barriers

Naftifine HCl itself is off-patent, facilitating a surge of generic formulations. Barriers to entry predominantly relate to manufacturing complexities, regulatory approvals, and quality assurance.

Regulatory Environment

The regulatory landscape varies globally:

- United States: The FDA classifies Naftifine as an over-the-counter (OTC) drug in certain formulations. Approval pathways for generic manufacturing are well established.

- European Union: EMA registration categorizes it as an OTC medication, with stringent quality, safety, and efficacy requirements.

- Developing Markets: Often experience less rigorous regulatory requirements, influencing market entry timing and product pricing.

Regulatory reforms aimed at facilitating generic and OTC drug approval are expected to accelerate market access, increasing competition and impacting prices.

Pricing Dynamics and Future Projections

Current Price Benchmarks

As of 2023, the average wholesale price (AWP) for Naftifine HCl topical formulations varies:

- 30g tube (0.25% or 1% formulation): Approximate $10–$15.

- Raw Material Cost: Estimated at $20–$50 per kilogram, depending on purity and manufacturing scale.

The price of finished formulations is influenced by manufacturing costs, active ingredient purity, formulation stability, and marketing expenses.

Factors Influencing Future Price Trends

- Market Saturation: With multiple generic manufacturers, price competition is expected to suppress retail and wholesale prices.

- Regulatory Changes: Reduced barriers in emerging markets may increase product availability, further driving down prices.

- Raw Material Costs: Volatile raw material prices—affected by supply chain disruptions—can cause fluctuations in manufacturing costs.

- Technological Advancements: Innovative formulations (e.g., sustained-release topical applications) could command higher prices initially, but increased competition would eventually bring prices down.

- Demand Fluctuations: Rising dermatological disease prevalence, especially in developing countries, will sustain demand growth.

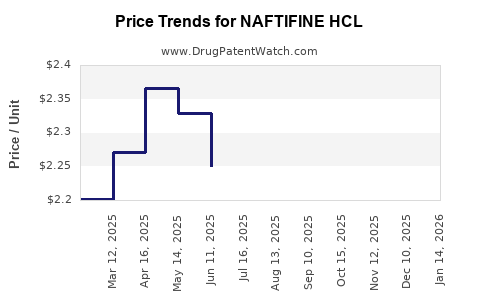

Projected Price Trajectory (2023–2030)

- Short-term (2023-2025): Prices are expected to decline owing to market saturation and increased generic competition. Raw material costs and regulatory streamline may marginally offset this trend.

- Medium-term (2025-2027): Stabilization likely as the market reaches equilibrium. Premium formulations or combination therapies may fetch higher prices.

- Long-term (2028–2030): Price plateau or slight decreases as manufacturing efficiencies improve and global uptake increases; however, niche formulations and advanced delivery systems may sustain higher price points in certain segments.

Overall, the wholesale price for bulk raw material is projected to decrease by 10–20% over this period, with finished product prices declining proportionally.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost-efficient production and regulatory navigation to capitalize on increasing demand, especially in emerging markets.

- Investors: Growth prospects remain favorable due to expanding dermatological market segments, though intense generic competition necessitates differentiation.

- Healthcare Providers: Cost-effective formulations emerging from competitive markets could broaden patient access to antifungal therapies.

- Regulatory Bodies: Streamlining approval pathways, particularly for generics and OTCs, could accelerate market entry and further influence pricing.

Key Takeaways

- Naftifine HCl remains a critical topical antifungal with expanding global demand driven by dermatological condition prevalence.

- The market is highly competitive, with multiple generics influencing downward price trends.

- Supply chain vulnerabilities and raw material costs impact manufacturing costs but are likely to improve with technological advancements.

- Regulatory reforms, especially in emerging markets, will accelerate market access, exerting further downward pressure on prices.

- Price projections suggest a steady decline of 10–20% over the next five years, with some niche formulations maintaining premium pricing.

FAQs

Q1: How does the patent status of Naftifine HCl impact market prices?

A1: Being off-patent, Naftifine HCl faces significant generic competition, leading to lower retail and wholesale prices due to increased market accessibility and price competition.

Q2: What are the main factors influencing raw material costs for Naftifine HCl?

A2: Raw material costs are driven by supply chain stability, raw material availability, geopolitical factors, and manufacturing efficiencies, with recent disruptions causing temporary price increases.

Q3: Which regions are expected to witness the fastest growth in Naftifine HCl demand?

A3: Asia-Pacific is projected to lead demand growth owing to increasing dermatological conditions, expanding healthcare infrastructure, and rising urbanization.

Q4: How might regulatory changes affect the future pricing of Naftifine HCl?

A4: Reforms that streamline approval processes for generics and OTC formulations will likely increase market entry, intensify competition, and further reduce prices.

Q5: Are there emerging formulations of Naftifine HCl that could command higher prices?

A5: Yes. Innovations such as sustained-release topical formulations, combination therapies, and delivery systems with enhanced absorption could sustain higher prices but are subject to patent and regulatory considerations.

Sources

[1] Grand View Research. "Dermatology Market Size, Share & Trends Analysis Report." 2022.