Last updated: July 27, 2025

Introduction

Nadolol, a non-selective beta-adrenergic receptor blocker, plays a critical role in managing conditions such as angina pectoris, hypertension, and certain cardiovascular disorders. Market dynamics, patent landscape, manufacturing trends, and emerging therapies influence its pricing and commercial viability. This analysis captures current market realities and offers price trajectory insights for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview and Therapeutic Role

Nadolol’s primary indications include prophylaxis of angina pectoris, management of hypertension, and off-label use for certain arrhythmias. Its unique property of long half-life (about 24 hours) allows once-daily dosing, enhancing patient adherence. The drug’s leading position is not driven by high innovation but by established efficacy and safety profiles, rendering it a staple generic medication across global markets.

Global demand remains steady, with North America and Europe accounting for the majority of consumption due to high cardiovascular disease prevalence and established healthcare practices. Emerging markets, notably in Asia and Latin America, are experiencing increased access to affordable cardiovascular therapies, including nadolol, driven by expanding healthcare infrastructure and disease awareness.

Market Drivers and Challenges

Drivers

- Established Therapeutic Use: Nadolol's proven efficacy in preventing angina episodes sustains steady demand.

- Cost-Effectiveness: As a generic, it offers a lower-cost alternative to newer beta-blockers, supporting healthcare budgets.

- Patent Expiry and Generics: Nadolol's patent expired decades ago, facilitating proliferation of generic versions, which exert downward pricing pressure.

- Rising Cardiovascular Disease Burden: Increasing prevalence of hypertension and ischemic heart disease globally fuels consistent demand.

Challenges

- Market Saturation: The mature status of nadolol limits growth, primarily affecting pricing margins.

- Competing Therapies: Introduction of highly selective beta-blockers (e.g., atenolol, bisoprolol) and newer agents such as vasodilatory beta-blockers (carvedilol) limit nadolol’s market share.

- Regulatory and Reimbursement Policies: Variations in approval statuses and reimbursement policies influence market penetration and pricing.

- Emerging Treatment Paradigms: Advances in interventional cardiology and novel therapies might reduce reliance on traditional beta-blockers.

Patent and Regulatory Landscape

Nadolol was patented in the 1960s, leading to immediate and widespread generic development upon patent expiry. Currently, no patents protect the molecule; however, formulation patents or improved delivery systems could influence regional markets temporarily.

Regulatory approvals remain stable across key regions, enabling broad manufacturing and distribution. Regulatory barriers for generics are minimal but vary regionally, affecting pricing strategies.

Manufacturing and Supply Chain Dynamics

Global manufacturing of nadolol is highly consolidated among generic manufacturers. Cost structures are favorable due to established synthesis routes and scale economies. Nonetheless, supply chain disruptions, raw material prices, and regulatory compliance costs can intermittently impact pricing stability.

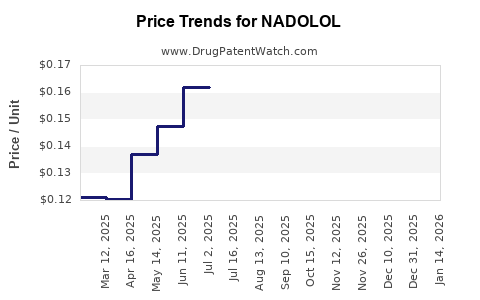

Pricing Trends and Future Projections

Current Pricing Realities

As of 2023, nadolol’s average wholesale prices (AWP) for a standard 30-day supply (starting from the US and scaled for key markets) are approximately:

- United States: $10–$15

- Europe: €8–€12

- Asia (India/China): $2–$5

These prices reflect significant generics competition, with discounts often exceeding 50% off branded equivalents.

Projected Price Trajectory (2023-2033)

Considering market maturity, competition, and healthcare trends, the following projections are anticipated:

- Short-term (2023–2025): Prices remain relatively stable with minor fluctuations due to currency effects and supply chain factors. Expect a stabilization around current levels in mature markets.

- Mid-term (2026–2028): Slight downward pressure as new generics enter markets, further commoditizing the drug, with prices declining by approximately 10–15%.

- Long-term (2029–2033): Market saturation and potential substitution by newer therapies may lead to additional price reductions, with wholesale prices potentially approaching $1–$3 in high-volume markets, especially in emerging regions.

Factors Influencing Future Pricing

- Market Penetration of Alternatives: Greater adoption of selective beta-blockers or other cardiovascular modulators could further depress nadolol’s price.

- Policy and Reimbursement Changes: Cost-containment measures in healthcare systems (e.g., formulary restrictions) can influence negotiated prices.

- Emerging Biosimilars/Innovations: While biosimilars are less relevant for small molecules like nadolol, formulation innovations could impact prices marginally.

- Global Economic Conditions: Currency fluctuations and inflation affect manufacturing costs and retail prices, especially in emerging markets.

Competitive Landscape and Market Share

Nadolol’s prominence is predominantly in developed markets with established generic infrastructure. Competing products include atenolol, metoprolol, and propranolol, which may be preferred based on specific patient needs or clinician preferences.

Emerging competition from brand-name entities offering specialized formulations or delivery systems might marginally influence market share, but the low-cost generic landscape ensures nadolol’s continued relevance, primarily in cost-sensitive jurisdictions.

Regulatory and Policy Outlook

Health authorities’ focus on cost-effective prescribing aligns with generic promotion policies, favoring nadolol’s sustained market presence. Patent lapses and regulatory harmonization promote wider access, particularly in developing countries.

However, evolving regulatory environments emphasizing evidence-based medicine may favor newer, more selective beta-blockers with improved side effect profiles, potentially constraining nadolol’s market scope over the long term.

Implications for Stakeholders

Pharmaceutical manufacturers should prioritize cost-efficient production and regional compliance to maintain competitive pricing. Healthcare providers and payers should consider nadolol as a cost-effective option within its therapeutic class in formulary decisions. Investors should monitor regional regulatory and competitive developments to predict market share shifts and price trajectories.

Key Takeaways

- Nadolol remains a low-cost, widely used generic beta-blocker, with stable demand driven by established indications.

- Market saturation and competition from other beta-blockers are limiting growth; prices are expected to decline gradually over the next decade.

- Price projections suggest wholesale costs could fall to $1–$3 in key markets by 2033, especially in regions with high generic penetration.

- Regulatory policies favoring cost containment and increasing healthcare access in emerging markets will support continued demand.

- Stakeholders should monitor the evolving competitive landscape, policy changes, and emerging therapies to adapt pricing and distribution strategies effectively.

FAQs

1. What factors primarily influence the pricing of nadolol in global markets?

Nadolol’s pricing is influenced by generic competition, regional regulatory policies, manufacturing costs, healthcare system reimbursement policies, and the availability of alternative therapies.

2. How does patent status affect nadolol’s marketability and price?

Since nadolol’s patent expired decades ago, multiple generic manufacturers produce it, resulting in increased competition and significantly lowered prices.

3. Are there upcoming developments that could impact nadolol’s market share?

Yes. The introduction of newer, selective beta-blockers, advanced cardiovascular therapies, and potential formulation innovations could influence switch patterns and market share.

4. Which regions are likely to see the most significant price declines for nadolol?

Emerging markets—particularly in Asia and Latin America—where generic penetration is high and healthcare costs are tightly controlled, are expected to experience the most notable price reductions.

5. What strategic moves should generic manufacturers consider to remain competitive?

Focusing on cost-efficient manufacturing, maintaining regulatory compliance, expanding into underserved markets, and offering competitive pricing will be essential for sustained profitability.

Sources

[1] FDA Drug Approvals and Patent Data, 2022

[2] IMS Health, Global Pharma Trends, 2022

[3] World Health Organization, Cardiovascular Disease Statistics, 2023

[4] IQVIA, Global Generics Market Report, 2022