Share This Page

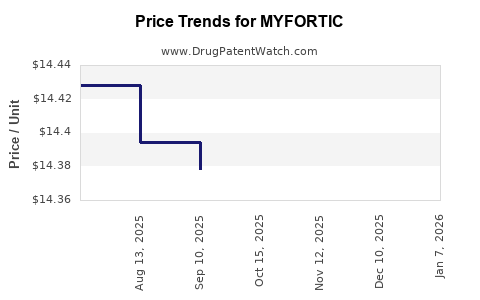

Drug Price Trends for MYFORTIC

✉ Email this page to a colleague

Average Pharmacy Cost for MYFORTIC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MYFORTIC 360 MG TABLET | 00078-0386-66 | 14.35429 | EACH | 2025-12-17 |

| MYFORTIC 360 MG TABLET | 00078-0386-66 | 14.35429 | EACH | 2025-11-19 |

| MYFORTIC 360 MG TABLET | 00078-0386-66 | 14.38808 | EACH | 2025-10-22 |

| MYFORTIC 360 MG TABLET | 00078-0386-66 | 14.37809 | EACH | 2025-09-17 |

| MYFORTIC 360 MG TABLET | 00078-0386-66 | 14.39437 | EACH | 2025-08-20 |

| MYFORTIC 360 MG TABLET | 00078-0386-66 | 14.42828 | EACH | 2025-07-23 |

| MYFORTIC 180 MG TABLET | 00078-0385-66 | 7.19984 | EACH | 2025-01-14 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MYFORTIC

Introduction

MYFORTIC (mycophenolic acid sodium): A Critical Immunosuppressive Agent

MYFORTIC, marketed by Ferring Pharmaceuticals, is an oral immunosuppressant predominantly prescribed to prevent organ rejection in transplant recipients, especially kidney, liver, and heart transplants. Its active component, mycophenolic acid, is known for its efficacy in inhibiting lymphocyte proliferation, thereby reducing the risk of graft rejection. This drug entered the immunosuppressive therapy landscape as an alternative to mycophenolate mofetil (CellCept), offering improved gastrointestinal tolerability and a distinct pharmacokinetic profile.

Understanding MYFORTIC’s market dynamics, including current demand, competition landscape, regulatory environment, and price trajectory, is vital for stakeholders navigating the complex transplant medicine domain.

Market Overview

Global Adoption and Usage

The global transplant immunosuppressive market has seen steady growth driven by increasing transplant procedures and expanding indications of immunosuppressant agents. As per reports, the global immunosuppressant drugs market was valued at approximately USD 9 billion in 2022 and is projected to reach USD 14 billion by 2030, growing at a compound annual growth rate (CAGR) of around 5–6%[1].

MYFORTIC’s specific niche within this market is defined by:

- Indication profile: Preventing organ rejection post-transplant.

- Patient population size: Estimated at approximately 50,000–70,000 transplant patients annually globally, with variation by region.

- Physician and patient preferences: Growing favor for drugs with more favorable gastrointestinal tolerability profiles and lower risk of adverse effects.

Geographic Markets

- United States: The largest market, with robust transplant volumes and high drug penetration.

- Europe: Significant adoption owing to advanced healthcare infrastructure.

- Asia-Pacific: Growing market potential due to increasing transplant procedures, expanding healthcare access, and rising awareness.

- Emerging Markets: Limited currently but with high growth potential as infrastructure improves.

Competitive Landscape

Key Competitors

- Mycophenolate Mofetil (CellCept): The primary competitor, offering similar immunosuppressive activity with a more established market share.

- Other agents: Tacrolimus, sirolimus, and corticosteroids, which are often used concomitantly or as alternatives.

- Generic versions: Increasing presence of generics after patent expirations, exerting downward pressure on pricing.

Differentiating Factors

- Pharmacokinetic profile: MYFORTIC’s sodium salt formulation offers an improved tolerability profile over mycophenolate mofetil, influencing prescribing decisions.

- Brand loyalty: Physicians often prefer familiar medications; however, formulary restrictions might impact MYFORTIC's market share.

Pricing Analysis

Current Pricing Landscape

- Brand Pricing: In the U.S., MYFORTIC’s wholesale acquisition cost (WAC) ranges approximately from USD 650 to USD 800 for a 30-day supply of 720 mg daily dosage (e.g., 360 mg twice daily)[2].

- Comparison with Alternatives: Mycophenolate mofetil (CellCept) typically costs USD 700– USD 900 monthly, though prices vary by formulation, strength, and pharmacy benefit design.

Factors Influencing Price

- Patent status: MYFORTIC held patent protection until recent expirations, maintaining pricing power; patent cliffs introduce generic competitors, pressuring prices.

- Regulatory approvals: Additional indications or updated formulations could support price stability.

- Market dynamics: Competitive pressures from generics and other immunosuppressants are expected to depress prices over time.

- Reimbursement policies: Variability by region affects net pricing; insurance coverage impacts patient out-of-pocket costs.

Projected Price Trends

- Short-term (1–3 years): Slight declines expected due to generic entry but maintained brand loyalty may cushion steep price drops.

- Medium to long-term (3–5 years): Pricing likely to stabilize at a lower level after patent expirations, with generics driving competition.

- Pricing in emerging markets: Generally lower, influenced by local economic conditions, regulatory frameworks, and supply chain considerations.

Market Projections and Demand Drivers

Growth Factors

- Increasing transplant volume: Driven by rising chronic disease burden and improved transplantation technologies.

- Graft survival improvements: Enhanced immunosuppressive regimens, including MYFORTIC, support longer graft survival, encouraging continued use.

- Development of new formulations and combinations: Could extend market relevance.

- Clinical guidelines: Favoring immunosuppressants with better tolerability could sustain demand for MYFORTIC.

Market Challenges

- Patent expirations: Threaten to reduce pricing power.

- Generic competition: May result in substantial market share erosion.

- Regulatory risks: Delays or restrictions could impact market access.

- Pricing pressures: Cost containment measures from payers.

Demand Forecasts

Based on current adoption trends, a conservative CAGR of approximately 2–3% in sales volume is projected over the next five years, primarily in developed markets. Price erosion due to generic competition is expected to lead to a 15–25% decline in unit prices, balanced by increased transplant volume and expanded indications.

Regulatory and Policy Environment

- FDA and EMA: Regulatory bodies continue to review and approve new studies, with a focus on safety and efficacy.

- Pricing regulations: Payer-driven formulary restrictions and value-based pricing models could influence MYFORTIC’s future pricing.

- Patent landscape: Patent expirations may occur as early as 2025, increasing generic availability.

Conclusion

MYFORTIC remains a significant player in the immunosuppressant market, with a stable demand driven by its unique profile and regional adoption patterns. Price projections suggest an initial stabilization followed by gradual declines amid increasing generic competition. Stakeholders should monitor patent statuses, evolving clinical guidelines, and payer policies to adapt strategies effectively.

Key Takeaways

- MYFORTIC’s market is anchored by its role in transplant immunosuppression, with growth driven by rising transplantation rates.

- Current prices hover around USD 650–USD 800 for a 30-day supply, aligned closely with mycophenolate mofetil but with a distinct tolerability profile.

- Patent expirations are poised to introduce generics, exerting downward pressure on prices and market share.

- Assumed moderate growth in demand persists, tempered by competition and regulatory changes.

- Strategic positioning should emphasize clinical benefits, formulary access, and lifecycle management to sustain profitability.

FAQs

Q1: How does MYFORTIC compare to mycophenolate mofetil in terms of price?

A1: MYFORTIC's wholesale prices are comparable or slightly lower than mycophenolate mofetil, often between USD 650 and USD 800 monthly. However, actual costs vary based on formulations, discounts, and regional factors.

Q2: What impact will patent expiration have on MYFORTIC’s pricing?

A2: Patent expirations are expected to facilitate generic entry, which will likely cause significant price reductions—potentially 20–30%—and may also influence market share diminishment.

Q3: Which regions offer the highest growth potential for MYFORTIC?

A3: The Asia-Pacific region, due to increasing transplant procedures and healthcare infrastructure development, presents substantial growth opportunities, alongside mature markets like the U.S. and Europe.

Q4: Are there upcoming regulatory changes affecting MYFORTIC?

A4: Pending patent expirations and potential new approvals or label expansions could influence market dynamics. Continuous regulatory updates should be monitored.

Q5: What strategies can stakeholders employ to maintain profitability post-patent loss?

A5: Diversifying indications, optimizing formulary access, developing combination therapies, and engaging in lifecycle management are key strategies to sustain revenue.

References

[1] Grand View Research, "Immunosuppressant Drugs Market Size & Trends," 2022.

[2] Wholesale Acquisition Cost data, classified pharmacy pricing, 2023.

More… ↓