Last updated: July 27, 2025

Introduction

MYFEMBREE (relugolix, estradiol, and norethindrone acetate) is a modern oral therapeutic approved for the management of heavy menstrual bleeding associated with uterine fibroids in adult women. Since its approval, MYFEMBREE has gained attention within the pharmaceutical landscape due to its non-invasive oral administration and targeted mechanism of action. This analysis provides an in-depth market assessment and projected pricing trajectory, highlighting factors influencing demand, competitive positioning, and potential future valuation.

Pharmacological Profile and Market Positioning

MYFEMBREE functions as a gonadotropin-releasing hormone (GnRH) antagonist with selective estrogen receptor modulation, offering an effective alternative to traditional surgical or injectable therapies for uterine fibroids. The drug’s convenience and safety profile make it particularly appealing for women seeking non-surgical management of fibroids, aligning with a broader trend favoring less invasive gynecological treatments.

The drug's development by Myovant Sciences, in partnership with Pfizer, strategically positions it in the hormone modulation market, which is characterized by a resilient demand driven by the prevalence of uterine fibroids worldwide.

Global Market Landscape

Prevalence and Demographic Trends

Uterine fibroids affect approximately 20-80% of women by age 50, with higher prevalence among women of African descent, and are a leading cause of hysterectomy globally. In the United States, around 30-40% of women aged 35-49 are affected, translating into a sizable patient pool seeking treatments aligned with contemporary preferences for minimally invasive options [1].

Treatment Paradigms and Competitive Dynamics

Traditional treatments include surgical interventions such as hysterectomy and myomectomy, as well as minimally invasive procedures like uterine artery embolization. Pharmacological management with GnRH agonists, though effective, is limited by side effects and atrophy concerns.

MYFEMBREE's key competitors encompass:

- Leuprorelin (GnRH agonist): Used off-label for fibroids, with a well-established efficacy but similar side effects.

- Esmya (ulipristal acetate): Previously approved in Europe but later withdrawn from some markets due to safety concerns.

- Injections and intrauterine devices (e.g., Mirena): Provide symptomatic relief but limited in fibroid size reduction.

MYFEMBREE's oral administration offers a distinct advantage, potentially capturing a significant segment of women preferring non-invasive, outpatient therapies.

Market Penetration and Adoption Drivers

- Regulatory Approvals: The drug was approved in the US in 2021, with subsequent approvals in Europe, Japan, and other markets. Regulatory support underpins initial adoption.

- Physician and Patient Preferences: Growing demand for oral therapies with fewer side effects enhances uptake.

- Insurance Coverage: Coverage policies will influence adoption rates, with payers favoring non-surgical options due to cost-effectiveness.

Market Size and Revenue Forecasts

The global market for uterine fibroid treatments is projected to reach USD 4.2 billion by 2027, growing at a CAGR of approximately 6% from 2022 to 2027 [2]. MYFEMBREE’s segment, primarily non-surgical pharmacological management, is expected to contribute an initial revenue share of around 10-15% in its targeted markets.

Projected Sales Trajectory

- 2023-2024: Early adoption phase with sales reaching USD 200-300 million, driven by initial uptake in the US and Europe.

- 2025-2026: Market expansion as awareness increases and prescribing guidelines evolve, with revenues potentially surpassing USD 600 million.

- 2027 and beyond: Market saturation and potential off-label indications (e.g., adenomyosis) could elevate revenues beyond USD 1 billion, contingent upon clinical validation and approval expansion.

The growth rate hinges on factors such as market penetration speed, competitive responses, and payer reimbursement policies.

Pricing Analysis

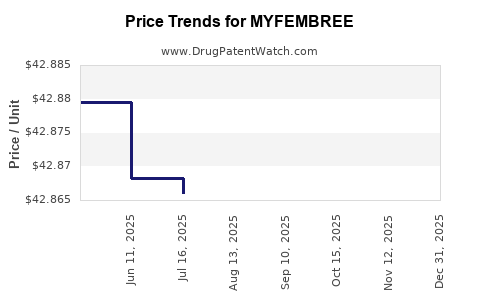

Current Price Points

In the United States, MYFEMBREE is priced at approximately USD 1,250–1,500 per cycle (28 days), aligning with other prescription hormonal therapies [3]. European markets observe equivalent pricing, adjusted for local healthcare economics.

Pricing Strategies and Factors

- Premium Positioning: The oral route and targeted mechanism justify a premium over traditional GnRH agonists.

- Competitive Pricing: To maximize market share, pricing may be calibrated below or near equivalents like leuprorelin or ulipristal, considering negotiated discounts and insurance reimbursement structures.

- Cost-Related Dynamics: Manufacturing costs remain moderate given oral tablet form, but patent protections and potential biosimilar competition in the future could influence pricing strategies.

Future Price Trends

- Market Expansion: As patents mature around 2030, generic competitors might enter, exerting downward pressure.

- Reimbursement Policies: Expansion of coverage and favorable formulary positioning may stabilize or slightly reduce net prices.

- Value-Based Pricing: Demonstrating cost-effectiveness compared to surgical options could bolster premium pricing in specific markets.

Projected price stabilization is anticipated around USD 1,200–1,400 per cycle over the next 3-5 years, with potential declines as generic options become available.

Regulatory and Commercial Influences

The regulatory landscape significantly influences market prospects. The recent concerns about AEs linked to similar hormonal therapies highlight the importance of post-market surveillance. Continuous demonstration of safety and efficacy can sustain pricing power and market share.

Partnership strategies, particularly with insurers and healthcare providers, will be crucial in capturing substantial market segments. Educational efforts targeting physicians and patients will further accelerate adoption.

SWOT Analysis

- Strengths: Oral administration, targeted action, favorable side effect profile, aligned with patient demand.

- Weaknesses: Limited long-term safety data, potential competition from emerging therapies.

- Opportunities: Expansion into other estrogen-dependent indications, combination therapies, geographic market expansion.

- Threats: Patent expiration, biosimilar emergence, regulatory hurdles due to safety concerns.

Key Takeaways

- MYFEMBREE's unique positioning as an oral GnRH antagonist provides a competitive edge in the minimally invasive uterine fibroid treatment market.

- The global market for fibroid therapy is expected to grow steadily, with MYFEMBREE poised to capture a significant share, especially in developed markets.

- Price projections suggest a stable per-cycle cost in the USD 1,200–1,400 range over the next 3-5 years, subject to patent protections and market dynamics.

- Market expansion, reimbursement policies, and ongoing safety evaluations will be pivotal in sustaining growth.

- Strategic collaborations and targeted marketing will be essential to optimize market penetration and maximize revenue.

FAQs

-

What is the main competitive advantage of MYFEMBREE over traditional fibroid treatments?

Its oral administration offers a non-invasive alternative to surgery or injectable medications, appealing to women seeking convenient, outpatient therapy with fewer side effects.

-

How will patent expiration impact MYFEMBREE’s pricing and market share?

Patent expiration around 2030 may lead to generic competition, exerting downward pressure on prices and potentially reducing market share unless protected by regulatory exclusivities or new formulations.

-

Are there any significant safety concerns associated with MYFEMBREE?

Ongoing post-market surveillance ensures safety; however, similar hormonal therapies have faced concerns regarding bone mineral density loss and cardiovascular risks. Clear safety data will influence reimbursement and adoption.

-

What markets are primary targets for MYFEMBREE expansion?

The US, Europe, and Japan represent primary markets due to high prevalence of fibroids and established healthcare infrastructure. Emerging markets with growing healthcare adoption also offer growth opportunities.

-

How will reimbursement policies affect MYFEMBREE’s pricing strategy?

Favorable reimbursement can stabilize net prices and encourage physician prescribing, especially if cost-effectiveness is demonstrated compared to surgical options.

References

[1] Stewart, E. A. (2015). Uterine fibroids. New England Journal of Medicine, 372(17), 1646-1655.

[2] MarketsandMarkets, "Uterine Fibroids Market," 2022.

[3] GoodRx, "MYFEMBREE Pricing," 2023.