Share This Page

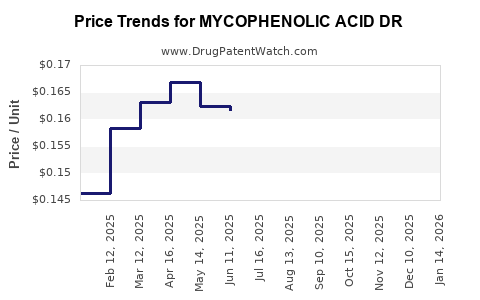

Drug Price Trends for MYCOPHENOLIC ACID DR

✉ Email this page to a colleague

Average Pharmacy Cost for MYCOPHENOLIC ACID DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MYCOPHENOLIC ACID DR 180 MG TB | 00904-6785-61 | 0.14036 | EACH | 2025-12-17 |

| MYCOPHENOLIC ACID DR 180 MG TB | 24979-0160-44 | 0.14036 | EACH | 2025-12-17 |

| MYCOPHENOLIC ACID DR 180 MG TB | 59651-0621-08 | 0.14036 | EACH | 2025-12-17 |

| MYCOPHENOLIC ACID DR 180 MG TB | 16729-0261-29 | 0.14036 | EACH | 2025-12-17 |

| MYCOPHENOLIC ACID DR 360 MG TB | 72888-0200-12 | 0.24437 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Mycophenolic Acid DR

Introduction

Mycophenolic acid (MPA) DR represents a critical segment within immunosuppressive therapeutics, primarily used in organ transplantation and certain autoimmune diseases. Developed as a delayed-release formulation, MPA DR enhances patient compliance by reducing gastrointestinal side effects inherent to immediate-release formulations. This report provides a consolidated market analysis, covering current dynamics, competitive landscape, regulatory factors, and future price projections, emphasizing the strategic implications for stakeholders.

Market Overview

Therapeutic Indications and Market Demand

Mycophenolic acid, marketed under various brand names such as Myfortic, is predominantly prescribed for preventing organ rejection post-transplantation, notably kidney, heart, and liver transplants. Its immunosuppressive mechanism involves the inhibition of inosine monophosphate dehydrogenase, essential for lymphocyte proliferation.

The global transplantation market is expanding due to rising incidences of end-stage organ failure and improved survival rates [1]. Consequently, demand for MPA and its formulations like MPA DR is projected to grow correspondingly.

Market Size & Growth Trajectory

As of 2022, the global immunosuppressant drugs market was valued at approximately USD 16.5 billion, with MPA-based drugs accounting for a significant share due to their efficacy and favorable safety profile [2]. The MPA DR segment is anticipated to expand at a CAGR of 6-8% over the next five years, driven by increased transplant procedures and patient preference for delayed-release formulations.

Competitive Landscape

Key Players

- GlaxoSmithKline (Myfortic): The leading supplier of MPA DR with a dominant market share, backed by robust marketing and established regulatory approval.

- Other generic manufacturers: Growing competition from emerging players offering cost-effective alternatives, potentially impacting pricing dynamics.

Product Differentiation

MPA DR's primary advantage over generic immediate-release formulations is improved gastrointestinal tolerability, potentially leading to higher patient adherence and better clinical outcomes.

Regulatory and Patent Environment

Patent Expiry and Market Entry Barriers

- The primary patent for Myfortic expired around 2020 in several key markets, enabling generic competition.

- Regulatory pathways for approval of generic MPA DR are streamlined under existing bioequivalence standards, facilitating market entry for new entrants [3].

Pricing Regulation

Healthcare systems in North America and Europe exert price controls and reimbursement restrictions, impacting profit margins. Emerging markets often have less restrictive policies, creating pricing asymmetries.

Pricing Analysis and Projections

Current Pricing Trends

- Branded MPA DR (Myfortic): Average wholesale prices (AWP) range from USD 250 to USD 300 per 30-tablet pack worldwide.

- Generics: Entry post-patent expiry has led to a significant price decline, with generics available at approximately 40-60% of branded costs, around USD 100-150 per pack.

Factors Influencing Price Movements

- Market Penetration of Generics: Increased approvals and market entry reduce average selling prices (ASPs).

- Regulatory Policies: Stricter price controls in prominent markets may suppress prices further.

- Manufacturing Costs: Advances in synthesis and scale economies are expected to decrease production costs, facilitating lower prices.

Future Price Projections (2023-2028)

Based on current trends, the following projections are anticipated:

- Branded MPA DR (Myfortic): Prices are expected to decline marginally (~5-10%) due to generic competition but remain relatively stable owing to brand loyalty and perceived quality.

- Generics: Prices may decrease further by an additional 10-20%, driven by increasing market saturation and manufacturing efficiencies. In emerging markets, prices could stabilize at USD 80-120 per pack.

Given the expiration of key patents and rising generic competition, the average market price for MPA DR is poised to decline cumulatively by approximately 15-25% over the next five years.

Market Challenges and Opportunities

Challenges

- Pricing Pressure: Escalating generic competition pressures profit margins.

- Reimbursement and Regulatory Barriers: Variations across geographies complicate global pricing strategies.

- Clinical Acceptance: Ensuring physician confidence in generic counterparts remains critical.

Opportunities

- Expanding Indications: Growing use in autoimmune diseases could diversify revenue streams.

- Emerging Markets: Higher growth potential due to improving healthcare infrastructure.

- Formulation Innovations: Developing fixed-dose combinations or improvements in bioavailability may command premium pricing.

Implications for Stakeholders

Manufacturers should focus on cost-efficient production methods and strategic patent management. Companies need to balance pricing strategies across developed and emerging markets, considering regulatory landscapes and reimbursement policies. Investment in clinical data supporting biosimilarity and interchangeability will enhance market access.

Key Takeaways

- The global MPA DR market is on an upward trajectory, with demand driven by rising transplantation cases and autoimmune indications.

- Post-patent expiry competitive pressures have significantly lowered prices, especially among generics.

- Future price reductions are anticipated, especially in markets with increased regulatory and reimbursement controls.

- Differentiation through formulation improvements and expanding indications will be vital for maintaining profitability.

- Strategic market positioning in emerging economies offers growth opportunities amidst global price declines.

FAQs

1. What factors primarily influence the pricing of MPA DR?

Regulatory environment, patent status, market competition, manufacturing costs, and reimbursement policies significantly influence pricing decisions.

2. How does generic competition impact the price of MPA DR?

Increased generic entries lead to substantial price reductions, often driven by competitive bidding, bioequivalence approval, and market saturation.

3. Are there upcoming regulatory hurdles that could affect MPA DR prices?

Yes. Changes in reimbursement policies, stricter bioequivalence requirements, or new safety regulations can influence market access and pricing.

4. What growth opportunities exist for MPA DR companies?

Expanding indications (autoimmune diseases), penetration into emerging markets, and innovations in formulation are key growth avenues.

5. How does the emergence of biosimilars or alternative immunosuppressants impact MPA DR?

While biosimilars may not directly compete due to different mechanisms, improved alternatives could pressure MPA DR pricing and market share.

References

[1] Grand View Research. "Immunosuppressant Drugs Market Size, Share & Trends Analysis Report." 2022.

[2] MarketWatch. "Global Immunosuppressant Drugs Market Value & Forecasts." 2022.

[3] FDA. "Bioequivalence Standards and Regulatory Pathways." 2021.

More… ↓