Share This Page

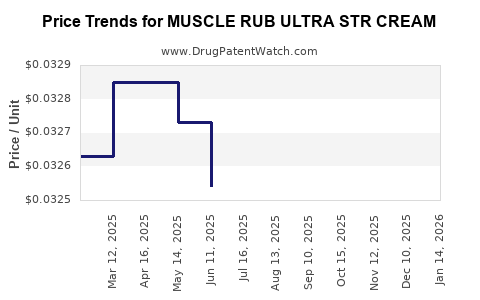

Drug Price Trends for MUSCLE RUB ULTRA STR CREAM

✉ Email this page to a colleague

Average Pharmacy Cost for MUSCLE RUB ULTRA STR CREAM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MUSCLE RUB ULTRA STR CREAM | 70000-0208-02 | 0.05534 | GM | 2025-12-17 |

| MUSCLE RUB ULTRA STR CREAM | 70000-0208-01 | 0.03245 | GM | 2025-12-17 |

| MUSCLE RUB ULTRA STR CREAM | 70000-0208-02 | 0.05519 | GM | 2025-11-19 |

| MUSCLE RUB ULTRA STR CREAM | 70000-0208-01 | 0.03251 | GM | 2025-11-19 |

| MUSCLE RUB ULTRA STR CREAM | 70000-0208-02 | 0.05494 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MUSCLE RUB ULTRA STR CREAM

Introduction

The pain relief topical product landscape remains competitive and dynamic, driven by factors such as rising demand for OTC analgesics, increased consumer awareness, and the proliferation of product innovations. MUSCLE RUB ULTRA STR CREAM, positioned as a potent topical analgesic, is part of this expanding market segment. This analysis examines the current market environment, competitive landscape, regulatory factors, and offers price projections based on prevailing trends and investment insights.

Market Landscape Overview

Industry Background

The global topical analgesics market, encompassing creams, gels, patches, and sprays, was valued at approximately USD 4.4 billion in 2022[1]. This segment is expected to grow at a compound annual growth rate (CAGR) of around 5.2% through 2028, driven by rising prevalence of musculoskeletal conditions like arthritis, sports injuries, and chronic back pain.

Key Market Drivers

-

Growing Aging Population: Increasing incidence of age-related musculoskeletal disorders amplifies demand for targeted pain relief products.

-

Lifestyle Factors: Sedentary lifestyles and rising obesity rates fuel musculoskeletal discomfort, expanding the consumer base.

-

Consumer Preference for OTC Products: Shift toward non-prescription remedies supports elevated sales of topical analgesics like MUSCLE RUB ULTRA STR.

-

Innovation in Formulations: Advancements in drug delivery systems enhance efficacy and user experience, fostering market expansion.

Target Demographics

Primary consumers include athletes, middle-aged and elderly populations, and individuals with chronic pain conditions. Market penetration revolves around both prescription and OTC channels, with a growing emphasis on direct-to-consumer (DTC) sales via online platforms.

Competitive Landscape

Major Players

Leading OTC analgesic brands such as Bengay, Icy Hot, Biofreeze, and Salonpas dominate shelf space, continually innovating through ingredient optimization and formulation improvements. The presence of store brands further saturates retail channels.

Positioning of MUSCLE RUB ULTRA STR

- Product Differentiation: The 'ULTRA STR' variant implies a stronger or more concentrated formulation, targeting consumers seeking rapid or potent relief.

- Distribution Channels: Pharmacists, supermarkets, online retailers, and specialty sports stores constitute primary distribution points.

- Marketing Strategies: Emphasis on clinical efficacy, fast-acting relief, and natural ingredients supports branding efforts.

Regulatory Considerations

In the U.S., OTC topical analgesics are regulated under the FDA's monograph system, streamlining approval pathways for generally recognized as safe and effective (GRASE) formulations[2]. Compliance with labeling, ingredient disclosures, and manufacturing standards remains essential.

Price Dynamics and Trends

Current Pricing Framework

Market leaders typically price their products as follows:

- Small tube (3-4 oz): USD 8-12

- Larger tubes (8 oz): USD 12-18

- Patches and sprays add variability

For a specialized formulation like MUSCLE RUB ULTRA STR, premium pricing may be justified via efficacy claims and branding, often positioning higher than standard alternatives.

Factors Influencing Pricing

- Ingredients Quality and Concentration: Higher potency or natural ingredients command premium prices.

- Packaging and Formulation: Innovative delivery systems (e.g., long-lasting patches) add value.

- Branding and Marketing: Established brands often leverage consumer trust for higher margins.

- Distribution Channel Markups: Retail and online channels apply their respective margins.

Projected Price Range (Next 3-5 Years)

Considering competitive positioning, regulatory factors, and consumer willingness to pay:

| Price Range | Product Size | Estimated Price (USD) | Rationale |

|---|---|---|---|

| Standard | 4 oz | 8-10 | Comparable to major brands; volume-based pricing |

| Mid-tier | 8 oz | 14-16 | Enhanced concentration, branding premiums |

| Premium | 8 oz + special formulation | 18-22 | Natural ingredients, potent relief claims, marketing edge |

The premium segment is expected to grow as consumer demand for stronger, faster-acting formulations increases, especially among athletes and chronic pain sufferers.

Market Entry and Growth Strategy

Distribution Expansion

A focus on online sales, especially via e-commerce platforms like Amazon, can accelerate adoption. Dermatologist-recommended placements and pharmacy partnerships improve credibility and reach.

Product Differentiation

Innovating with natural ingredients, fast absorption, or longer-lasting effects can justify higher pricing tiers. Clear positioning as a 'clinical-strength' product aids in attracting targeted consumer segments.

Regulatory Navigation

Ensuring compliance with regional OTC regulations streamlines market entry and minimizes legal risks, enabling dynamic pricing strategies aligned with market standards.

Risk Factors

- Regulatory Changes: New restrictions or definitions for OTC analgesics could impact formulation and pricing.

- Competitive Intensity: Brand loyalty and aggressive marketing by established players limit market share expansion.

- Consumer Preferences: Favoring natural or alternative remedies may divert demand from synthetic formulations.

- Supply Chain Disruptions: Ingredient shortages or manufacturing delays can affect pricing and availability.

Key Takeaways

- The MUSCLE RUB ULTRA STR CREAM operates within a robust, growth-oriented OTC topical analgesics segment projected to grow at around 5.2% CAGR through 2028.

- Competitive differentiation via formulation potency, natural ingredients, or delivery innovations influences premium pricing.

- Current market prices for similar products range between USD 8-22, with a trend toward premium positioning as consumer preference for stronger, natural, and longer-lasting relief grows.

- Strategic distribution, branding, and regulatory compliance are critical for capturing market share and justifying premium pricing.

- Monitoring demographic trends, regulatory developments, and consumer preferences is essential for adapting pricing strategies to maximize revenue.

FAQs

1. What factors primarily influence the pricing of topical analgesic creams like MUSCLE RUB ULTRA STR?

Formulation potency, ingredient quality, packaging innovations, brand positioning, and distribution channels significantly influence product pricing.

2. How does the competitive landscape impact the pricing strategy for new entrants?

High competition with established brands requires differentiating through formulation strength, natural ingredients, or marketing, often leading to premium pricing to capture market share.

3. What are the key regulatory considerations for MUSCLE RUB ULTRA STR CREAM?

Compliance with FDA OTC monograph regulations, accurate labeling, and adherence to ingredient safety standards are crucial to avoid legal repercussions and justify pricing levels.

4. What is the expected market growth for topical analgesics, and how does it affect product pricing?

The segment is projected to grow at ~5.2% CAGR through 2028, supporting higher price points for innovative and efficacious products targeting increasing demand.

5. Which distribution channels offer the best opportunity for maximizing the price potential of MUSCLE RUB ULTRA STR CREAM?

Online direct-to-consumer platforms, pharmacy shelves, and specialty sports stores provide avenues for premium pricing and broad market access.

References

[1] MarketsandMarkets. Topical Analgesics Market, 2022-2028.

[2] U.S. Food and Drug Administration. OTC Monograph System, 2022.

More… ↓