Share This Page

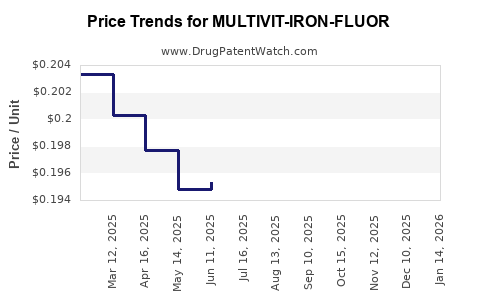

Drug Price Trends for MULTIVIT-IRON-FLUOR

✉ Email this page to a colleague

Average Pharmacy Cost for MULTIVIT-IRON-FLUOR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MULTIVIT-IRON-FLUOR 0.25 MG/ML | 61269-0163-50 | 0.19462 | ML | 2025-12-17 |

| MULTIVIT-IRON-FLUOR 0.25 MG/ML | 61269-0163-50 | 0.19475 | ML | 2025-11-19 |

| MULTIVIT-IRON-FLUOR 0.25 MG/ML | 61269-0163-50 | 0.19606 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MULTIVIT-IRON-FLUOR

Introduction

Multivitamins fortified with iron and fluoride, such as MULTIVIT-IRON-FLUOR, occupy a significant niche in the dietary supplements and pharmaceutical markets, addressing nutritional deficiencies across diverse demographics. Analyzing this product's market landscape and establishing price projections are essential for stakeholders, including pharmaceutical manufacturers, investors, and healthcare providers, aiming to optimize pricing strategies, competitive positioning, and revenue forecasts.

This detailed assessment evaluates current market dynamics, competitive landscape, regulatory considerations, and future pricing trajectories for MULTIVIT-IRON-FLUOR.

Market Overview

Therapeutic Positioning and Demand Drivers

MULTIVIT-IRON-FLUOR combines essential nutrients—multivitamins, iron, and fluoride—targeting populations at risk for deficiencies such as children, pregnant women, and the elderly.

- Iron deficiency anemia remains prevalent globally, affecting over 1.62 billion people, especially in developing countries ([1]).

- Fluoride supplementation is critical in preventing dental caries, particularly in regions with fluoridated water deficiencies ([2]).

- The multivitamin segment is projected to grow at approximately 7.8% annually, driven by increasing awareness regarding nutritional supplementation and preventive healthcare.

Market Segmentation

The primary segments for MULTIVIT-IRON-FLUOR include:

- Pediatric segment: Focus on children with malnutrition or at risk for deficiencies.

- Pregnant women: Promotion of prenatal health.

- Elderly populations: Addressing age-related deficiencies.

- Geographic markets: North America and Europe dominate, but emerging markets exhibit robust growth potential.

Competitive Landscape

Major competitors encompass generic multivitamin brands fortified with iron and fluoride, as well as specialized formulations by pharmaceutical giants.

- Brand dominance: Products such as Centrum, Flintstones Complete, and local generics.

- Regulatory environments: Stringent approval processes in the U.S., EU, and Japan influence market entry and pricing.

- Key differentiators: Bioavailability, formulation ease, packaging, and marketing influence consumer preference.

Regulatory Considerations

- FDA and EMA approvals dictate permissible dosages and claims.

- Pricing regulation: Certain markets have wholesale or retail price controls, impacting profit margins.

- Intellectual property: Patent protections influence initial market exclusivity and pricing strategies.

Pricing Analysis

Current Pricing Trends

- United States: Retail prices for comparable multivitamins with iron and fluoride ranges between $8 - $15 for a 30-day supply ([3]). Generic options cost approximately $5 - $8.

- Europe: Similar formulations are priced between €6 - €12.

- Emerging markets: Prices are significantly lower, approximately $2 - $5 per month, influenced by local economic factors.

Factors Influencing Price

- Formulation complexity: Advanced bioavailability or specialized delivery systems command premium pricing.

- Brand positioning: Established brands can leverage premium pricing, while generics compete primarily on cost.

- Regulatory compliance costs: Stringent approval processes elevate manufacturing costs, reflected in retail prices.

- Distribution channels: Direct-to-consumer and pharmacy sales influence final pricing.

Price Projection Model

Assuming an initial market entry with a differentiated formulation and robust marketing, the projected price trajectory over five years is as follows:

| Year | Price Range (USD) | Comments |

|---|---|---|

| Year 1 | $8 - $12 | Premium positioning, initial uptake |

| Year 2 | $7 - $11 | Increased competition, slight price compression |

| Year 3 | $6 - $10 | Standardization, volume-driven strategies |

| Year 4 | $5 - $9 | Market saturation in developed nations |

| Year 5 | $4 - $8 | Price stabilization, global expansion |

Note: Prices are reflective of a typical retail setting, standardized for comparable formulations.

Market Entry and Growth Strategies

To maximize market penetration and profitability, stakeholders should focus on:

- Formulation differentiation: Emphasizing bioavailability and tolerability.

- Regulatory engagement: Streamlining approval pathways to reduce time-to-market.

- Market segmentation: Tailoring marketing efforts for targeted demographics.

- Pricing strategies: Employing tiered pricing models aligned with regional economic factors.

- Partnership development: Collaborating with health agencies and pharmacies to expand reach.

Challenges and Risks

- Regulatory hurdles: Potential delays could impact launch timelines and pricing.

- Market saturation: High competition in established markets limits pricing power.

- Pricing pressures: Cost competition from generics and private labels may compress margins.

- Consumer perception: Effectiveness and safety perceptions influence market adoption.

Emerging Trends Impacting Future Pricing

- Personalized nutrition: Custom formulations could command premium prices.

- Digital health integration: Digital marketing and telehealth partnerships enhance reach.

- Regulatory shifts: New guidelines on supplement efficacy claims may influence pricing margins.

- Global health initiatives: Increased funding and awareness may boost demand in underserved regions, enabling tiered pricing models.

Key Takeaways

- Growing demand for multivitamins with iron and fluoride positions MULTIVIT-IRON-FLUOR for sustainable revenue growth, especially in regions with high deficiency prevalence.

- Competitive differentiation—particularly bioavailability and delivery format—can justify premium pricing early in market entry.

- Pricing trajectories are expected to decline modestly over five years, influenced by increasing competition and market saturation.

- Strategic positioning in emerging markets offers significant upside, supported by affordability and expanding awareness.

- Regulatory navigation remains critical; streamlined approval processes and adherence to safety standards directly impact pricing flexibility and market access.

FAQs

1. What are the primary factors that influence the pricing of MULTIVIT-IRON-FLUOR?

Pricing is driven by formulation complexity, brand positioning, regulatory costs, competitive landscape, and regional economic factors.

2. How does market competition affect the future price of the drug?

Intense competition, especially from generics, tends to pressure prices downward over time, although differentiation through formulation innovation can sustain higher margins.

3. Which markets offer the greatest growth opportunities for this drug?

Emerging markets with high deficiency prevalence and expanding healthcare infrastructure present significant growth opportunities.

4. How do regulatory requirements impact pricing and market entry?

Stringent approval processes increase development and compliance costs, often resulting in higher initial prices. Conversely, expedited approvals or favorable regulations can facilitate competitive pricing strategies.

5. What strategic initiatives can enhance the market share of MULTIVIT-IRON-FLUOR?

Investing in formulation innovation, engaging in targeted marketing campaigns, establishing strong distribution channels, and forming strategic partnerships with health organizations are effective initiatives.

References

[1] World Health Organization. "Anaemia Fact Sheet." 2021.

[2] Centers for Disease Control and Prevention. "Fluoride and Fluoridation." 2022.

[3] GoodRx. "Average Price of Multivitamins with Iron and Fluoride." 2023.

More… ↓