Share This Page

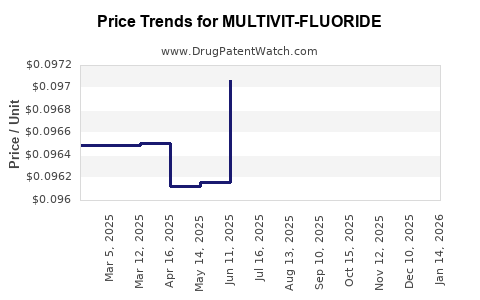

Drug Price Trends for MULTIVIT-FLUORIDE

✉ Email this page to a colleague

Average Pharmacy Cost for MULTIVIT-FLUORIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MULTIVIT-FLUORIDE 1 MG TAB CHW | 61269-0157-01 | 0.09472 | EACH | 2025-12-17 |

| MULTIVIT-FLUORIDE 1 MG TAB CHW | 58657-0165-01 | 0.09472 | EACH | 2025-12-17 |

| MULTIVIT-FLUORIDE 1 MG TAB CHW | 58657-0165-90 | 0.09472 | EACH | 2025-12-17 |

| MULTIVIT-FLUORIDE 1 MG TAB CHW | 61269-0157-01 | 0.09501 | EACH | 2025-11-19 |

| MULTIVIT-FLUORIDE 1 MG TAB CHW | 58657-0165-01 | 0.09501 | EACH | 2025-11-19 |

| MULTIVIT-FLUORIDE 1 MG TAB CHW | 58657-0165-90 | 0.09501 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MULTIVIT-FLUORIDE

Introduction

MULTIVIT-FLUORIDE, a comprehensive multivitamin supplement fortified with fluoride, targets dental health optimization. As an innovative combination drug, it seeks to position itself within the dental and nutritional markets, capitalizing on increasing consumer awareness about oral health and preventive care. This report provides a detailed market analysis and future price projections, enabling stakeholders to make strategic decisions regarding development, manufacturing, and commercialization.

Market Overview

Current Market Landscape

The global oral health market was valued at approximately $33 billion in 2022, with expected compound annual growth rate (CAGR) around 5.2% from 2023 to 2030 (Grand View Research). The rising prevalence of dental caries, periodontal diseases, and increased consumer preference for preventive healthcare underpin this growth.

Multivitamins represent a significant segment, with the global market reaching $43 billion in 2022 and expanding at a CAGR of 8.2% [1]. Fluoride products, chiefly in toothpaste and supplements, are vital components of oral health strategies, driven by public health initiatives. Combining these elements in a single formulation, as MULTIVIT-FLUORIDE does, could carve out a niche within both segments.

Competitive Environment

The current competitive landscape includes standalone multivitamin brands (e.g., Centrum, Nature's Way), fluoride supplements (e.g., NeutraFluor, FLUORIDE tabs), and combination products marketed as oral health accessories. Few formulations integrate multivitamins with fluoride in a single, oral-dose format; thus, market entry opportunities exist for innovative products.

Key competitors are largely regional, with the global presence dominated by conglomerates like GSK and Colgate-Palmolive. However, niche and premium segments favor innovative formulations, especially in health-conscious markets.

Regulatory and Reimbursement Trends

Regulatory bodies such as the U.S. FDA and EMA enforce strict standards on oral health and supplement claims. The European Union emphasizes fluoride safety protocols, especially concerning children. Reimbursement frameworks for nutritional supplements are limited; hence, market success depends predominantly on consumer demand and direct sales strategies.

Market Potential and Segmentation

Target Demographics

- Children (ages 6-12): Emphasis on fluoride’s role in cavity prevention, with tailored dosing.

- Teens and young adults: Focus on aesthetic and health consciousness.

- Adults: Preventive care, especially for those at higher risk for periodontal disease.

- Elderly: Addressing age-related dental health declines.

Geographic Hotspots

- North America: Mature market with high awareness, substantial spending capacity.

- Europe: Favorable regulatory climate, support for preventive dental initiatives.

- Asia-Pacific: Rapidly growing middle class, increasing oral health awareness, and favorable demographics.

Distribution Channels

- Pharmacies and drugstores (majority share)

- Supermarkets and hypermarkets

- Dental clinics and healthcare providers

- Online pharmacies and direct-to-consumer websites

Price Analysis and Projections

Current Pricing Environment

Multivitamin supplements generally retail at $0.10–$0.50 per dose, depending on formulation, branding, and distribution channel. Fluoride supplements usually range $0.05–$0.20 per unit.

Given the combination nature, MULTIVIT-FLUORIDE is expected to command a premium. Assuming a perceived value additive, retail prices could fall within $0.30–$0.70 per dose.

Cost of Goods Sold (COGS)

Manufacturing costs vary based on dosage, formulation complexity, and scale. For a high-quality, stable, and bioavailable formula, the COGS could approximate $0.10–$0.20 per unit at scale.

Pricing Strategy

Premium positioning suggests a retail price around $0.50–$0.70 per dose. This positioning leverages its combination benefit, superior bioavailability, and targeted marketing.

Price Projections (2023–2030)

Assuming gradual market penetration, favorable regulatory conditions, and growing consumer interest, the following projections are feasible:

| Year | Estimated Average Price per Dose | Rationale |

|---|---|---|

| 2023 | $0.50 | Launch phase, targeting early adopters |

| 2025 | $0.55 | Slight increase reflecting brand positioning |

| 2027 | $0.60 | Growing market acceptance, potential economies of scale |

| 2030 | $0.65 | Market maturity, inflation, ongoing innovation |

The slight upward trajectory accounts for inflation, product differentiation, and potential premium branding.

Strategic Drivers Influencing Price

- Regulatory approvals and compliance costs: As a combination product, navigating multiple regulatory frameworks inflates initial costs but can justify higher pricing.

- Claims and marketing: Emphasizing comprehensive oral health benefits bolsters consumer willingness to pay a premium.

- Manufacturing scale: Larger production runs will reduce per-unit costs, enabling competitive pricing and margins.

- Market penetration and competitive response: Aggressive marketing and strategic partnerships will influence pricing flexibility.

Revenue and Market Share Projections

Assuming early-stage penetration within targeted demographics and channels:

- 2023: 1 million units sold globally, generating $0.50 per dose × 1 million = $0.5 million.

- 2025: 5 million units, revenue of $2.75 million at average price.

- 2030: 20 million units, revenue reaching $13 million, with continued growth and market expansion.

Margins and profitability are contingent on manufacturing scale, marketing investment, and regulatory compliance.

Challenges and Opportunities

Challenges

- Regulatory hurdles: Variations in fluoride and supplement regulations may delay market entry.

- Consumer perceptions: Skepticism regarding fluoride safety and supplement efficacy can influence demand.

- Market saturation: Growing competition from established multivitamin and oral health brands.

Opportunities

- Preventive health focus: Rising consumer preference for proactive health products aligns with product positioning.

- Customization and targeting: Variations for age, demographic, and region can optimize market reach.

- Digital marketing: Leveraging online channels to educate and engage health-conscious consumers.

Conclusion

MULTIVIT-FLUORIDE presents a compelling opportunity within the expanding oral health and nutritional supplement markets. Its envisioned premium price positioning around $0.50–$0.70 per dose aligns with consumer valuation of comprehensive dental health benefits. Price projections indicate steady growth over the next decade, driven by market expansion, improved manufacturing efficiencies, and strategic marketing.

Manufacturers should prioritize regulatory strategy, consumer education, and targeted distribution channels to maximize market penetration and financial returns.

Key Takeaways

- The global oral health market is expanding at over 5% CAGR, driven by preventive care trends.

- MULTIVIT-FLUORIDE can occupy a niche by combining multivitamins with fluoride, addressing diverse age groups and demographics.

- Initial retail pricing at $0.50–$0.70 per dose offers a premium positioning aligned with perceived added value.

- Price projections anticipate a gradual increase to $0.65 per dose by 2030, reflecting market maturation and inflation.

- Success depends on regulatory navigation, effective marketing, and establishing trust around fluoride safety.

FAQs

1. What is the unique selling point of MULTIVIT-FLUORIDE?

It combines essential multivitamins with fluoride in a single dose, promoting both general health and dental cavity prevention, offering convenience and targeted oral health benefits.

2. How does fluoride safety impact market acceptance?

Regulatory standards vary; transparent safety data and compliance are vital for consumer trust and regulatory approval, especially for pediatric formulations.

3. What are the key regulatory considerations?

Compliance with FDA and EMA regulations regarding dietary supplements, claims substantiation, and fluoride content limits influence market entry and marketing strategies.

4. Which markets offer the most growth potential?

North America and Europe remain mature but lucrative markets, while Asia-Pacific presents high growth opportunities driven by increasing oral health awareness.

5. How can manufacturers mitigate market entry risks?

By investing in rigorous safety testing, building brand credibility through healthcare partnerships, and deploying targeted marketing to educate consumers on fluoride benefits.

Sources:

- Grand View Research, "Oral Care Market Size, Share & Trends Analysis Report," 2023.

More… ↓