Share This Page

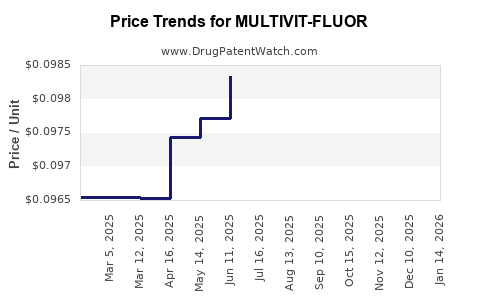

Drug Price Trends for MULTIVIT-FLUOR

✉ Email this page to a colleague

Average Pharmacy Cost for MULTIVIT-FLUOR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MULTIVIT-FLUOR 0.25 MG/ML DROP | 58657-0325-50 | 0.20168 | ML | 2025-12-17 |

| MULTIVIT-FLUOR 0.25 MG/ML DROP | 61269-0161-50 | 0.20168 | ML | 2025-12-17 |

| MULTIVIT-FLUOR 0.25 MG TAB CHW | 61269-0155-01 | 0.10353 | EACH | 2025-12-17 |

| MULTIVIT-FLUOR 0.5 MG TAB CHEW | 58657-0164-01 | 0.09500 | EACH | 2025-12-17 |

| MULTIVIT-FLUOR 0.25 MG TAB CHW | 58657-0163-01 | 0.10353 | EACH | 2025-12-17 |

| MULTIVIT-FLUORIDE 1 MG TAB CHW | 61269-0157-01 | 0.09472 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MULTIVIT-FLUOR

Introduction

MULTIVIT-FLUOR, a proprietary multivitamin supplement infused with fluoride, addresses common deficiency concerns and dental health needs. Its unique formulation combines essential vitamins with fluoride compounds, targeting populations seeking oral health improvement alongside general wellness. Given its innovation and the current market dynamics, a thorough market analysis and price projection are critical for stakeholders evaluating investment, commercialization strategies, and competitive positioning.

Market Landscape Overview

Growing Demand for Oral and General Wellness Supplements

The global dietary supplement market is expanding robustly, driven by increasing health consciousness, product innovation, and aging populations [1]. Specifically, the demand for dental health products, including fluoride-containing supplements, is rising due to the persistent prevalence of dental caries and periodontal disease. The incorporation of multivitamins enhances appeal for preventive health management, further broadening target demographics.

Key Target Segments

- Pediatric Population: Emphasis on preventive oral health starting early, with fluoride supplementation recommended by dental associations.

- Adults and Elderly: For general wellness and maintaining optimal mineral levels, especially in regions with fluoride-deficient water supplies.

- Developing Countries: Rising awareness and improving healthcare infrastructure amplify demand.

Competitive Landscape

Existing fluoride supplements are often standalone products or incorporated into toothpaste and mouthwashes. Multivitamin-fluoride combinations like MULTIVIT-FLUOR are less prevalent, offering differentiating benefits. Major competitors include:

- Local and regional formulations available OTC.

- Prescription alternatives, primarily in dental clinics.

- Mega-brand multivitamins with optional fluoride supplements.

The novelty of MULTIVIT-FLUOR positions it as a niche yet promising entrant, especially if backed by clinical validation and strong distribution channels.

Regulatory Environment and Approvals

Regulatory pathways influence market entry costs and timelines. The classification of MULTIVIT-FLUOR as a dietary supplement, OTC drug, or combination product varies by jurisdiction:

- United States (FDA): Supplements classified under dietary supplement regulations, requiring Generally Recognized as Safe (GRAS) status and adherence to Good Manufacturing Practices (GMP).

- Europe (EMA): Regulatory pathways under food supplements or medicinal products, contingent on claims.

- Emerging Markets: Regulatory frameworks often less stringent but with increasing oversight.

Securing necessary approvals and compliance certifications benefits market access and credibility.

Market Size and Growth Projections

Current Market Valuation

The global fluoride supplements market was valued approximately at USD 350 million in 2022, with a compound annual growth rate (CAGR) projected at 4-6% over the next five years [2]. The multivitamin segment commands around USD 35 billion globally, with increasing overlap in functional supplement offerings.

Projected Market Trajectory

Considering the integration trend and increasing consumer preference for comprehensive wellness solutions, the multivitamin-fluoride segment could exhibit a CAGR of 6-8% from 2023 through 2028, with potential acceleration in regions prioritizing dental health and preventive care.

Market Penetration Strategies

- Targeted marketing campaigns emphasizing dual health benefits.

- Strategic partnerships with dental clinics and healthcare providers.

- Distribution via pharmacies, online channels, and health stores.

Pricing Analysis and Projections

Factors Influencing Price Points

- Product formulation complexity: Combining vitamins and fluoride safely and effectively.

- Manufacturing costs: Quality control, compliance, and R&D investments.

- Regulatory costs: Approvals and certifications.

- Market positioning: Premium vs. competitive pricing strategies.

- Distribution channels: Wholesale, retail, pharmacy margins.

Initial Price Benchmarking

Current similar multivitamin products priced in the OTC segment range from USD 10 to USD 25 per bottle (30-60 capsules/tablets). Fluoride supplements alone often retail at USD 5 to USD 15.

MULTIVIT-FLUOR, positioned as a doctor-recommended, health-enhancing supplement, could command a premium price point:

- Estimated retail price: USD 15 to USD 30 per unit in mature markets.

- Pricing elasticity allows flexibility, especially with evidence-based marketing.

Price Projections (2023–2028)

- 2023: Launch phase, pricing set at USD 20 to balance positioning and production costs.

- 2024–2025: With increased production efficiency and market acceptance, price could stabilize around USD 18–22.

- 2026–2028: As competition emerges and brand equity solidifies, potential price reduction to USD 15–20 may occur, driven by volume sales and market expansion.

Revenue and Profitability Forecasts

Assuming a modest initial market share capturing 10% of the fluoride supplement market in key regions, projected revenues by 2028 could reach USD 150–200 million, assuming sustained growth rates and expansion into new markets.

Gross margins are expected to be 30–50%, contingent on manufacturing scale, sourcing efficiencies, and regulatory costs. Continued innovation and marketing are critical to enhancing brand value and sustaining price points.

Challenges and Risks

- Regulatory hurdles may delay product launch or impose additional costs.

- Market acceptance depends heavily on clinical evidence supporting efficacy and safety.

- Pricing pressures from competitors and generic entrants.

- Consumer perceptions regarding fluoride safety and multivitamin benefits.

Mitigating these risks requires rigorous clinical trials, strategic marketing, and early engagement with regulatory bodies.

Conclusions and Strategic Insights

MULTIVIT-FLUOR is positioned within a promising segment at the intersection of dietary supplements and dental health. Market growth is driven by increasing health awareness, preventive care emphasis, and consumer willingness to adopt multifunctional health products. The product’s success hinges on effective positioning, regulatory compliance, and competitive pricing—initially around USD 20 per unit with room for adjustment as volume grows and brand reputation solidifies.

Stakeholders should pursue targeted distribution, leverage clinical validation, and monitor regional regulatory developments. Strategic collaborations with dental and healthcare providers will enhance credibility and accelerate market penetration.

Key Takeaways

- The global fluoride supplement market is expanding at approximately 4-6% annually; adding multivitamins enhances appeal.

- Pricing for MULTIVIT-FLUOR is projected between USD 15–30 per unit, with initial launch prices around USD 20.

- Revenue potential reaches USD 150–200 million by 2028, assuming successful market adoption and geographic expansion.

- Regulatory pathways and clinical evidence are critical determinants of market entry and scalability.

- Competitive differentiation through efficacy, safety, and comprehensive health benefits will underpin long-term success.

FAQs

1. What factors influence the pricing strategy for MULTIVIT-FLUOR?

Pricing depends on manufacturing costs, regulatory compliance, positioning as a premium or standard product, competitor prices, and distribution channel margins.

2. How does regulatory approval affect the market outlook for MULTIVIT-FLUOR?

Stringent approval processes can delay market entry and increase costs but also enhance credibility and consumer confidence, influencing long-term sales.

3. What target markets should manufacturers focus on for initial product launches?

Priority markets include developed regions with high health awareness (North America, Europe) and emerging markets with increasing regulatory infrastructure and dental health initiatives.

4. How does consumer perception of fluoride impact product adoption?

Concerns about fluoride safety can hinder adoption; thus, transparent clinical validation and educational marketing are essential to mitigate fears and promote benefits.

5. What strategic partnerships can accelerate market penetration?

Collaboration with dental clinics, healthcare providers, NGOs, and pharmacies can enhance credibility, distribution reach, and consumer trust.

References

[1] Grand View Research, “Dietary Supplements Market Size & Share,” 2022.

[2] Statista, “Fluoride Supplements Market Revenue Forecast,” 2023.

More… ↓