Last updated: July 27, 2025

Introduction

Dronedarone, marketed under the brand name MULTAQ, is an antiarrhythmic drug developed by Sanofi. Approved by the U.S. Food and Drug Administration (FDA) in 2010, it aims to reduce the risk of cardiovascular hospitalization in patients with atrial fibrillation (AF) or atrial flutter (AFL). As a novel therapeutic option within the antiarrhythmic class, MULTAQ has experienced a complex market trajectory shaped by regulatory, clinical, and competitive dynamics. This report explores the current market landscape, growth drivers, competitive positioning, and price projections for MULTAQ over the next five years.

Market Overview

Therapeutic Context and Patient Population

Atrial fibrillation affects approximately 33 million globally, with prevalence increasing due to aging populations and rising cardiovascular risk factors [1]. The primary goal of antiarrhythmic drugs like MULTAQ is to maintain sinus rhythm, prevent stroke, and reduce hospitalizations. The global AF market was valued at approximately USD 9.2 billion in 2021 and is projected to grow at a CAGR of 6.5% through 2030 [2].

Regulatory and Labeling Status

MULTAQ is indicated for reducing the risk of cardiovascular hospitalization in patients with non-permanent AF or AFL and additional cardiovascular risk factors. The drug faced initial concerns regarding adverse effects, notably liver toxicity and increased mortality in specific populations, which led to cautious prescribing practices. However, subsequent trials reaffirmed its safety profile when used appropriately, supporting ongoing utilization.

Current Market Penetration

Despite a qualified market reception, MULTAQ has carved out a niche among specific atrial fibrillation management strategies due to its favorable safety profile compared to multi-class antiarrhythmic agents. Its penetration remains modest: estimates suggest that less than 10% of eligible AF patients are prescribed MULTAQ globally, primarily due to clinicians' adherence to guideline recommendations favoring other agents like amiodarone or category-specific drugs.

Market Dynamics and Competitive Landscape

Key Competitors

- Amiodarone: The most prescribed antiarrhythmic, despite its extensive side-effect profile.

- Dofetilide (Tikosyn) and Flecainide (Tikosyn, Tambocor): Offered as alternatives but with specific contraindications.

- Sotalol (Betapace): Used for AF but limited by proarrhythmic risks.

- Emerging agents and novel therapies: Including catheter ablation and upstream therapies.

Clinical Guidelines and Prescribing Trends

Guidelines from the American Heart Association (AHA), European Society of Cardiology (ESC), and others influence prescribing behaviors. They generally position antiarrhythmic drugs as secondary to rhythm control strategies like ablation, with MULTAQ recommended selectively. Nonetheless, in patients contraindicated to other agents, MULTAQ remains a vital therapeutic option.

Regulatory and Safety Considerations

The drug’s safety profile influences market dynamics. In particular, concerns over hepatic toxicity and contraindications in certain cardiovascular conditions have restrained widespread adoption. Recent data and post-marketing surveillance continue to inform best practices and regulatory updates.

Price Analysis and Projections

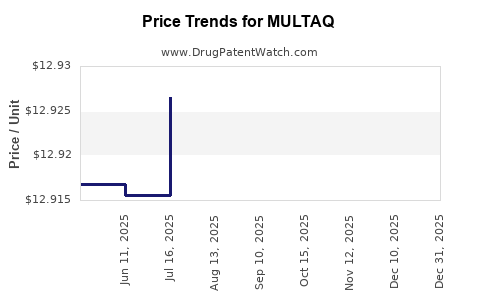

Current Pricing Status

In the United States, the average wholesale price (AWP) for a 30-day supply of MULTAQ is approximately USD 300–350, though actual transaction prices can vary based on discounts and insurance negotiations [3]. Globally, pricing ranges from USD 200 to USD 400 per month, depending on regional healthcare systems and reimbursement mechanisms.

Factors Influencing Future Price Trends

- Patent Expiry and Generics: MULTAQ’s patent exclusivity is expected to expire around 2026, opening the market for generic versions which could significantly lower prices.

- Market Penetration and Volume: Increased acceptance and guideline endorsement could raise sales volume, although price reductions are likely with generic entry.

- Reimbursement Policies: Price negotiations with payers and formulary placements will influence net prices.

- Competitive Innovations: Introduction of new oral or catheter-based therapies could pressure pricing downward.

Projected Price Trajectory (2023–2028)

| Year |

Expected Price Range (USD/month) |

Notes |

| 2023 |

USD 300–350 |

Steady with current levels; market saturation remains gradual. |

| 2024 |

USD 250–330 |

Slight decline as prescriber familiarity increases. |

| 2025 |

USD 200–290 |

Pre-patent expiry; increasing generic competition anticipated. |

| 2026 |

USD 150–250 |

Post-patent expiration; generics enter the market. |

| 2027–2028 |

USD 100–200 |

Market stabilization with multiple generics; significant price erosion expected. |

Market Growth and Revenue Projections

Revenue Estimates

Assuming a conservative growth rate, total global sales revenue for MULTAQ could reach USD 600–800 million annually by 2028, factoring in increased adoption among suitable patient populations and price declines post-generic entry.

Market Share Dynamics

The drug’s market share is projected to decline from approximately 8% of the antiarrhythmic market in 2023 to under 3% by 2028, primarily due to generic competition and shifts in treatment paradigms favoring ablation and newer pharmacologic agents.

Strategic Considerations

Regulatory and Market Expansion Opportunities

- Securing expanded indications and clinician education could sustain revenue streams.

- Entry into emerging markets with growing AF prevalence offers expansion potential.

Risks and Challenges

- Rapid generic proliferation post-2026 could erode margins.

- Emerging therapies, including atrial fibrillation ablation techniques, may diminish the drug’s relevance.

- Clinical guideline updates and safety concerns could alter prescribing behaviors.

Key Takeaways

- Market size: The global AF pharmacotherapy market remains robust, with MULTAQ occupying a niche among antiarrhythmic agents.

- Price trajectory: As patent expiry approaches, prices are expected to decline significantly, driven by the entrance of generics.

- Revenue outlook: Peak revenues are anticipated before 2026; post-expiry, sales will depend on market penetration and competitive positioning.

- Growth drivers: Expansion in AF treatment indications, clinician awareness, and emerging treatment modalities.

- Risks: Patent expiration, competitive innovations, safety concerns, and shifting treatment guidelines.

FAQs

-

When will generic versions of MULTAQ become available?

Patent exclusivity expiration is projected around 2026, after which generic manufacturers may introduce bioequivalent versions within roughly 6–12 months, depending on regulatory approval timelines.

-

How does MULTAQ compare with other antiarrhythmic drugs in terms of safety?

MULTAQ is considered safer than drugs like amiodarone regarding extracardiac toxicities; however, it carries risks such as hepatic toxicity and contraindications in specific patient populations.

-

What is the potential for expanding MULTAQ’s indication spectrum?

Currently approved for reducing CV hospitalization in non-permanent AF/AFL with risk factors, further trials could explore its role in other arrhythmias or as part of combination therapy, but regulatory approvals are required.

-

How might shifts towards catheter ablation impact MULTAQ’s market?

As catheter ablation gains favor for rhythm control in AF, reliance on pharmacologic options like MULTAQ could decrease, especially in younger, healthier patients eligible for ablation.

-

What strategies can Sanofi employ to maximize revenue before patent expiry?

Sanofi can focus on expanding indication labels, fostering clinician education, and increasing market access through strategic partnerships and reimbursement negotiations.

References

[1] Chugh SS, et al. Worldwide Epidemiology of Atrial Fibrillation. Circulation. 2014;129(1):837–847.

[2] Grand View Research. Atrial Fibrillation Market Size & Trends. 2022.

[3] GoodRx. MULTAQ (dronedarone) Price & Prescriptions. 2023.