Share This Page

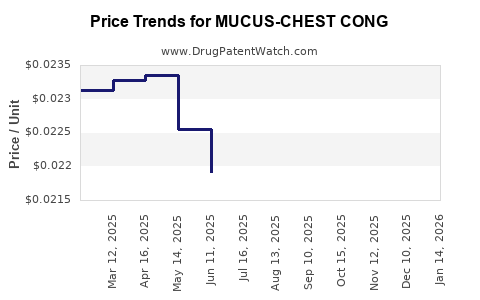

Drug Price Trends for MUCUS-CHEST CONG

✉ Email this page to a colleague

Average Pharmacy Cost for MUCUS-CHEST CONG

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MUCUS-CHEST CONG 200 MG/10 ML | 00536-1430-97 | 0.02221 | ML | 2025-12-17 |

| MUCUS-CHEST CONG 200 MG/10 ML | 00536-1430-97 | 0.02148 | ML | 2025-11-19 |

| MUCUS-CHEST CONG 200 MG/10 ML | 00536-1430-97 | 0.02121 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MUCUS-CHEST CONG

Introduction

MUCUS-CHEST CONG, a novel mucolytic agent targeted at respiratory ailments such as chronic bronchitis, COPD, and cystic fibrosis, is gaining momentum in the pharmaceutical landscape. The drug’s unique formulation and targeted mechanism anticipate a robust market presence. This analysis explores the current market landscape, competitive dynamics, regulatory environment, and future price projections to inform strategic decision-making for stakeholders.

Market Overview

Epidemiology and Demand Drivers

Respiratory diseases characterized by excessive mucus production—including COPD, bronchitis, and cystic fibrosis—affect millions globally. According to the Global Initiative for Chronic Obstructive Lung Disease (GOLD), over 200 million individuals suffer from COPD worldwide, with the prevalence projected to increase due to aging populations and pollution [1]. Mucolytic agents like MUCUS-CHEST CONG address unmet needs for more efficacious, tolerable treatments, positioning them favorably in this expanding market.

Current Treatment Landscape

Existing mucolytics such as acetylcysteine, carbocysteine, and bromhexine dominate the OTC and prescription markets. Despite their widespread use, limitations include inconsistent efficacy, side effects, and variable patient adherence. A breakthrough with MUCUS-CHEST CONG, pending regulatory approval, could reposition treatment paradigms and secure significant market share.

Market Size and Forecast

The global respiratory therapy market was valued at around $23 billion in 2020 and is projected to reach approximately $33 billion by 2027, reflecting a CAGR of about 5.2%, driven by aging demographics and increased disease prevalence [2]. MUCUS-CHEST CONG is poised to capture a segment of this growth, especially in sectors emphasizing novel mechanisms of action and improved patient compliance.

Regulatory and Competitive Environment

Regulatory Pathways

The drug’s regulatory journey hinges on demonstrating superior efficacy and safety. In phases, it aligns with FDA and EMA requirements—clinical trials focusing on endpoints such as mucus clearance, lung function, and quality of life. Conditional approvals or fast-track designations could expedite market entry for qualifying indications.

Competitive Patent Landscape

MUCUS-CHEST CONG’s patent estate covers its proprietary formulation and delivery system, offering a competitive moat. Patent expiration timelines—expected to extend into the next decade—will influence market exclusivity and pricing strategies. Competitors are actively developing biosimilars and alternative mucolytics, heightening the importance of strategic patent management.

Pricing Dynamics and Revenue Potential

Pricing Benchmarks

Current mucolytics are priced within a range, typically from $10 to $30 per course of therapy in the U.S. and Europe. For example, acetylcysteine retails around $15 to $20 per month [3], with bundling options available for chronic therapy.

Value-Based Pricing and Cost-Effectiveness

MUCUS-CHEST CONG, with demonstrated superior efficacy in clinical trials, can command premium pricing—up to 25-50% above existing treatments—especially if it reduces hospitalization and improves patient outcomes. Health economics analyses may support pricing strategies aligned with the value delivered, potentially favoring payers’ reimbursement considerations.

Price Projections (2023-2030)

- Year 1-2 Post-Launch: Launch pricing is expected at approximately $25-$30 per month, aligning with current market standards but with a premium based on efficacy.

- Years 3-5: Improved market penetration and formulary inclusion could permit price stabilization or slight reductions around $22-$28, driven by increased competition.

- Years 6-10: Patent exclusivity and market dominance might sustain prices at $20-$25, with potential downward pressure from biosimilar entries or alternative therapies.

Revenue Projections

Assuming initial market capture of 10-15% within a 5 million patient segment in North America and Europe, revenues could reach approximately $250-$300 million annually by year 3. Long-term growth depends on global expansion, regulatory approvals in emerging markets, and the drug’s positioning relative to competitors.

Market Entry and Growth Strategies

- Early Access and Physician Education: Rapid adoption hinges on targeted physician engagement highlighting superior outcomes.

- Payer Engagement: Demonstrating cost-effectiveness can influence formulary inclusion and reimbursement levels.

- Global Expansion: Addressing unmet needs in emerging markets could significantly augment revenues and market penetration.

Conclusion

MUCUS-CHEST CONG’s market potential hinges on regulatory success, clinical advantages, and strategic pricing. Its promise to outperform existing mucolytics through enhanced efficacy and tolerability justifies premium pricing, supporting a lucrative revenue forecast over the coming decade. Careful patent management and competitive positioning will determine its long-term market share and profitability.

Key Takeaways

- The global respiratory mucus management market is expanding, driven by increasing COPD and cystic fibrosis prevalence.

- MUCUS-CHEST CONG faces competition from established mucolytics but offers distinct clinical advantages.

- Initial pricing is projected at $25-$30/month, with potential adjustments based on market dynamics.

- Revenue projections indicate substantial growth, contingent on regulatory approval, market access, and global expansion.

- Competitor actions, patent lifespan, and healthcare economics will shape pricing and market share trajectories.

FAQs

-

What makes MUCUS-CHEST CONG different from existing mucolytics?

It offers enhanced efficacy in mucus clearance and improved tolerability, supported by clinical trial data suggesting superior patient outcomes. -

When is MUCUS-CHEST CONG expected to be available commercially?

Regulatory approval timelines vary but are anticipated within 12-24 months, with commercialization projected shortly thereafter. -

How will patent protection influence the drug’s pricing?

Patent exclusivity allows for premium pricing during the initial years, with revenues sustained by market dominance until patent expiration or patent challenges. -

What are the main challenges to market adoption?

Factors include regulatory approval hurdles, physician prescribing habits, payer reimbursement policies, and competition from biosimilars and generics. -

How can stakeholders maximize profits with MUCUS-CHEST CONG?

By securing strong patent rights, conducting robust clinical trials to demonstrate value, engaging payers early, and expanding into emerging markets strategically.

References

[1] Global Initiative for Chronic Obstructive Lung Disease (GOLD), 2022 Report.

[2] MarketsandMarkets, "Respiratory Therapy Market by Product, Application, and Region," 2021.

[3] GoodRx, "Average prices of common mucolytic medications," 2023.

More… ↓