Share This Page

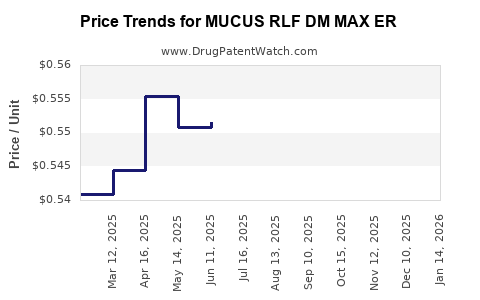

Drug Price Trends for MUCUS RLF DM MAX ER

✉ Email this page to a colleague

Average Pharmacy Cost for MUCUS RLF DM MAX ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MUCUS RLF DM MAX ER 1200-60 MG | 70000-0464-02 | 0.53895 | EACH | 2025-12-17 |

| MUCUS RLF DM MAX ER 1200-60 MG | 00536-1213-88 | 0.53895 | EACH | 2025-12-17 |

| MUCUS RLF DM MAX ER 1200-60 MG | 00536-1447-88 | 0.53895 | EACH | 2025-12-17 |

| MUCUS RLF DM MAX ER 1200-60 MG | 70000-0464-01 | 0.53895 | EACH | 2025-12-17 |

| MUCUS RLF DM MAX ER 1200-60 MG | 70000-0464-02 | 0.54629 | EACH | 2025-11-19 |

| MUCUS RLF DM MAX ER 1200-60 MG | 00536-1213-88 | 0.54629 | EACH | 2025-11-19 |

| MUCUS RLF DM MAX ER 1200-60 MG | 70000-0464-01 | 0.54629 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MUCUS RLF DM MAX ER

Introduction

MUCUS RLF DM MAX ER, a combination pharmaceutical product, addresses respiratory conditions involving excessive mucus production, cough, and bronchospasm. As a long-acting, extended-release (ER) medication, it caters to patients requiring sustained symptom control. This analysis evaluates the current market landscape, competitive environment, regulatory considerations, and future price trajectory, aiming to inform stakeholders on strategic decision-making.

Product Overview

MUCUS RLF DM MAX ER combines expectorant, antitussive, and bronchodilator agents, typically including guaifenesin, dextromethorphan, and extended-release formulations, designed to provide sustained relief from cough and mucus congestion. Its unique ER formulation aims to enhance patient adherence, minimize dosing frequency, and improve symptom management.

Market Landscape

Global and U.S. Market Trends

The global respiratory therapeutics market was valued at approximately USD 30 billion in 2022, with expected compound annual growth rate (CAGR) of around 6% until 2030, driven by rising prevalence of respiratory diseases, aging populations, and increased awareness of respiratory health. The U.S. holds the largest share, attributable to high disease prevalence and advanced healthcare infrastructure [1].

Key Indications and Demographics

The primary indications—influencing demand—are chronic bronchitis, COPD, asthma, and acute upper respiratory infections. Incidence increases with age, creating a substantial elderly population segment seeking effective, long-acting symptom management.

Competitive Landscape

Several branded and generic products compete within this segment, including:

- Robitussin DM Max and Delsym ER for cough suppression.

- Mucinex Max for mucus relief.

- Other combination products with similar active ingredients.

The market is characterized by high generic penetration, pressurized pricing, and a trend towards combination therapies for improved compliance.

Regulatory and Patent Environment

MUCUS RLF DM MAX ER’s patent life, exclusivity status, and regulatory approvals influence its market penetration and pricing. Given the expiration of patents on many active ingredients, generic competition is escalating, exerting downward pressure on prices.

Regulatory pathways via the FDA (in the United States) include 505(b)(2) applications for reformulations or combination products, potentially extending market exclusivity if successfully navigated. Patent litigation and formulation innovations are vital for prolonging product lifecycle.

Pricing Dynamics

Current Pricing Landscape

The price of MUCUS RLF DM MAX ER is influenced by:

- Brand vs. Generic: The branded product commands higher prices; generics are typically 30-50% cheaper.

- Formulation Complexity: ER formulations often command premium pricing due to manufacturing and stability challenges.

- Market Access and Reimbursement: Insurance coverage, pharmacy benefit managers (PBMs), and formulary placements significantly impact patient out-of-pocket costs.

In the U.S., the average retail price for similar ER combination cough products ranges from USD 30 to USD 70 per month of therapy. Premium brands sometimes exceed USD 80 per month.

Pricing Trends and Pressures

- Post-Patent Expiry: Introduction of generics is expected to reduce the price delta, with typical 20-50% price declines observed within two years of patent expiration.

- Market Penetration and Competition: Generic entry and OTC availability increase pressure, decreasing margins.

- Pricing Strategies: Manufacturers may employ value-based pricing, bundling, or patient assistance programs to retain market share.

Future Price Projections (2023-2030)

Short-Term Outlook (2023-2025)

- Existing Brand Premium: The product is likely to sustain a price point of USD 35-50 per month, considering current market conditions and patent exclusivity.

- Impact of Pending Patent Challenges: If patent protections are challenged or expire, prices are expected to decline by approximately 30-50%.

- Competitive Launches: Entry of generics could accelerate price erosion, especially in mature markets like the U.S. and Europe.

Medium to Long-Term Outlook (2026-2030)

- Market Saturation & Generics Domination: Expect prices for the original branded MUCUS RLF DM MAX ER to stabilize at a lower level, perhaps USD 20-30 per month.

- Formulation Innovations: Next-generation ER formulations or combination therapies with improved efficacy or tolerability could command premium pricing, extending revenue streams.

- Market Expansion: Emerging markets with less-developed regulatory environments may offer higher margins temporarily, but with increasing generic competition.

Pricing Drivers

- Regulatory exclusivity periods

- Generic approval timelines

- Market demand trends

- Reimbursement policies and healthcare spending

Implications for Stakeholders

Manufacturers should anticipate a gradual decline in prices post-patent expiry, emphasizing cost-efficient manufacturing, pipeline innovation, and strategic partnerships. Conversely, investors and payers must monitor patent statuses and generics' entry to adjust valuation and coverage policies accordingly.

Conclusions

MUCUS RLF DM MAX ER operates within a highly competitive, price-sensitive market driven by patent expiration cycles and increasing generic market share. While current pricing sustains a premium owing to ER formulation advantages, future projections indicate significant downward pressure, with median prices likely to stabilize between USD 20-30 per month by 2030. Effective lifecycle management, through reformulation, clinical differentiation, and strategic market positioning, remains essential to optimize revenue streams.

Key Takeaways

- The respiratory therapeutics market is expanding but faces imminent generic competition for MUCUS RLF DM MAX ER.

- Existing patent protections support current premium pricing; however, patent expiry could reduce prices by up to 50% within two years.

- Price projections forecast a decline to USD 20-30 per month by 2030, contingent on patent landscape and market competition.

- Formulation innovations and strategic positioning are critical to maintaining profitability amid declining brand premiums.

- Stakeholders should closely monitor regulatory developments, market entry of generics, and reimbursement policies for effective decision-making.

FAQs

1. What factors most significantly influence the price of MUCUS RLF DM MAX ER?

Patent status, manufacturing complexity, market competition (generics), reimbursement policies, and formulary placements are primary determinants.

2. How will patent expirations impact the drug’s pricing?

Patent expirations typically lead to increased generic competition, resulting in a median price reduction of 30-50% over the subsequent 1-2 years.

3. What are the key opportunities for extending the product’s market life?

Formulation enhancements, new combination therapies, and securing additional regulatory exclusivities can prolong profitability.

4. How do generics affect the overall market for respiratory combination drugs?

Generics increase accessibility and reduce drug costs, pressuring branded products to innovate or differentiate. They also erode market share and limit pricing power.

5. What strategies should companies adopt to maximize returns on MUCUS RLF DM MAX ER?

Investing in differentiating formulations, exploring new indications, optimizing manufacturing efficiencies, and engaging in strategic partnerships are essential.

References

[1] Grand View Research. Respiratory Therapeutics Market Size, Share & Trends Analysis Report, 2022-2030.

More… ↓