Share This Page

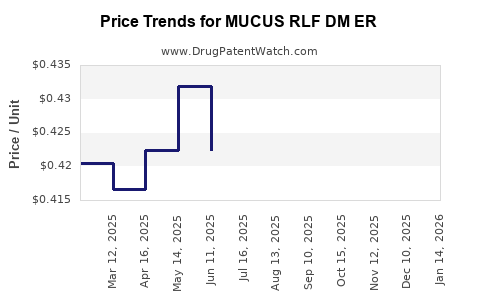

Drug Price Trends for MUCUS RLF DM ER

✉ Email this page to a colleague

Average Pharmacy Cost for MUCUS RLF DM ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MUCUS RLF DM ER 600-30 MG TAB | 00536-1446-34 | 0.37766 | EACH | 2025-12-17 |

| MUCUS RLF DM ER 600-30 MG TAB | 70000-0722-01 | 0.37766 | EACH | 2025-12-17 |

| MUCUS RLF DM ER 600-30 MG TAB | 00536-1161-34 | 0.37766 | EACH | 2025-12-17 |

| MUCUS RLF DM ER 600-30 MG TAB | 70000-0491-01 | 0.37766 | EACH | 2025-12-17 |

| MUCUS RLF DM ER 600-30 MG TAB | 00536-1161-37 | 0.37766 | EACH | 2025-12-17 |

| MUCUS RLF DM ER 600-30 MG TAB | 00536-1161-44 | 0.37766 | EACH | 2025-12-17 |

| MUCUS RLF DM ER 600-30 MG TAB | 00536-1446-34 | 0.39171 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MUCUS RLF DM ER

Introduction

MUCUS RLF DM ER is a combination pharmaceutical indicated predominantly for the symptomatic relief of cough and mucus production associated with respiratory conditions such as bronchitis and other chronic obstructive pulmonary diseases. Its formulation typically includes expectorants, cough suppressants, and decongestants in an extended-release (ER) formulation designed to improve patient compliance and therapeutic efficacy. With rising global respiratory disease prevalence and evolving pharmaceutical markets, understanding the market landscape and future pricing trends for MUCUS RLF DM ER is vital for stakeholders ranging from manufacturers to investors.

Market Overview

Industry Landscape

The demand for respiratory medications remains robust, driven by increasing incidences of chronic respiratory diseases, particularly in aging populations and regions with high pollution levels. The global expectorant and cough suppressant market was valued at approximately USD 4.2 billion in 2022, with a compound annual growth rate (CAGR) estimated at around 5.2% through 2030 [1].

Extended-release formulations, such as MUCUS RLF DM ER, have gained traction owing to better adherence, consistent drug levels, and improved symptom control. The patent landscape for combination expectorants is relatively mature, though new formulations with improved delivery systems or additional therapeutic benefits continue to emerge, fostering competition and innovation.

Key Market Drivers

-

Rising Respiratory Diseases: The World Health Organization reports over 200 million cases of chronic respiratory diseases worldwide, with COPD being the third leading cause of death [2].

-

Aging Population: Increased demand from the elderly, characterized by higher susceptibility to bronchitis, COPD, and related conditions.

-

Increased Access to Healthcare: Expanding healthcare coverage in developing countries facilitates greater prescription rates.

-

Regulatory Acceptance of ER Formulations: Extended-release formats improve adherence, leading to broader adoption.

Competitive Landscape

Major players include Pfizer, GlaxoSmithKline, Teva Pharmaceuticals, and Johnson & Johnson, each offering proprietary or generic formulations in the expectorant and cough suppressant therapeutic space. MUCUS RLF DM ER’s positioning depends on its unique formulation, efficacy profile, and market penetration strategies.

Regulatory Status and Patent Considerations

The regulatory pathway for MUCUS RLF DM ER involves approval by agencies such as the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA). Patent protections for proprietary formulations, delivery mechanisms, or combination strategies influence market exclusivity. The expiration of patents often triggers generics entry, impacting pricing.

Currently, if MUCUS RLF DM ER holds a patent exclusive to its formulation, it is poised to command premium pricing until patent expiry. Post-patent, price reductions typically occur due to generic competition, with potential variations based on market dynamics and dosing patent life.

Market Penetration and Geographic Considerations

North America

The North American market remains the largest, owing to high healthcare expenditure, widespread insurance coverage, and advanced distribution networks. MUCUS RLF DM ER penetration correlates with prescribing practices, physician awareness, and formulary inclusion.

Europe

Europe exhibits steady growth, driven by aging populations and respiratory disease awareness campaigns. Reimbursement policies influence pricing strategies significantly.

Emerging Markets

Countries such as India, China, and Brazil present substantial growth opportunities, driven by increasing respiratory disease prevalence and expanding healthcare infrastructure. Cost-sensitive pricing remains critical here, often favoring generic alternatives.

Price Projections

Current Price Dynamics

As of 2023, the average retail price of MUCUS RLF DM ER in the United States ranges between USD 150–USD 200 per month supply, depending on formulation strength and pharmacy markups [3]. Generic competitors typically price approximately 20–30% lower, pressuring branded formulations to justify premium pricing through efficacy or convenience.

Projection Framework

-

Patent-Driven Period (Next 2–3 Years): With a patent protection in place, MUCUS RLF DM ER can command a premium, with annual price inflation projected at 2–3% driven by inflation and healthcare system adjustments.

-

Post-Patent Expiry (3+ Years): Generic entry is anticipated within 3–5 years, leading to a potential price reduction of 30–50%, aligning with historical trends for respiratory medications.

-

Regional Variations: In low- and middle-income countries (LMICs), prices are expected to be substantially lower—potentially 50–70% off U.S. levels—due to market competition and reimbursement constraints.

Impact of Extended-Release Technology

Innovations in ER delivery systems may allow for sustained pricing premiums, particularly if clinical benefits such as fewer dosing requirements or improved symptom management are demonstrated. This could result in a 10–15% higher price point compared to immediate-release counterparts.

Emerging Trends

-

Market Consolidation: Larger pharmaceutical companies acquiring smaller niche players may stabilize or increase prices through bundled therapy offerings.

-

Value-Based Pricing: As real-world evidence (RWE) accumulates demonstrating superior efficacy or adherence, payers may be willing to reimburse at higher rates.

Market Forecast Summary

| Scenario | Price Trend | Timeframe |

|---|---|---|

| Patent protection in place | Slight increase (2–3% annually) with maintained premium pricing | Next 2–3 years |

| Post-patent expiration | Significant price decline (30–50%) due to generics entering the market | 3–5 years |

| Adoption of innovative ER formulations | Potential premium with stabilization or slight increase (10–15%) over existing prices | 2–5 years |

Risks and Challenges

- Generic Competition: Rapid entry post-patent expiry could force sharp price declines.

- Regulatory Barriers: Stringent approval processes and delays can affect market timing.

- Market Saturation: High existing market penetration might limit growth potential.

- Pricing Regulations: Payer pressures and price caps, especially in Europe and emerging markets, may constrain margins.

Conclusion

MUCUS RLF DM ER exists within a dynamic respiratory therapeutics market characterized by ongoing innovation and competitive pressures. Its current pricing strategy, market share, and future valuation hinge heavily on patent status, regional market considerations, and technological enhancements. Stakeholders should monitor patent expirations, regulatory developments, and emerging formulation innovations to optimize pricing and market growth.

Key Takeaways

- The global respiratory therapeutics market is poised for sustained growth, driven by demographic shifts and rising disease prevalence.

- MUCUS RLF DM ER’s premium pricing is supported by its extended-release technology and clinical efficacy, with prices projected to rise marginally during patent exclusivity.

- Post-patent expiry, expect significant price reductions aligned with generic market entry, especially in developed markets.

- Regional variations significantly influence pricing strategies; LMICs require cost-effective formulations to penetrate markets.

- Advancements in ER technology and real-world evidence can sustain or elevate pricing premiums beyond generic competition, provided clinical benefits are demonstrated.

FAQs

1. When is the patent expiry for MUCUS RLF DM ER likely to occur?

Patent expiration typically occurs 3–5 years after market launch, contingent on jurisdiction-specific patent protections and whether supplementary patents on formulations or delivery systems exist.

2. How does the introduction of generics impact the pricing of MUCUS RLF DM ER?

Generic entry often leads to a 30–50% reduction in price, driven by increased competition and pressure from healthcare payers seeking cost-effective alternatives.

3. Are there regional differences in the pricing strategy for MUCUS RLF DM ER?

Yes, developed markets like North America and Europe tend to adopt higher pricing models due to reimbursement systems, while emerging markets focus on affordability, leading to lower prices.

4. What role do technological innovations in ER delivery systems play in market positioning?

Innovations that improve efficacy, adherence, or convenience can justify premium pricing and expand market share despite existing competitors.

5. How might regulatory changes affect the future market for MUCUS RLF DM ER?

Stringent approval processes, pricing regulations, or reimbursement policies can influence market entry timelines, pricing strategy, and overall profitability.

References

[1] MarketsandMarkets, “Expectorants and Cough Suppressants Market,” 2022.

[2] WHO, “Global Surveillance, Prevention and Control of Chronic Respiratory Diseases,” 2021.

[3] GoodRx, “Pricing Data for Cough and Cold Medications,” 2023.

More… ↓