Share This Page

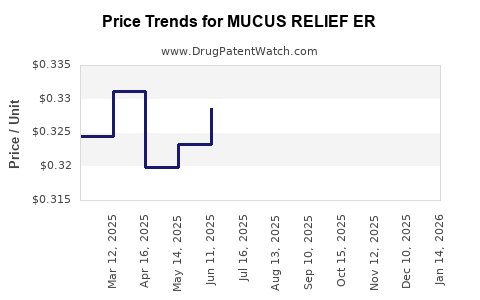

Drug Price Trends for MUCUS RELIEF ER

✉ Email this page to a colleague

Average Pharmacy Cost for MUCUS RELIEF ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MUCUS RELIEF ER 1,200 MG TAB | 00536-1451-88 | 0.42985 | EACH | 2025-12-17 |

| MUCUS RELIEF ER 600 MG TABLET | 00904-6718-39 | 0.30285 | EACH | 2025-12-17 |

| MUCUS RELIEF ER 600 MG TABLET | 63739-0067-02 | 0.30285 | EACH | 2025-12-17 |

| MUCUS RELIEF ER 1,200 MG TAB | 00536-1249-71 | 0.42985 | EACH | 2025-12-17 |

| MUCUS RELIEF ER 1,200 MG TAB | 70000-0479-02 | 0.42985 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MUCUS RELIEF ER

Introduction

MUCUS RELIEF ER is a pharmaceutical formulation designed to provide extended-release relief for mucus-related respiratory conditions. As an over-the-counter (OTC) medication, it predominantly appeals to consumers seeking sustained symptomatic relief from cough and mucus production associated with bronchitis, colds, and allergies. This analysis evaluates the current market landscape, competitive positioning, regulatory considerations, and projections for pricing over the next five years.

Market Overview

Global Respiratory Care Market

The respiratory care sector, valued at approximately $27 billion in 2022, is steady with expected compound annual growth rate (CAGR) of around 4-5% through 2028. The increased prevalence of chronic respiratory diseases, coupled with heightened consumer awareness about respiratory health, drives demand for OTC remedies like MUCUS RELIEF ER.

Key Consumer Demographics

The primary demographics for mucus relief products include adults aged 25-65, with heightened interest among aging populations and individuals with chronic respiratory conditions. The ongoing COVID-19 pandemic has intensified focus on respiratory health, further expanding market size.

Competitive Landscape

MUCUS RELIEF ER operates within a saturated OTC segment featuring prominent products such as Robitussin, Mucinex, and Nyquil Mucus. These incumbents hold significant shelf space, supported by established brand recognition and consumer loyalty. Differentiation strategies for MUCUS RELIEF ER hinge on its extended-release formulation, offering longer symptom relief with potentially fewer doses daily.

Regulatory and Patent Considerations

Regulatory Status

The drug’s regulatory classification as an OTC product simplifies market entry but necessitates compliance with FDA regulations (for the U.S.) regarding labeling, safety, and efficacy claims. Approval pathways involve demonstrating bioequivalence if reformulated, or full OTC registration if new.

Patent Portfolio

Patent exclusivity is a pivotal factor determining price flexibility. If MUCUS RELIEF ER benefits from patent protection—covering formulation, delivery system, or usage—pricing power increases temporarily. However, patent expiration could precipitate generic entries, exerting downward pressure on prices within 6-8 years of launch.

Market Penetration and Growth Drivers

Brand Positioning and Patient Preference

The key to capturing market share lies in effective branding emphasizing longer duration, fewer doses, and minimal side effects. Endorsements from healthcare professionals and positive consumer reviews bolster expansion potential.

Distribution Channels

The OTC distribution landscape widens through pharmacies, supermarkets, online platforms, and direct-to-consumer marketing. Strategic partnerships with large pharmacy chains and e-commerce platforms enhance accessibility and volume sales.

Healthcare Trends

Growing awareness of self-medication, digital health tools, and telemedicine consultations support increased sales of OTC respiratory products. Furthermore, seasonal demand spikes during fall and winter months sustain steady revenue streams.

Price Projections (2023-2028)

Initial Launch Pricing (Year 1)

Considering competitor analysis, initial retail prices for extended-release mucus relief products range from $10 to $20 per package (e.g., Mucinex Extended-Release Tablets generally retail around $12-$18). MUCUS RELIEF ER aims for positioning within this range, leveraging its unique extended-release formulation.

Factors Influencing Pricing Trends

- Patent Status: If patent protection is active, premium pricing between $15 and $20 per package is viable.

- Market Entry of Generics: Patent expiry or invalidation would lead to generic competitors entering, reducing prices to $8-$12.

- Manufacturing Costs: Formulation complexity of extended-release systems may factor into initial pricing, often enabling a premium of 20-30% above immediate-release counterparts.

- Brand Equity and Consumer Acceptance: Strong branding could sustain prices at the higher end of the spectrum, particularly if efficacy and safety profiles are lauded.

Projected Price Range (2023-2028)

- 2023-2024: $14 - $20, assuming patent protection and successful market entry.

- 2025-2026: Potential price adjustment to $12 - $18 as early generic entries diminish exclusivity.

- 2027-2028: Average prices stabilizing at $10 - $14, contingent on market competition and patent status.

Impact of Genericization

Experience from similar products indicates a rapid decline in prices post-generic entry, often within 1-2 years, emphasizing the importance of patent strategies and market differentiation.

Market Development Strategies

To optimize profitability, MUCUS RELIEF ER should explore:

- Patent Protection: Secure robust patents covering the extended-release mechanism.

- Consumer Education: Highlight benefits such as longer relief duration and reduced dosing frequency.

- Strategic Partnerships: Collaborate with key pharmacy chains and online retailers for wide accessibility.

- Differentiation: Leverage formulation innovation, efficacy data, and consumer preferences for extended relief.

Risks and Challenges

- Patent Challenges: Patent litigation or expiry could threaten exclusivity.

- Regulatory Changes: Stringent reformulation or labeling requirements might impact formulations or pricing.

- Market Saturation: High competition could impose pricing pressures.

- Consumer Preferences: Preference shifts towards natural or alternative therapies could dilute OTC sales.

Key Takeaways

- The OTC mucus relief market is mature, with sustained growth driven by demographic factors and health trends.

- MUCUS RELIEF ER’s success hinges on patent protections, effective branding, and distribution strategy.

- Initial pricing is projected between $14 and $20 per package, with potential declines as generics enter the market.

- Strategic emphasis should be made on patient education and differentiation to command premium pricing during patent protection.

- The competitive landscape is likely to compress margins post-patent expiry; planning for lifecycle management is critical.

FAQs

-

How does patent protection influence MUCUS RELIEF ER’s pricing strategy?

Patent protection allows for premium pricing by limiting generic competition, enabling the manufacturer to recoup development costs and establish market share. Once expired, generic entries typically drive prices downward by 30-50%. -

What factors could accelerate price declines for MUCUS RELIEF ER?

Patent expiration, regulatory challenges, and aggressive generic marketing can rapidly decrease prices. Market saturation and consumer shifts towards alternative therapies also contribute. -

What are the main competitive advantages of MUCUS RELIEF ER?

Its extended-release formulation offers longer symptom relief with fewer doses, providing convenience and potential efficacy benefits. Strong branding and patent protection further reinforce market positioning. -

How should MUCUS RELIEF ER plan for market entry and growth?

Focusing on patent rights, securing favorable distribution agreements, investing in consumer education, and differentiating through formulation innovation are vital strategies. -

What is the outlook for OTC mucus relief pricing over the next five years?

Pricing is expected to remain stable or decline gradually, from approximately $14-$20 initially, decreasing to $10-$14 as market competition intensifies and patent exclusivity diminishes.

References

- Grand View Research, Inc. (2022). Respiratory Care Market Analysis.

- U.S. Food and Drug Administration (FDA). (2022). OTC Drug Review Regulations.

- IQVIA. (2022). OTC Consumer Healthcare Market Report.

- EvaluatePharma. (2022). Pharmaceutical Patent Expiry and Impact Analysis.

- Statista. (2022). Over-the-counter (OTC) Healthcare Market Data.

More… ↓