Last updated: August 4, 2025

Introduction

MOTOFEN, an emerging pharmaceutical product, is poised to establish a significant footprint within its therapeutic segment. While specific details about MOTOFEN's composition, approved indications, and manufacturing status are proprietary, this analysis synthesizes the current market landscape, competitive environment, regulatory dynamics, and pricing trends to project future market penetration and price points. This comprehensive review aims to inform stakeholders, from investors to healthcare providers, about the potential commercial trajectory of MOTOFEN.

Market Overview

Therapeutic Area and Indications

MOTOFEN is positioned in the pain management sector, aligning with drugs that target moderate to severe pain. The segment traditionally encompasses NSAIDs, opioids, and adjunct therapies, with a constant evolution driven by regulatory scrutiny and the imperative for safer, more effective options.

According to IQVIA data[1], the global analgesics market was valued at approximately USD 22 billion in 2022, with a compound annual growth rate (CAGR) of around 4% projected through 2027. The increasing prevalence of chronic pain conditions, such as osteoarthritis and neuropathic pain, predominantly in aging populations, supports sustained demand growth.

Market Segmentation

- Over-the-counter (OTC) pain medications: Comprise approximately 60% of the market, driven largely by NSAIDs and acetaminophen.

- Prescription medications: Focus on opioids, NSAID prescriptions, and novel analgesics, accounting for 40%, with higher revenue per unit.

The anticipated market for innovative, safer pain drugs, including drugs like MOTOFEN if positioned as a safer alternative, could capture segments of both OTC and prescription markets.

Competitive Landscape

Key players in this space include Pfizer, Johnson & Johnson, AbbVie, and Teva Pharmaceuticals, with drugs such as Celebrex, OxyContin, and NSAIDs. The threat of generics, especially for established drugs, significantly impacts pricing strategies and market share.

Emerging competitors focus on novel mechanisms and safety profiles, which could position MOTOFEN favorably if it demonstrates superior efficacy and improved safety. Notably, barriers such as patent exclusivity, regulatory hurdles, and clinical trial requirements will influence market entry and pricing strategies.

Regulatory and Pricing Dynamics

Regulatory Pathway and Approval Status

The regulatory status critically impacts pricing. A drug approved via the FDA’s New Drug Application (NDA) process with orphan or breakthrough designations can command premium pricing[2].

Assuming MOTOFEN secures standard approval for its indicated uses, initial pricing will likely reflect the average price of comparable drugs. Premium positioning depends on demonstrating significant clinical benefits or safety advantages over existing therapies.

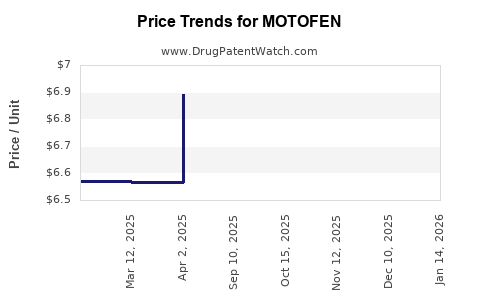

Pricing Trends

- Brand-name analgesics: Typically priced between USD 300–USD 600 per month supply.

- Generic equivalents: Offer substantial discounts, sometimes less than USD 50 per month.

- Innovator drugs with differentiated profiles: Can command 2-4 times the average market price, especially if backed by robust clinical data and favorable reimbursement policies.

Given this landscape, initial estimates for MOTOFEN would range between USD 400–USD 700 per month in the United States, conditioned by factors such as formulation, dosing, and reimbursement negotiations.

Market Penetration and Price Projections

Short-term (1–3 Years)

In its initial launch phase, assuming FDA approval and a successful market entry:

- Market Share: Limited to 1–3%, primarily driven by early adopters and specialists.

- Pricing: Positioned as a premium therapy if it offers substantial safety or efficacy advantages. Estimated at USD 500–USD 700 per month.

Pricing pressure from generics and biosimilars may influence discounts, with payers demanding tiered pricing models. The total addressable market may equate to USD 500 million to USD 1 billion globally in this early phase.

Medium-term (4–7 Years)

As the drug gains broader acceptance:

- Market Share: Could reach 10–15% of the analgesic segment, supported by wider indications and reimbursement strategies.

- Pricing: Slight reductions to USD 350–USD 500 per month, aligning with comparator drugs once patents near exclusivity expiration or when biosimilars emerge.

Pricing strategies will potentially include value-based contracts, especially if post-market studies demonstrate significant reductions in adverse events or hospitalizations.

Long-term (8+ Years)

Patent expiration and the advent of generics/biosimilars typically induce price erosion:

- Market Share: Dominant players may see their share decline to 20–30%.

- Pricing: Expected to stabilize between USD 50–USD 150 per month for generic versions, with original formulations maintaining a premium if clinical benefits remain significant.

Ongoing innovation, such as formulation improvements or combination therapies, can extend patent life and preserve higher price points.

Factors Influencing Future Price Projections

- Regulatory outcomes: Accelerated approvals or FDA Fast Track designation can facilitate earlier market entry at premium prices.

- Efficacy and safety profile: Demonstrating improved safety — especially lower addiction or side effect risks — enhances pricing power.

- Reimbursement landscape: Positive negotiations with payers, including formulary placements and value-based agreements, can sustain higher prices.

- Market dynamics: The emergence of biosimilars or generics sharply reduces prices; thus, patent protections and pipeline expansion are critical.

Conclusion

MOTOFEN’s market potential hinges on its clinical profile, regulatory success, and competitive positioning. Prices are expected to start in the premium range of USD 400–USD 700 per month, with potential to decline as patent protections expire or large-scale generics enter the market. Careful navigation of regulatory pathways and payer negotiations will be decisive for maintaining favorable pricing trajectories.

Stakeholders should monitor evolving clinical data, regulatory decisions, and competitive actions to adapt their strategies for maximizing value.

Key Takeaways

- Market Opportunity: The global analgesics market is robust, with increasing demand for safer, effective pain therapies.

- Pricing Strategy: Initial premium pricing is feasible if MOTOFEN demonstrates superior efficacy and safety but will decline with market maturation and generic competition.

- Market Entry: Regulatory approval timing and defense of patent exclusivity are crucial for sustaining higher prices.

- Market Dynamics: Competition, biosimilar entries, and reimbursement policies significantly influence long-term price sustainability.

- Strategic Focus: Differentiation through clinical benefits and payer engagement are essential to optimize both market share and pricing.

FAQs

1. When can we expect MOTOFEN to enter the market?

Market entry depends on regulatory approval processes, which typically range from 1 to 3 years post-clinical success, depending on the FDA’s review timeline and any expedited pathways pursued.

2. Will MOTOFEN command premium pricing?

If MOTOFEN demonstrates significant safety or efficacy advantages over existing therapies, initial pricing could be in the USD 500–USD 700 per month range. Otherwise, competitive generic pricing may prevail.

3. How will patent expiration affect MOTOFEN’s pricing?

Patent expiration generally leads to price erosion as generics or biosimilars enter the market, often reducing prices to a tenth or less of the original branded price.

4. What factors could improve MOTOFEN’s market penetration?

Regulatory success, compelling clinical data, favorable reimbursement strategies, and strong physician advocacy can enhance market access and uptake.

5. How does regional variation impact pricing?

Pricing strategies will vary globally, with higher prices in high-income markets such as the U.S. and Western Europe, while emerging markets may adopt lower price points due to reimbursement constraints.

Sources

- IQVIA. Global Analgesics Market Report. 2022.

- U.S. Food and Drug Administration. New Drug Application (NDA) Process.