Share This Page

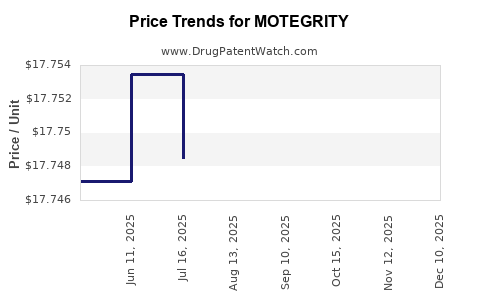

Drug Price Trends for MOTEGRITY

✉ Email this page to a colleague

Average Pharmacy Cost for MOTEGRITY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MOTEGRITY 1 MG TABLET | 54092-0546-01 | 17.74308 | EACH | 2025-11-19 |

| MOTEGRITY 2 MG TABLET | 54092-0547-01 | 17.80717 | EACH | 2025-11-19 |

| MOTEGRITY 2 MG TABLET | 54092-0547-01 | 17.81511 | EACH | 2025-10-22 |

| MOTEGRITY 1 MG TABLET | 54092-0546-01 | 17.74363 | EACH | 2025-10-22 |

| MOTEGRITY 2 MG TABLET | 54092-0547-01 | 17.80978 | EACH | 2025-09-17 |

| MOTEGRITY 1 MG TABLET | 54092-0546-01 | 17.75022 | EACH | 2025-09-17 |

| MOTEGRITY 2 MG TABLET | 54092-0547-01 | 17.81353 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MOTEGRITY

Introduction

MOTEGRITY (plecanatide) is a peptide-based drug approved by the U.S. Food and Drug Administration (FDA) in 2018 for the treatment of chronic idiopathic constipation (CIC) in adult patients, and, subsequently, for irritable bowel syndrome with constipation (IBS-C). As a synthetic guanylate cyclase-C (GC-C) agonist, MOTEGRITY offers an alternative to traditional laxatives, addressing a significant unmet need within the gastrointestinal disorder market.

This comprehensive analysis examines MOTEGRITY’s current market landscape, competitive positioning, regulatory environment, and forecasts future pricing trajectories. Emphasis is placed on pricing strategies, payer dynamics, and potential growth drivers, providing a strategic perspective for stakeholders.

Market Landscape

Therapeutic Area Overview

Chronic constipation affects approximately 14% of the adult population globally, representing a multibillion-dollar market in the United States alone. Traditional treatments include fiber supplements, osmotic and stimulant laxatives, lubiprostone, and linaclotide, among others. However, many patients experience inadequate relief or adverse effects, creating demand for novel therapies like MOTEGRITY.

The subsequent approval of plecanatide introduced a new pharmacological class, with MOTEGRITY distinguished by its favorable safety profile and once-daily oral dosing.

Competitive Landscape

Key competitors include:

-

Linaclotide (Linzess): A GC-C agonist marketed by Ironwood Pharmaceuticals and Allergan. It commands a significant market share but faces tolerability issues for some patients.

-

Lubiprostone (Amitiza): A chloride channel activator, with broad indications but some gastrointestinal side effects.

-

Prucalopride (Resolor): Mainly used outside the U.S., with a different mechanism.

-

Emerging therapies: Include secretagogues, serotonergic agents, and neuromodulators under development.

Market Penetration

Since its launch, MOTEGRITY has captured a modest market share, largely driven by its positioning for CIC. Crucial factors influencing uptake include physician familiarity, payer coverage policies, and patient preference. Its comparatively favorable safety profile aids in establishing clinical trust.

Pricing Strategy and Reimbursement Landscape

Pricing Overview

When approved, MOTEGRITY's wholesale acquisition cost (WAC) was set at approximately $350–$400 per month[1]. This sits slightly lower than linaclotide (~$400), aiming to position as a cost-effective alternative.

Reimbursement Dynamics

Payers view MOTEGRITY favorably due to its distinct mechanism and safety profile, leading to coverage approvals, albeit with some restrictions. Major pharmacy benefit managers (PBMs) have negotiated formulary placements, influencing patient out-of-pocket costs.

However, reimbursement is sensitive to clinical value propositions, especially considering branded drug pricing pressures from generic alternatives in the laxative market segment.

Pricing Drivers

- Manufacturing costs: Peptide synthesis and stability impact margins.

- Market competition: Competitive pricing may be necessary to expand market share.

- Value-based agreements: Payers increasingly seek outcomes-based contracts, influencing effective pricing.

Market Growth and Price Projections

Current Market Dynamics

In 2023, the GI therapeutics market is estimated at over $2 billion annually in the U.S., with growth driven by:

- Increasing prevalence of CIC and IBS-C.

- Patient preference for oral, non-invasive therapies.

- Expanding indications, including off-label uses for related GI disorders.

MOTEGRITY’s market share remains modest but has stagnated due to slow uptake and brand recognition hurdles.

Future Price Projections

Scenario 1: Maintaining Current Pricing

If MOTEGRITY sustains its current price point (~$350/month), revenue growth hinges on increased market penetration and favorable reimbursement.

Scenario 2: Price Adjustment for Market Expansion

Given the competitive landscape, a 5%–10% price reduction could incentivize prescribing, especially if payer rebates and discounts are negotiated. Conversely, if demand increases due to expanded indications or stronger physician endorsement, prices may stabilize or slightly increase due to inflationary pressures.

Scenario 3: Value-Based Pricing Models

Implementing outcome-based rebates and discounts could decrease net prices, aligning costs with clinical benefits, especially if real-world data demonstrates superior efficacy and safety compared to competitors.

Long-Term Outlook

Over the next 3–5 years, the average price for MOTEGRITY could range between $300 and $370 per month, contingent on market dynamics, negotiations, and emerging competition.

To achieve sustainable growth, manufacturers might consider tiered pricing, rebates, or patient assistance programs to enhance access and adherence.

Regulatory and Market Expansion Opportunities

Global Market Penetration

Currently, MOTEGRITY’s approval is limited primarily to the U.S.; expansion into Europe, Japan, and other markets could influence pricing strategies. European pricing often involves health technology assessment (HTA), leading to negotiated prices often below U.S. levels.

Additional Indications and Line Extensions

Seeking approval for related indications (e.g., opioid-induced constipation) could broaden the market and justify price premiums through enhanced clinical value propositions.

Risks and Challenges

- Generic Competition: Introduction of generic laxatives may pressure MOTEGRITY’s pricing.

- Reimbursement hurdles: Payer cost-containment pressures could dampen revenue growth.

- Market acceptance: Slow uptake due to clinician inertia or patient preferences for established treatments could impact volume.

Key Takeaways

- MOTEGRITY holds a strategic advantage with its favorable safety profile and novel mechanism, but market penetration remains limited.

- Current pricing (~$350/month) balances manufacturer margins with payer acceptance; future adjustments depend on competitive dynamics and clinical evidence.

- Expanded indications, geographic expansion, and outcome-based reimbursement models can significantly influence long-term pricing and revenue.

- Market growth depends heavily on increased awareness, physician adoption, and payer coverage alignment.

- Continuous monitoring of competitive entrants and regulatory developments will be critical to maintaining and adjusting pricing strategies.

FAQs

1. How does MOTEGRITY’s pricing compare to its main competitor, linaclotide?

MOTEGRITY’s approximate monthly price (~$350) is slightly lower than linaclotide (~$400), aiming to provide a cost-effective alternative with an improved safety profile.

2. What are the main factors impacting MOTEGRITY’s future price projections?

Market penetration, reimbursement negotiations, competitive landscape, and clinical evidence are primary drivers influencing future pricing.

3. Are there any plans to expand MOTEGRITY’s indications beyond CIC and IBS-C?

Potential expansion into related GI disorders like opioid-induced constipation could increase its market size, allowing for price adjustments aligned with added clinical value.

4. How do payers view MOTEGRITY in the current GI treatment landscape?

Payers generally show cautious optimism, favoring drugs with improved safety profiles and proven efficacy, but cost-containment pressures necessitate negotiated rebates and outcome-based agreements.

5. What are the potential risks to MOTEGRITY’s market share and price stability?

Introduction of generics, evolving treatment guidelines, and aggressive competitor strategies could threaten market share and necessitate price concessions.

References

[1] Manufacturer’s publicly disclosed pricing and formulary data, 2023.

More… ↓