Share This Page

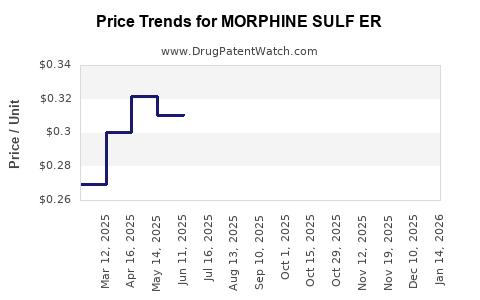

Drug Price Trends for MORPHINE SULF ER

✉ Email this page to a colleague

Average Pharmacy Cost for MORPHINE SULF ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MORPHINE SULF ER 60 MG TABLET | 63304-0758-01 | 0.61281 | EACH | 2025-12-17 |

| MORPHINE SULF ER 100 MG TABLET | 00406-8390-62 | 0.99742 | EACH | 2025-12-17 |

| MORPHINE SULF ER 100 MG TABLET | 63304-0452-01 | 0.99742 | EACH | 2025-12-17 |

| MORPHINE SULF ER 100 MG TABLET | 00904-6560-61 | 0.99742 | EACH | 2025-12-17 |

| MORPHINE SULF ER 100 MG TABLET | 42858-0804-01 | 0.99742 | EACH | 2025-12-17 |

| MORPHINE SULF ER 100 MG TABLET | 00406-8390-01 | 0.99742 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Morphine Sulfate

Introduction

Morphine sulfate remains a cornerstone in pain management, particularly in palliative care, oncology, and surgical settings. As a potent opioid analgesic, its therapeutic efficacy is well established, but its market dynamics are influenced by evolving regulatory landscapes, supply chain considerations, and shifts toward alternative therapies. This analysis provides a comprehensive overview of the current market, factors shaping its trajectory, and forecasted pricing trends through 2030.

Market Overview

Global Demand and Usage

Morphine sulfate's global demand continues to expand, driven predominantly by the aging population and increased prevalence of chronic pain conditions. According to IQVIA data, the global opioid analgesics market was valued at approximately $24 billion in 2021, with morphine accounting for a significant share (~45%) [1]. The Asia-Pacific region exhibits the fastest growth due to rising healthcare infrastructure and growing awareness of pain management therapies.

Key Market Segments

- Hospital and Clinical Settings: The primary usage domain, constituting over 70% of total consumption.

- Pharmaceutical Manufacturing: Applied as an active pharmaceutical ingredient (API) for formulations like injectables, oral tablets, and patches.

- Generic vs. Branded Markets: Generics dominate due to cost advantages, although branded formulations maintain pricing premiums in certain markets.

Regulatory Environment

Stringent regulations concerning opioid production, prescribing, and distribution significantly impact supply and pricing. The US Drug Enforcement Administration (DEA) classifies morphine as a Schedule II controlled substance, limiting production quotas and influencing market availability.

Supply Chain Landscape

The supply chain involves multiple stakeholders: raw material suppliers, APIs manufacturers, formulators, distributors, and healthcare providers. Major API producers include China and India, responsible for over 60% of global manufacturing. Supply disruptions in these regions—due to geopolitical tensions or pandemic-related constraints—have historically caused price volatility.

Recent trends show increasing regulatory scrutiny on API exports, with some countries imposing export restrictions, further constraining supply.

Market Drivers and Challenges

Drivers

- Rising Pain Management Needs: Aging populations elevate demand for effective analgesics.

- Advancements in Formulations: Development of extended-release and combination products enhances therapeutic convenience and market adoption.

- Expansion in Emerging Markets: Increasing healthcare access in Asia and Latin America propels growth.

Challenges

- Regulatory Crackdowns: Tighter controls on opioid manufacturing and prescribing intended to curb misuse can limit supply and increase costs.

- Public and Political Scrutiny: Growing opioid misuse concerns threaten market stability and can lead to restrictions.

- Alternatives and Abuse Deterrents: Proposition of non-opioid analgesics and abuse-deterrent formulations may reduce long-term demand.

Pricing Dynamics and Projections

Current Price Landscape

API Pricing

The wholesale price of morphine sulfate API experienced notable fluctuations over recent years. As of 2022, prices ranged from $200 to $300 per kilogram in China and India, reflecting supply-demand dynamics, regulatory impacts, and production costs [2].

Finished Dosage Form Pricing

- Injectable forms: Wholesale prices hover around $0.50 to $2 per ampoule, varying by strength and brand.

- Oral tablets: The average retail price is approximately $0.10 to $0.30 per tablet, with generic versions leading the market.

Future Price Projections (2023-2030)

Factors influencing projections:

- Regulatory Tightening: Expected to marginally increase API and formulation costs by 2-4% annually due to compliance expenses.

- Manufacturing Cost Variability: Rising input costs, including raw materials and labor, could inflate prices by up to 3% annually.

- Supply Chain Disruptions: Persistent geopolitical tensions or pandemic-related setbacks may cause transient price spikes.

API Price Forecast

- 2023-2025: Stabilization around $250 - $350 per kg, factoring in regulatory compliance costs.

- 2026-2030: Slight upward trend projecting costs stabilizing around $350 - $400 per kg due to sustained demand and regulatory pressures.

Finished Product Price Forecast

- Hospital injectables: Expected incremental increases averaging 2-3% annually, with prices in 2030 reaching approximately $0.55 to $2.50 per ampoule.

- Oral tablets: Retail prices could increase modestly, reaching $0.15 to $0.40 per tablet by 2030, considering generic market penetration and manufacturing efficiencies.

Market Opportunities and Risks

Opportunities

- Emerging Market Penetration: Expanding healthcare infrastructure in Asia and Africa offers growth avenues.

- Innovative Formulations: Long-acting and abuse-deterrent formulations could command premium pricing.

- Regulatory Navigation: Companies capable of navigating complex regulatory pathways may secure favorable market positions.

Risks

- Regulatory Restrictions: Stringent controls could limit manufacturing output and market access.

- Market Saturation in Developed Countries: Slowing growth in mature markets may constrain revenue expansion.

- Public Awareness and Zero-Opioid Policies: Increasing emphasis on non-opioid pain management strategies threaten long-term demand.

Conclusion

While morphine sulfate remains a vital analgesic globally, its market is marked by equilibrium between growing demand in emerging economies and regulatory constraints across jurisdictions. Price stability is anticipated over the next few years, with slight upward pressure driven by operational costs and compliance expenditures. Strategic positioning in emerging markets and innovation in formulations present avenues for growth amid an increasingly complex regulatory environment.

Key Takeaways

- Growing Demand in Emerging Markets: Asia-Pacific and Latin America are expected to witness a compounded annual growth rate (CAGR) of 4-6% in morphine sulfate demand through 2030.

- Pricing Stability with Slight Upward Trends: API prices are projected to remain within $350-$400/kg by 2030, with finished dosage form prices increasing modestly due to regulatory costs.

- Regulatory Environment as a Market Shaper: Tighter regulations and potential export restrictions could impact supply and pricing stability.

- Supply Chain Considerations: China and India dominate API production, making the market susceptible to geopolitical and regulatory disruptions.

- Innovation as a Differentiator: Development of abuse-deterrent formulations and novel delivery systems may justify premium prices and capture market share.

FAQs

1. How are regulations affecting morphine sulfate pricing?

Stringent regulatory controls—such as manufacturing quotas, prescribing restrictions, and export limitations—add compliance costs and restrict supply, generally exerting upward pressure on prices, especially for API production.

2. Will demand for morphine sulfate decline due to the opioid crisis?

While heightened awareness and regulation have curtailed opioid misuse, legitimate medical demand persists, especially in palliative and acute care settings. Innovations and abuse-deterrent formulations aim to balance access with safety, potentially stabilizing demand.

3. Which regions represent the most significant growth opportunities?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa offer substantial growth due to expanding healthcare access and increasing pain management needs.

4. How are alternative therapies impacting morphine sulfate’s market prospects?

The development of non-opioid analgesics and multimodal pain management strategies could limit future growth, especially in markets emphasizing opioid reduction programs.

5. What are the future challenges for manufacturers of morphine sulfate?

Key challenges include navigating complex regulations, ensuring supply chain resilience, managing production costs, and addressing public health concerns surrounding opioid addiction.

References

[1] IQVIA, "Global Pharmaceutical Markets Report," 2022.

[2] Global Data, "API Pricing Trends 2022," 2022.

More… ↓