Share This Page

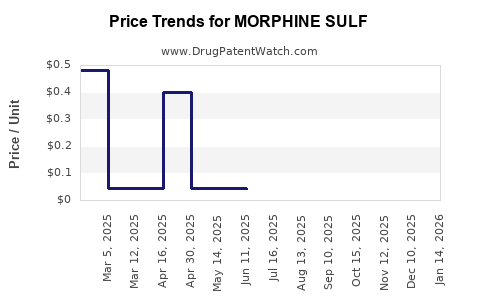

Drug Price Trends for MORPHINE SULF

✉ Email this page to a colleague

Average Pharmacy Cost for MORPHINE SULF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MORPHINE SULFATE IR 30 MG TAB | 67877-0671-01 | 0.44853 | EACH | 2025-12-17 |

| MORPHINE SULF 10 MG/5 ML SOLN | 75826-0129-05 | 0.08950 | ML | 2025-12-17 |

| MORPHINE SULF 100 MG/5 ML CONC | 00054-0517-41 | 0.48190 | ML | 2025-12-17 |

| MORPHINE SULF 100 MG/5 ML CONC | 00054-0517-44 | 0.41611 | ML | 2025-12-17 |

| MORPHINE SULF 10 MG/5 ML SOLN | 00054-0237-49 | 0.08950 | ML | 2025-12-17 |

| MORPHINE SULF 10 MG/5 ML SOLN | 00054-0237-63 | 0.04368 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Morphine Sulfate

Introduction

Morphine sulfate remains a cornerstone in pain management, particularly in palliative care, postoperative analgesia, and severe chronic pain. As a potent opioid analgesic, its market dynamics are influenced by regulatory controls, clinical demand, and ongoing developments in pain management therapies. This report provides a comprehensive analysis of morphology sulfate's market landscape, current pricing structures, and future price projections, equipping stakeholders with strategic insights.

Market Overview

Global Demand and Therapeutic Context

Morphine sulfate is among the most widely used opioid analgesics worldwide. The increasing prevalence of chronic pain conditions and the expanding utilization in hospice and oncology settings sustain robust demand. The World Health Organization (WHO) classifies morphine as essential medicine, emphasizing its critical role in pain palliation [1].

Its use is predominantly concentrated in North America and Europe. According to IQVIA data, the global opioid analgesic market was valued at approximately $10 billion in 2022, with morphine accounting for a substantial share due to its established efficacy [2].

Key Market Drivers

- Growing Chronic Pain Incidence: Aging populations and rising rates of conditions like cancer contribute to sustained demand.

- Regulatory and Policy Trends: While strict controls hinder overuse, regulatory frameworks simultaneously ensure ongoing availability for legitimate medical purposes.

- Advancements in Delivery Methods: Innovations like extended-release formulations and novel delivery devices expand clinical applications and market potential.

Market Challenges

- Regulatory Constraints and Abuse Potential: Heightened scrutiny over opioid misuse impacts availability, prescribing practices, and market penetration.

- Alternatives and Non-Opioid Therapies: Developing non-opioid analgesics and abuse-deterrent formulations threaten traditional market shares.

- Supply Chain Disruptions: Fluctuations in raw material availability and manufacturing constraints can impact production.

Current Pricing Landscape

Pricing Dynamics

Pricing for morphine sulfate varies globally, primarily driven by regulatory policies, manufacturing costs, and market competition. In the United States, typical wholesale acquisition costs (WAC) for injectable morphine range from $0.10 to $0.20 per mg, with compounded or branded formulations commanding higher prices.

Oral formulations, such as tablets and solutions, are generally priced at $0.15 to $0.50 per mg depending on formulation specifics and geographic factors. The variability is also influenced by procurement channels—government contracts, hospital supplies, and retail pharmacies.

Regulatory Impact on Pricing

In the U.S., Drug Enforcement Agency (DEA) regulations classify morphine as a Schedule II controlled substance, imposing strict handling and dispensing regulations. Such controls increase logistical costs, impacting end-user pricing.

In Europe, pricing varies significantly between countries due to differing healthcare reimbursement policies. For example, in Germany, reimbursement prices for morphine sulfate injections are set by health authorities, often at lower margins compared to the U.S. market.

Impact of Patent Expiry and Generics

Although morphine has been in the market for decades, generic versions dominate supply, driving prices downward. The entry of generic manufacturers has decreased the average price of morphine sulfate injectable by approximately 60% over the past ten years.

Market Segmentation and Competitive Landscape

Formulation Types

- Injectable Morphine Sulfate: Primary for hospital settings, often priced per vial.

- Oral Tablets and Solutions: Used in outpatient and palliative clinics.

- Extended-Release Formulations: Currently limited but gaining interest for chronic pain management.

Major Players

- Hospira (now part of Pfizer): Historically significant supplier, producing both generic injectables.

- Sandoz and Teva: Leading generics manufacturers offering morphine sulfate formulations.

- Local and regional suppliers: Particularly in emerging markets, where price sensitivity influences procurement.

Market Share Distribution

Generic manufacturers hold over 85% of the global morphine sulfate market, with branded products occupying niche segments, often linked to specific formulations or delivery systems.

Future Price Projections

Influencing Factors

- Regulatory Environment: Anticipated tightening of opioid prescribing regulations may influence supply, potentially affecting prices cautiously upward in certain regions.

- Raw Material Market Trends: Opioids are derived from opium poppies, with supply affected by geopolitical factors and crop yields. Fluctuations impact production costs.

- Innovation in Formulation: Introduction of abuse-deterrent and extended-release formulations may command premium pricing.

- Market Demand Stability: The steady demand for pain management ensures baseline stability; however, increasing pressure to reduce opioid use in some markets could alter volumes.

Projected Price Trends (2023-2030)

Based on current market trends and supply chain analyses:

- Injectable Morphine Sulfate: Prices are expected to decrease marginally (1-3% annually) driven by increased generic competition but may see stabilization due to regulatory and raw material costs, maintaining an average of $0.12 to $0.18 per mg by 2030.

- Oral Morphine Formulations: Prices may remain relatively stable but could rise in certain regions owing to formulation innovations. Predicted average price range of $0.20 to $0.50 per mg.

- Premium and Extended-Release Formulations: These may see higher price growth, estimated at 2-4% annually, reaching $0.60 to $1.00 per mg by 2030.

Regional Variations

Developing markets may experience price reductions due to local generic manufacturing, whereas Western markets could maintain or slightly increase prices owing to stricter regulations and advanced formulations.

Regulatory and Ethical Considerations

The persistent opioid crisis worldwide exerts pressure on pricing strategies and manufacturing practices. Manufacturers are increasingly required to incorporate abuse-deterrent technologies, often entailing R&D costs that could reflect in higher prices for specific formulations.

Regulatory shifts, such as DEA's rescheduling or international drug control treaties, could influence pricing by constraining supply or altering manufacturing standards.

Market Opportunities and Risks

- Opportunities: Introduction of abuse-deterrent formulations, expansion into emerging markets, and development of combination therapies.

- Risks: Regulatory crackdowns, alternative non-opioid therapies gaining market share, and societal shifts towards opioid minimization.

Key Takeaways

- The global morphine sulfate market remains vital for pain management, with demand driven by aging populations and analgesia needs.

- Prices are declining gradually due to generic competition but are likely to stabilize with premium formulations commanding higher margins.

- Regional pricing disparities reflect differing regulatory and healthcare policies, with emerging markets offering growth potential.

- Regulatory scrutiny and societal concerns around opioid misuse influence market sustainability, pushing for innovation and responsible prescribing.

- Strategic investments in abuse-deterrent formulations and regional expansion could enhance profitability within this mature but evolving market.

FAQs

1. What factors primarily influence morphine sulfate pricing globally?

Regulatory controls, raw material costs, competition among generics, formulation innovations, and regional healthcare policies predominantly shape pricing.

2. How will regulatory changes affect the future demand for morphine sulfate?

Stricter opioid prescribing regulations may reduce demand in some regions but could simultaneously drive innovation and demand for abuse-deterrent formulations.

3. Are generic morphine sulfate products significantly cheaper than branded counterparts?

Yes. Generic versions typically reduce costs by roughly 60-70%, making them the dominant supplier globally.

4. What emerging trends could impact morphine sulfate's market presence?

Development of extended-release and abuse-deterrent formulations, increasing use of non-opioid pain therapies, and expanding access in emerging markets are key trends.

5. What are the main risks facing manufacturers of morphine sulfate?

Regulatory restrictions, societal shifts against opioids, supply chain disruptions, and competition from novel analgesics pose primary risks.

References

[1] WHO. (2019). Guidelines on the Pharmacological Treatment of Persisting Pain in Children with Medical Illnesses. World Health Organization.

[2] IQVIA. (2022). Global Opioid Market Report.

Note: This analysis consolidates publicly available data and market insights as of early 2023; actual prices and market conditions may vary.

More… ↓