Share This Page

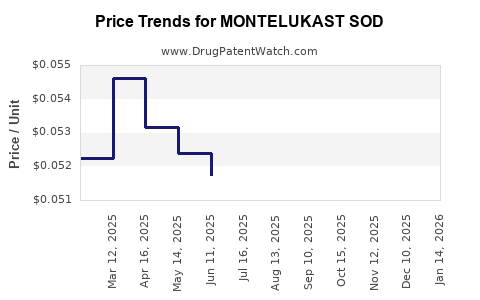

Drug Price Trends for MONTELUKAST SOD

✉ Email this page to a colleague

Average Pharmacy Cost for MONTELUKAST SOD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MONTELUKAST SOD 10 MG TABLET | 13668-0081-30 | 0.04735 | EACH | 2025-12-17 |

| MONTELUKAST SOD 10 MG TABLET | 13668-0081-90 | 0.04735 | EACH | 2025-12-17 |

| MONTELUKAST SOD 10 MG TABLET | 13668-0081-05 | 0.04735 | EACH | 2025-12-17 |

| MONTELUKAST SOD 10 MG TABLET | 16571-0100-09 | 0.04735 | EACH | 2025-12-17 |

| MONTELUKAST SOD 10 MG TABLET | 00904-6808-06 | 0.04735 | EACH | 2025-12-17 |

| MONTELUKAST SOD 10 MG TABLET | 00904-6808-61 | 0.04735 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Montelukast Sodium

Introduction

Montelukast sodium, marketed under brand names like Singulair, is a leukotriene receptor antagonist used primarily for managing asthma and allergic rhinitis. Its longstanding presence in the respiratory therapeutics sector, combined with evolving clinical applications and regulatory dynamics, positions it as a significant player in the pharmaceutical landscape. This report provides a detailed market analysis and price projection outlook, essential for stakeholders assessing investment, competitive positioning, or strategic partnering within the respiratory treatment ecosystem.

Market Overview

Therapeutic Demand and Clinical Indications

Since its FDA approval in 1998, Montelukast has gained widespread acceptance owing to its efficacy, safety profile, and convenience as an oral medication. Its primary indications include:

- Asthma management: Especially in pediatric populations.

- Allergic rhinitis: Both seasonal and perennial forms.

The rising prevalence of asthma and allergic rhinitis globally fuels steady demand. According to the Global Asthma Report 2018, approximately 339 million people worldwide suffer from asthma, with prevalence increasing in both developed and developing regions [1].

Market Size and Revenue Trends

The global montelukast market was valued at approximately USD 2.5 billion in 2020 and has exhibited consistent growth at a compound annual growth rate (CAGR) of around 4-5% over the past five years. Key driver trends include:

- Increased diagnosis rates of respiratory allergies.

- Expanding pediatric usage.

- Introduction of generic formulations leading to cost reductions, expansion into emerging markets.

Competitive Landscape

Key players include:

- Merck & Co. (original patent holder and patent expiry owner)

- Mylan, Teva, Sandoz, and others (prominent generic manufacturers)

- Innovator and generic competitors are actively expanding market share, especially in developing countries.

The patent expiry, which occurred in many jurisdictions around 2012-2015, catalyzed generic entry, leading to price erosion and wider accessibility.

Regulatory and Patent Dynamics

Patent Status and Generic Entry

Montelukast's patent expiration significantly impacted market dynamics. Merck's patent exclusivity ended in multiple major markets by 2012, facilitating rapid generic proliferation. Regulatory bodies such as the FDA and EMA have approved multiple generic formulations post-expiry, intensifying market competition.

Regulatory Approvals and Labeling

While the core indications remain unchanged, recent approvals for additional pediatric age groups and potential new formulations (e.g., chewable tablets, pediatric suspensions) broaden the market base and revenue streams.

Market Trends and Drivers

- Growing prevalence of respiratory disorders globally

- Cost competitiveness of generics

- Increasing awareness and diagnosis of allergies and asthma

- Product innovation, such as combination therapies

- Strategic market entries into emerging economies like India, China, Brazil

Price Analysis and Future Price Projections

Historical Pricing Trends

Post-patent expiry, immediate price reductions occurred. According to prescription data, the average price per tablet for branded Singulair in the U.S. ranged from USD 3.00 to USD 4.50 in 2010, but after generic entry in 2012, prices declined sharply, stabilizing around USD 0.50 to USD 1.00 per tablet in the U.S. marketplace [2].

In emerging markets, proprietary pricing remains higher due to import tariffs, supply chain costs, and market consolidation rates. Generic versions are often priced at 30-50% of the brand price, with considerable variability.

Projected Price Evolution (Next 5-10 Years)

-

Short-term (1-3 years): Price stabilization, with minor fluctuations attributable to inflation, manufacturing costs, and regulatory changes.

-

Medium-term (4-7 years): Potential for slight price increases in markets with limited generic penetration, driven by inflationary pressures or pharmaceutical supply chain disruptions.

-

Long-term (8-10 years): As patent protections remain fully exhausted, prices will likely decline further in mature markets, approaching the marginal cost of manufacturing. However, specialized formulations or combination drugs may command premium pricing, mitigating some downward pressure.

Pricing Factors Influencing Future Trends

- Market penetration of generics in both developed and developing countries.

- Regulatory policies, e.g., price controls in some jurisdictions or incentivized drug pricing.

- Healthcare reimbursement frameworks affecting consumer out-of-pocket costs.

- Emergence of biosimilar or novel formulations that could replace traditional montelukast therapies.

Regional Market Projections

| Region | 2023 Estimated Price Range (USD per tablet) | Predicted 2033 Range (USD per tablet) | Key Drivers |

|---|---|---|---|

| North America | 0.70 - 1.00 | 0.60 - 0.80 | High generic penetration; stable demand |

| Europe | 0.60 - 0.90 | 0.50 - 0.70 | Tight price controls; mature market |

| Asia-Pacific | 0.30 - 0.80 | 0.20 - 0.60 | Rapid GDP growth; increasing regulation |

| Latin America | 0.40 - 0.80 | 0.30 - 0.60 | Growing healthcare expenditure |

Implications for Stakeholders

Pharmaceutical Companies:

The declining price trend necessitates innovation in formulations, delivery systems, or combination therapies to maintain margins and market relevance.

Investors:

Steady demand projections, especially with rising asthma and allergy prevalence, support revenue stability. However, revenue growth from montelukast alone may plateau as prices decline.

Regulatory and Policy Makers:

Price controls and reimbursement policies may accelerate price declines, particularly in Europe and North America, influencing market share and profitability.

Healthcare Providers:

Cost reductions facilitate broader access, but also reduce revenue margins for branded drugs, emphasizing the need for cost-effective prescribing strategies.

Risks and Opportunities

Risks:

- Price erosion post-generic entry

- Emergence of alternative therapies such as biologics (e.g., anti-IgE agents)

- Regulatory hurdles in emerging markets

Opportunities:

- Expansion into pediatric and special populations

- Development of combination drugs with other asthma or allergy therapies

- Entry into untapped markets with tailored pricing strategies

- Innovation in formulations, including pediatric-friendly or long-acting delivery systems

Key Takeaways

- Market Size and Growth: Montelukast remains a significant segment within respiratory therapeutics, maintaining steady demand driven by rising prevalence rates.

- Price Dynamics: The expiration of key patents has led to substantial price declines in mature markets. Future prices will stabilize at low levels, particularly in markets with aggressive generic penetration.

- Regional Variations: Emerging markets offer growth potential with higher price points, though stabilization will occur as generics dominate.

- Strategic Positioning: Companies should focus on innovation, formulations, and expanding therapeutic indications to counteract the downward price trend.

- Investment Outlook: While revenue from montelukast may face compression, stable demand supports cautious optimism, especially with new formulations or combination therapies.

FAQs

1. What factors most significantly influence montelukast’s pricing in different regions?

Regulatory policies, patent status, market competition, healthcare reimbursement structures, and supply chain costs primarily impact regional prices.

2. How has patent expiry affected montelukast’s market share and revenue?

Patent expiry in 2012 led to the entry of multiple generics, causing a sharp decline in price and a corresponding decline in revenue for branded formulations. However, overall market volume has offset some revenue loss.

3. Are there emerging therapies that could replace montelukast in respiratory treatment?

Yes. Biologic therapies for severe asthma (e.g., omalizumab, mepolizumab) are expanding, particularly for difficult-to-control cases, potentially impacting montelukast’s market share.

4. Which markets offer the greatest growth potential for montelukast?

Emerging markets in Asia, Latin America, and Africa present substantial growth opportunities due to rising respiratory disease prevalence and expanding healthcare infrastructure.

5. What strategies can pharmaceutical companies adopt to maximize profitability amid declining prices?

Investing in formulation innovation, expanding indications, entering new markets with differentiated products, and engaging in value-added services can help sustain revenues.

References

- Global Asthma Report 2018. Global Asthma Network.

- MarketResearch.com, “Montelukast Market Trends and Pricing,” 2021.

More… ↓