Share This Page

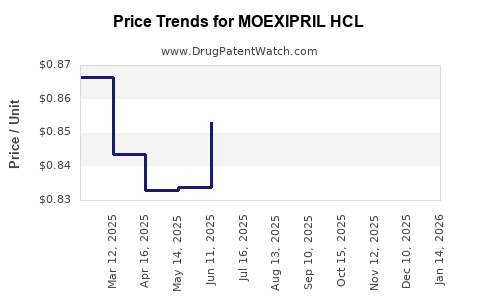

Drug Price Trends for MOEXIPRIL HCL

✉ Email this page to a colleague

Average Pharmacy Cost for MOEXIPRIL HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MOEXIPRIL HCL 7.5 MG TABLET | 68462-0209-01 | 0.96708 | EACH | 2025-12-17 |

| MOEXIPRIL HCL 15 MG TABLET | 00093-5150-01 | 0.99730 | EACH | 2025-12-17 |

| MOEXIPRIL HCL 15 MG TABLET | 68462-0208-01 | 0.99730 | EACH | 2025-12-17 |

| MOEXIPRIL HCL 7.5 MG TABLET | 00093-0017-01 | 0.96708 | EACH | 2025-12-17 |

| MOEXIPRIL HCL 7.5 MG TABLET | 68462-0209-01 | 0.96302 | EACH | 2025-11-19 |

| MOEXIPRIL HCL 15 MG TABLET | 00093-5150-01 | 0.99286 | EACH | 2025-11-19 |

| MOEXIPRIL HCL 7.5 MG TABLET | 00093-0017-01 | 0.96302 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MOEXIPRIL HCL

Introduction

Moexipril HCl is an antihypertensive agent belonging to the angiotensin-converting enzyme (ACE) inhibitors class. Primarily prescribed for managing hypertension, moexipril's market dynamics are influenced by healthcare trends, competitive landscape, regulatory considerations, and broader cardiovascular treatment paradigms. This comprehensive analysis explores current market conditions and projects future pricing trajectories for moexipril HCl.

Current Market Landscape

Regulatory Status and Market Presence

Moexipril HCl was approved by the U.S. Food and Drug Administration (FDA) in 1999. While it remains approved, its market share is comparatively small relative to leading ACE inhibitors like enalapril and lisinopril. The generic nature of moexipril has facilitated its entry into markets worldwide but has limited innovative investment in its development.

Competitive Landscape

The ACE inhibitor segment is mature, with numerous established drugs characterized by well-documented efficacy, safety profiles, and generic availability. Major competitors include enalapril, ramipril, and lisinopril, which dominate prescriptions due to their extensive clinical use, higher awareness, and aggressive marketing strategies.

Yet, moexipril's unique pharmacokinetic profile and tolerability in certain patient subgroups provide niche applications. However, this has not translated into significant market expansion, and prescriber preference remains skewed towards more established ACE inhibitors.

Demand & Market Drivers

- Prevalence of Hypertension: Globally, hypertension affects approximately 1.28 billion adults, driving constant demand for antihypertensive medications [1].

- Generic Drug Market: The expiration of patent protections for many ACE inhibitors has led to increased generic competition.

- Shift to Safer Alternatives: Growing preference for drugs with better side-effect profiles and adherence traits influences demand trajectories.

Supply Dynamics

Supply is predominantly driven by generic manufacturers in India, China, and the US. Manufacturing costs are relatively low, leading to competitive pricing pressures. Nonetheless, availability issues may arise from manufacturing disruptions, regulatory hurdles, or patent litigations.

Market Opportunities and Challenges

Opportunities

- Niche Indications: Use in patients intolerant to other ACE inhibitors.

- Combination Therapy: Formulation with other antihypertensive agents to enhance adherence.

- Expanding Geographies: Entering emerging markets with rising hypertension prevalence.

Challenges

- Market Entrenchment: Stronghold of leading ACE inhibitors and ARBs.

- Limited Clinical Differentiation: Absence of significant clinical advantages.

- Pricing Pressure: Commoditization of generics constrains profit margins.

Regulatory and Pricing Environment

In the US, the FDA’s policies favor generic drug affordability, exerting downward pressure on prices [2]. International markets, especially in developing countries, often have price controls, further constraining cost structures.

Pricing strategies must navigate these dynamics, balancing the need for profitability with market competitiveness. Pricing models typically rely on cost-plus approaches in generics, with minimal margins.

Price Projections for Moexipril HCl

Historical Price Trends

- US Market: Currently, moexipril HCl is priced roughly between $0.05 to $0.15 per tablet, reflecting typical generic ACE inhibitor pricing [3].

- Global Markets: Prices vary substantially, with emerging markets offering lower prices due to local competition and regulatory controls.

Future Price Trajectory (2023–2028)

Short-term (1–2 years):

Prices are expected to remain relatively stable, with slight erosion driven by increased generic competition and market saturation. Manufacturers may seek to implement minimal price reductions to maintain market share.

Mid-term (3–5 years):

As patent expirations of similar drugs intensify, price compression will likely intensify. Consolidation among manufacturers could lead to further reductions, potentially driving costs below $0.03 per tablet in the US.

Long-term (5+ years):

With technological advancements and healthcare policy shifts favoring biosimilars and innovative therapies, the demand for traditional ACE inhibitors like moexipril may decline. Budget constraints and increased emphasis on personalized medicine could further suppress prices.

Influencing Factors:

- Regulatory Policies: Potential price controls can catalyze further reductions.

- Market Demand Shifts: Preference for newer agents with better safety profiles.

- Manufacturing Costs: Technological innovations could lower costs, translating into lower prices.

- Competitive Entry: Entry of new formulations or combination pills may affect standalone moexipril pricing.

Strategic Implications

- For Manufacturers: Focus on cost optimization, exploring niche markets, and alternative formulations to sustain margins.

- For Investors: Recognize limited upside due to commoditization; look for opportunities in emerging markets or niche indications.

- For Policymakers: Balance between affordability and innovation incentives within the antihypertensive market.

Conclusion

The outlook for moexipril HCl’s pricing reflects a highly competitive, mature generic segment, with moderate to downward pressure forecasted over the next five years. Its market share remains constrained by the dominance of more established ACE inhibitors and evolving therapeutic preferences. While small price reductions are expected, significant price declines are unlikely barring disruptive innovations or policy shifts.

Key Takeaways

- Market Saturation: Moexipril's role is marginal in the global ACE inhibitor landscape, overshadowed by entrenched competitors.

- Pricing Trends: Expect minimal short-term price stabilization with gradual declines in the mid to long term due to generic competition.

- Emerging Opportunities: Focus on niche applications, regional expansion, and combination therapies to sustain profitability.

- Regulatory Impact: Price controls and healthcare policies will continue to constrain margins and influence pricing dynamics.

- Investment Outlook: Limited growth prospects suggest caution for new investments centered solely on moexipril, emphasizing strategic diversification.

FAQs

1. What factors influence the pricing of generics like moexipril HCl?

Pricing hinges on manufacturing costs, competition intensity, regulatory policies, supply chain efficiencies, and regional market conditions.

2. How does moexipril compare to other ACE inhibitors in the market?

While effective, moexipril has a limited market share owing to the extensive use and brand recognition of drugs like enalapril and lisinopril.

3. Are there emerging therapies that threaten the market for moexipril?

Yes, drugs such as ARBs and newer antihypertensives, alongside best practices favoring personalized treatment, can reduce demand.

4. What is the outlook for moexipril’s price in emerging markets?

Prices are expected to be lower due to local competition and price controls, yet demand may grow with increasing hypertension prevalence.

5. Can innovation revive the market for moexipril?

Potentially, but significant clinical or delivery advantages would be required to displace entrenched competitors and re-establish premium pricing.

References

[1] World Health Organization. "Hypertension." WHO Fact Sheet, 2021.

[2] U.S. Food and Drug Administration. "Generic Drug Facts." FDA.gov, 2022.

[3] GoodRx. "Price of Moexipril HCl Tablets." GoodRx.com, 2023.

More… ↓