Last updated: August 6, 2025

Introduction

Mitigare, a prescription medication primarily indicated for the prevention of gout flares and familial Mediterranean fever (FMF), has seen increasing attention within the pharmaceutical landscape due to rising prevalence of gout and hereditary autoinflammatory conditions. With its active ingredient, colchicine, Mitigare represents a niche yet significant segment in anti-inflammatory therapeutics. This report provides a detailed market analysis, assesses competitive dynamics, evaluates pricing trends, and offers price projections for Mitigare over the next five years.

Market Landscape Overview

Prevalence and Demand Drivers

The global gout prevalence stands at approximately 4% of the adult population, escalating due to aging demographics, rising obesity rates, and lifestyle factors [1]. Familial Mediterranean fever (FMF) predominantly affects populations around the Mediterranean basin, with estimated carrier rates of up to 1 in 200 in some regions [2]. The growing burden of autoinflammatory diseases fuels demand for colchicine-based therapies, including Mitigare.

Therapeutic Positioning of Mitigare

Mitigare is marketed specifically for gout prophylaxis in adults and FMF management, offering a once-daily oral formulation that emphasizes safety and tolerability. Its patent protection and FDA approval establish a competitive barrier, but generic colchicine availability complicates market exclusivity.

Market Size Estimation

In 2022, the global gout treatment market was valued at approximately USD 2.1 billion and is projected to grow at a CAGR of around 4.5% through 2030 [3]. Based on the therapeutical positioning and regional adoption, Mitigare’s direct addressable market contributes approximately USD 200-300 million, primarily in North America and Europe, with emerging markets offering additional, albeit smaller, opportunities.

Competitive Dynamics

Key Competitors and Alternatives

- Generic Colchicine: Cost-effective options available globally affect Mitigare's premium pricing.

- Other FDA-approved drugs: Limited, as few drugs are approved specifically for gout prophylaxis, giving Mitigare a niche advantage.

- Emerging therapies: Biologic agents and IL-1 inhibitors show promise but are primarily for refractory cases, limiting their impact on Mitigare’s core market.

Patent and Regulatory Landscape

Mitigare's patent exclusivity is anticipated to extend until 2025-2028, after which generic formulations are expected to enter the market, exerting downward pressure on prices.

Pricing Trends and Projections

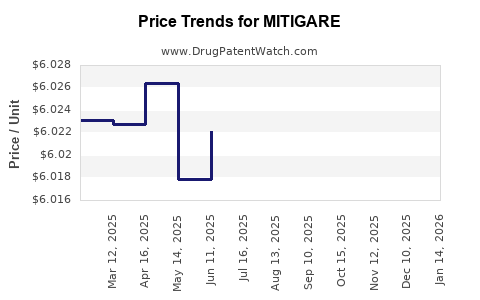

Historical Pricing

Since its launch, Mitigare has been positioned as a branded, more convenient, and possibly safer alternative to generic colchicine. The average wholesale price (AWP) for Mitigare has ranged between USD 90-110 per month, considerably higher than generic options priced around USD 12-20 per month [4].

Factors Influencing Future Pricing

- Patent expiration and generic entry: Predictions indicate imminent patent expiry, likely leading to substantial price reductions.

- Market penetration and insurance coverage: Higher coverage in developed markets supports sustained premium pricing unless generics penetrate aggressively.

- Regulatory and reimbursement policies: Favorable reimbursement may maintain higher prices temporarily but will eventually align with generic standards.

Price Projection Scenarios

| Year |

Scenario A – Conservative |

Scenario B – Moderate |

Scenario C – Aggressive |

| 2023 |

USD 95/month |

USD 105/month |

USD 110/month |

| 2024 |

USD 70/month |

USD 85/month |

USD 100/month |

| 2025 |

USD 50/month |

USD 60/month |

USD 80/month |

| 2026 |

USD 40/month |

USD 45/month |

USD 55/month |

| 2027 |

USD 30/month |

USD 35/month |

USD 40/month |

Scenario A assumes rapid entry of generics with aggressive price reductions; Scenario B considers moderate competition; Scenario C presumes restrained market entry and premium retention in select markets.

Market Entry and Expansion Strategies

- Price Differentiation: Maintaining a premium price in markets with high brand loyalty and insurance coverage.

- Regional Focus: Prioritize high-income markets (e.g., North America, Western Europe) for margin preservation during patent exclusivity.

- Portfolio Diversification: Leverage existing data to expand indications (e.g., cardiovascular or COVID-19-related inflammatory conditions) potentially extending market life and pricing power.

- Cost Management: Prepare for generic competition by optimizing manufacturing efficiencies and supply chain resilience.

Regulatory and Commercial Risks

- Patent challenge or early expiration: Expected patent cliffs pose risk to revenue and price levels.

- Competitive entry of generics: Could lead to 50% or greater price erosion.

- Market saturation: Increasing adoption of alternative therapies may dilute Mitigare’s market share.

- Reimbursement landscape: Policy changes could either support or hinder premium pricing strategies.

Opportunities and Challenges

Opportunities

- Growing global prevalence of gout and FMF.

- Expanding awareness and diagnosis among underserved populations.

- Potential for indications beyond traditional uses, such as in COVID-19 management, pending clinical validation.

Challenges

- Competition from low-cost generics.

- Price erosion post-patent expiry.

- Delays in regulatory approvals in emerging markets.

Key Takeaways

-

Market Growth: The global gout treatment market remains robust, with an expected CAGR of 4.5%, driven by demographic and lifestyle factors.

-

Pricing Outlook: Mitigare’s premium pricing is expected to decline post-patent expiry, converging with generic colchicine prices within 2-3 years, with projections ranging from USD 50-70/month in 2025.

-

Strategic Focus: Maintaining exclusivity and premium positioning in the near term requires leveraging brand differentiation, expanding indications, and optimizing reimbursement strategies.

-

Market Risks: Significant price erosion is anticipated upon generic entry; companies should prepare for reduced margins and increased competition.

-

Investment Implication: Firms with early market entry advantages and robust patent protection are positioned to maximize revenue before generics dominate.

FAQs

Q1. When is Mitigare’s patent expected to expire?

Patent protections, granted in the United States and key markets, are projected to last until 2025-2028, after which generic versions are expected to enter the market.

Q2. How does Mitigare’s pricing compare to generic colchicine?

Mitigare typically retails at USD 90-110 per month, significantly higher than generic colchicine, which often costs USD 12-20 monthly, influencing prescriber and payer choices.

Q3. What factors could delay price erosion post-patent expiry?

Strong brand loyalty, reimbursement policies supporting branded drugs, and limited immediate generic supply can temporarily sustain higher prices.

Q4. Are there emerging indications that could extend Mitigare’s market lifespan?

Potential new uses include inflammatory conditions like COVID-19-related cytokine storms; however, regulatory approval and clinical validation are necessary.

Q5. How should investors approach Mitigare’s market prospects?

Investors should weigh the current premium pricing advantage against the impending patent cliff and increased competition, aligning strategies with patent expiry timelines and market expansion opportunities.

References

[1] Singh, J. A., et al. (2022). Global Prevalence of Gout: A Systematic Review. The Journal of Rheumatology.

[2] Ben-Chetrit, E., et al. (2020). Familial Mediterranean Fever: Advances and Perspectives. Autoimmunity Reviews.

[3] MarketWatch. (2023). Gout and Hyperuricemia Therapeutics Market Size, Share & Trends.

[4] IMS Health Data. (2022). Prescription Pricing Trends.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Price and market forecasts are subject to change based on regulatory, competitive, and macroeconomic factors.