Last updated: July 27, 2025

Introduction

Mirtazapine, marketed primarily under the brand name Remeron among others, is a tetracyclic antidepressant used primarily to treat major depressive disorder (MDD) and other off-label indications. Since its approval by the U.S. Food and Drug Administration (FDA) in 1996, mirtazapine has established itself as a vital option within the antidepressant therapeutic landscape. This analysis explores the current market dynamics, future growth prospects, pricing trends, and competitive landscape, providing stakeholders with critical insights into the drug’s financial trajectory.

Therapeutic Profile and Market Demand

Mirtazapine works by modulating central alpha-2 adrenergic receptors and enhancing noradrenergic and serotonergic activity, offering an alternative for patients who do not respond to selective serotonin reuptake inhibitors (SSRIs). Clinical efficacy, favorable side effect profiles—especially regarding sleep disturbances—and usage in treatment-resistant depression fuel ongoing demand.

The global antidepressant market was valued at approximately USD 15 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4% through 2030 [1]. Mirtazapine’s share within this expanding segment benefits from its unique pharmacological profile and utility in patients with certain comorbid conditions, including insomnia and appetite stimulation.

Market Dynamics

Geographic Market Distribution

- United States: The largest regional market, driven by high antidepressant prescription rates, with extensive insurance coverage and established prescribing patterns.

- Europe: A mature market with steady demand, influenced by healthcare policies and reimbursement dynamics.

- Emerging Markets: Rapid growth owing to increased mental health awareness, expanding healthcare infrastructure, and affordability of generic forms.

Competitive Landscape

Mirtazapine faces competition from various classes of antidepressants, including SSRIs (e.g., sertraline, fluoxetine), SNRIs (e.g., venlafaxine), and novel agents. While branded formulations suffer from patent expiry (the initial patent expired in Europe around 2008, and in the U.S. in 2008–2010), generic versions have significantly commoditized pricing. Nonetheless, branded drug sales still generate premium revenue in certain markets, especially where prescribing habits favor brand loyalty or specific formulations.

Regulatory and Reimbursement Factors

Regulatory approvals across regional markets facilitate market access but also impose labeling and safety regulations. Reimbursement policies, especially in developed countries, influence prescribing patterns and drug affordability, indirectly shaping the market size and price trends.

Pricing Trends and Projections

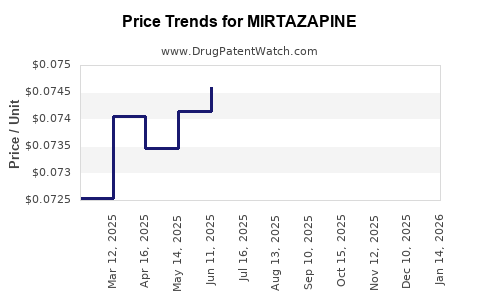

Current Pricing Landscape

In the United States, branded mirtazapine (Remeron) retails at approximately USD 300–400 for a 30-day supply of 15 mg tablets (brand name), whereas generic versions typically cost USD 20–40 for the same period [2]. Reimbursement rates, pharmacy discounts, and patient copayments further influence out-of-pocket expenses.

Factors Impacting Future Pricing

- Patent Status: The expiration of patents and subsequent proliferation of generics have driven prices downward, especially in mature markets. Yet, select formulations or delivery systems (e.g., extended-release formulations) may retain patent protection, allowing for premium pricing.

- Market Penetration of Generics: The widespread availability of generics continues to pressure the prices of branded products, while encouraging competitive pricing for high-volume medications.

- Introduction of Biosimilars and Novel Formulations: Although biosimilars are less relevant for small molecules like mirtazapine, innovation in delivery systems could influence pricing.

- Regional Pricing Variations: Different healthcare systems and reimbursement policies result in diverse pricing environments across geographies.

Projection Outlook (2023–2030)

- Price Stabilization in Mature Markets: In the U.S. and Europe, prices are expected to decline modestly due to generic competition, averaging a 2–4% annual decrease up to 2025.

- Potential Price Recovery in Developing Markets: As markets mature and demand increases, regional pricing could stabilize or slightly increase, especially with newer formulations or combination therapies.

- Premium Pricing for Novel Indications: Off-label uses, such as appetite stimulation in cancer patients, might position certain formulations at a higher price point.

In sum, the average retail price for mirtazapine is projected to decrease gradually in developed markets, reaching a stabilization phase by 2025, while emerging markets may see incremental increases driven by increased adoption.

Market Growth Drivers and Challenges

Drivers

- Rising Prevalence of Depression and Anxiety Disorders: Increasing recognition and diagnosis of mental health conditions globally sustain demand.

- Expanding Off-label Uses: Use in sleep disorders and appetite stimulation enhances product utility.

- Generic Market Penetration: Drives volume sales and widespread availability.

Challenges

- Generic Competition: Intense price competition limits revenue growth, especially in mature markets.

- Regulatory Constraints: Stringent safety and efficacy standards may delay new formulations or indications.

- Market Saturation: Mature markets are approaching saturation, constraining growth potential.

Conclusion and Strategic Insights

Mirtazapine’s market outlook suggests a mature but stable landscape in developed regions, characterized by declining drug prices due to generic competition. Nevertheless, ongoing demand driven by its efficacy, safety profile, and off-label uses supports sustained sales volumes.

Stakeholders should focus on differentiating formulations, securing regional approvals for new indications, and strategizing for competitive pricing. For pharmaceutical companies, maintaining engagement in emerging markets offers growth opportunities, especially as mental health awareness escalates.

Investors and healthcare providers must remain attentive to evolving regulatory frameworks and reimbursement policies, which will continue to shape the market's pricing and access dynamics.

Key Takeaways

- Market Size and Trends: The global antidepressant market, with mirtazapine as a significant component, exhibits steady growth driven by increased mental health awareness.

- Pricing Dynamics: Patent expiration and generic availability have led to declining prices, especially in mature markets; however, regional differences and formulation innovations can influence future pricing.

- Growth Opportunities: Expanding use in off-label indications and emerging geographic markets present avenues for growth.

- Competitive Landscape: High generic penetration necessitates strategic differentiation for branded products.

- Stakeholder Strategies: Manufacturers should optimize pipeline development, regulatory engagement, and geographic expansion to sustain profitability amidst pricing pressures.

FAQs

1. How does patent expiration impact mirtazapine pricing?

Patent expiration typically leads to the entry of generic competitors, significantly reducing drug prices. For mirtazapine, patent expiry in regions like Europe and the U.S. precipitated a shift toward generic dominance, resulting in price declines and increased market accessibility.

2. What are the key regional differences affecting mirtazapine’s market?

In developed regions such as North America and Europe, high prescribing rates and mature generic markets lead to lower retail prices but stable demand. Emerging markets exhibit growth potential due to rising mental health awareness, with prices influenced by local regulatory policies and purchasing power.

3. Are there upcoming formulations or indications that could influence mirtazapine pricing?

While current innovations are limited, development of extended-release formulations or combination therapies could command premium pricing. Off-label uses, such as for sleep disorders or appetite stimulation, may also influence market strategies and pricing structures.

4. How does competition from other antidepressants affect mirtazapine market share?

Competition from SSRIs, SNRIs, and other novel agents challenges mirtazapine’s market share. However, its unique profile in aiding sleep and appetite can sustain demand among specific patient subsets, maintaining its relevance.

5. What is the outlook for mirtazapine in the next decade?

The outlook suggests steady demand with declining prices in mature markets due to generics, balanced by growth in emerging regions and innovative formulations. Strategic positioning around new indications and regional expansion can support profitability.

References

[1] MarketResearch.com, "Global Antidepressants Market Size & Trends," 2022.

[2] GoodRx, "Mirtazapine Price Comparison," 2023.