Share This Page

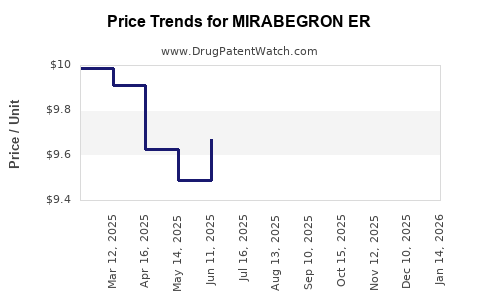

Drug Price Trends for MIRABEGRON ER

✉ Email this page to a colleague

Average Pharmacy Cost for MIRABEGRON ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MIRABEGRON ER 50 MG TABLET | 70710-1160-09 | 9.66406 | EACH | 2025-12-17 |

| MIRABEGRON ER 25 MG TABLET | 68180-0151-06 | 9.74755 | EACH | 2025-12-17 |

| MIRABEGRON ER 25 MG TABLET | 68180-0151-09 | 9.74755 | EACH | 2025-12-17 |

| MIRABEGRON ER 25 MG TABLET | 70710-1159-09 | 9.74755 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Mirabegron Extended-Release (ER)

Introduction

Mirabegron extended-release (ER) is a novel beta-3 adrenergic receptor agonist approved by the U.S. Food and Drug Administration (FDA) in 2012 for the treatment of overactive bladder (OAB) with symptoms of urgency, urinary frequency, and urge incontinence. As a first-in-class medication, mirabegron ER offers an alternative to antimuscarinics, with unique pharmacological advantages and a different side effect profile. This analysis explores the current market landscape, competitive positioning, regulatory factors, and forecasts the future price trajectory of mirabegron ER.

Market Landscape Overview

Epidemiology and Market Demand

Overactive bladder affects approximately 12-20% of adults worldwide, with higher prevalence among women and the elderly [1]. The increasing aging population globally and a growing awareness regarding OAB management bolster market demand. The U.S. alone reports nearly 33 million affected individuals [2].

Current Treatment Paradigm

Traditional treatment involves antimuscarinic agents such as oxybutynin, tolterodine, and solifenacin, which often cause adverse effects like dry mouth, constipation, and cognitive decline. Mirabegron ER introduces a different mechanism with generally better tolerability, leading to increased adoption.

Market Penetration and Sales Figures

Since its launch, mirabegron ER has experienced steady growth. In 2021, global sales surpassed USD 560 million, with the U.S. contributing approximately 65% of sales [3]. Market penetration remains significant in the outpatient urology segment, with increasing prescriber acceptance.

Competition and Market Share

Major competitors include antimuscarinics and other emerging therapies like onabotulinum toxin A and nerve stimulation devices. Mirabegron’s unique profile allows it to capture a considerable share, especially among patients intolerant to antimuscarinics. Leading pharmaceutical firms, such as Astellas Pharma (the original developer), continue to expand indications and healthcare provider awareness.

Regulatory Factors Affecting Market Dynamics

Approvals and New Indications

In 2018, the FDA approved a higher dose (50 mg) of mirabegron, and recent clinical trials explore indications for conditions like neurogenic bladder and nocturia, potentially expanding the addressable patient population [4].

Patent Landscape and Biosimilar Entry

Astellas Pharma’s patent protection extends into the late 2020s. The imminent patent expiry may invite biosimilar entrants, exerting price pressure and influencing market dynamics.

Price Trends and Projections

Current Pricing

As of 2023, the average wholesale price (AWP) for a 30-day supply of mirabegron ER (50 mg) hovers around USD 350–USD 400, depending on procurement channels. Patient out-of-pocket costs vary based on insurance coverage but generally range from USD 20–USD 100 monthly after copay assistance.

Pricing Drivers

Key factors influencing current and future pricing include:

-

Market competition: The entry of biosimilars or generics may significantly reduce prices.

-

Regulatory developments: Expanded indications could support value-based pricing strategies.

-

Manufacturing costs: Advances in formulation technology may reduce costs over time.

Future Price Projections (2023-2028)

Scenario 1: Conservative Estimate

Given the current patent protections and moderate competition, the price for a 30-day supply may decrease gradually by approximately 3-5% annually, driven by increased volume and payer negotiations. By 2028, prices could range between USD 280–USD 330.

Scenario 2: Competitive Pressure Post-Patent Expiry

If biosimilars or generics enter the market by 2025, prices could decline sharply, by 20-40% within the subsequent two years, possibly bringing the USD 200–USD 250 range for a monthly supply.

Scenario 3: Value-Added Strategies and Market Expansion

Additional indications and improved formulations could sustain higher prices, especially in specialty markets. Under this scenario, prices might stabilize around current levels or experience marginal increases, particularly in emerging markets.

Strategic Considerations

-

Pricing Strategy: Manufacturers should consider tiered pricing and payer incentives to maintain market share amid biosimilar competition.

-

Market Expansion: Broadening indications to neurogenic bladder and other urological conditions may justify premium pricing.

-

Cost Optimization: Investing in manufacturing efficiency can sustain profitable margins despite price erosion.

Regulatory and Healthcare Policy Impacts

Healthcare policies emphasizing biosimilar adoption and cost containment will shape future pricing trajectories. Additionally, value-based pricing models, where drug prices align with clinical benefits, could influence the valuation of mirabegron ER.

Key Market Opportunities

- Expanding indications for Mirabegron ER to neurogenic bladder and nocturia.

- Emerging markets where OAB treatment rates are rising but pricing sensitivity is high.

- Combination therapies for complex urological conditions, potentially commanding higher prices.

Conclusion

Mirabegron ER holds a stable place in the OAB therapeutic market, with growth driven by increasing prevalence and favorable tolerability. While current prices reflect a premium position, impending patent expirations suggest a future downward price trend, especially with biosimilar competition. Strategic expansion into new indications and markets, coupled with manufacturing efficiencies, will be critical for maintaining profitability and market relevance.

Key Takeaways

- Mirabegron ER is positioned as a first-line alternative to antimuscarinics, with growing global demand.

- Current prices are steady but face significant pressure from upcoming biosimilars and generics.

- Expansion of indications offers potential for value-based pricing and market differentiation.

- Price projections suggest a gradual decline over the next five years, with potential sharp decreases post-patent expiry.

- Manufacturers must adapt strategies around biosimilar competition, market expansion, and cost control.

FAQs

1. When will biosimilar versions of mirabegron ER arrive on the market?

Biosimilar development timelines depend on patent timelines and regulatory pathways, with entry likely around 2025-2027 following patent expiration in the late 2020s.

2. How does mirabegron ER compare price-wise to antimuscarinic agents?

Mirabegron ER typically costs more upfront (USD 350–USD 400/month) than generic antimuscarinics (USD 40–USD 100/month), though savings may be achieved through improved adherence and fewer side effects.

3. What factors could sustain higher prices for mirabegron ER?

Expansion into non-OAB indications, differentiated formulations, and inclusion in first-line therapy protocols could justify premium pricing.

4. How will healthcare policies influence mirabegron ER pricing?

Policies favoring biosimilar adoption and cost containment could pressure prices downward, while value-based reimbursement models may sustain higher prices depending on clinical benefits.

5. What emerging markets present opportunities for mirabegron ER?

markets in Asia, Latin America, and Eastern Europe where OAB prevalence is rising and healthcare infrastructure facilitates adoption will be key growth areas.

References

[1] Irwin DE, et al. "Worldwide prevalence estimates of symptomatic urinary incontinence in women." The Lancet Global Health, 2018.

[2] Abrams P, et al. "The standardization of terminology of lower urinary tract function." Neurourology and Urodynamics, 2002.

[3] Astellas Pharma Inc. "Mirabegron (Myrbetriq) global sales report," 2022.

[4] FDA. "FDA approves new drug for overactive bladder," 2012.

More… ↓