Share This Page

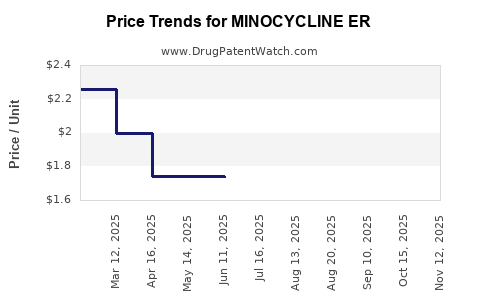

Drug Price Trends for MINOCYCLINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for MINOCYCLINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MINOCYCLINE ER 90 MG TABLET | 67877-0576-30 | 3.03047 | EACH | 2025-11-19 |

| MINOCYCLINE ER 90 MG TABLET | 67877-0576-30 | 2.92176 | EACH | 2025-10-22 |

| MINOCYCLINE ER 90 MG TABLET | 67877-0576-30 | 2.88552 | EACH | 2025-09-17 |

| MINOCYCLINE ER 90 MG TABLET | 67877-0576-30 | 2.81305 | EACH | 2025-08-20 |

| MINOCYCLINE ER 105 MG TABLET | 65862-0885-30 | 1.73420 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Minocycline ER

Introduction

Minocycline Extended-Release (ER) is a tetracycline antibiotic primarily prescribed for treating a spectrum of bacterial infections, including acne vulgaris and certain respiratory infections. As a once-daily formulation, Minocycline ER offers improved patient adherence compared to immediate-release formulations. Its market viability, competitive positioning, and pricing trends are influenced by the evolving landscape of antibiotic therapeutics, regulatory considerations, and emerging resistance patterns.

This analysis delineates the current market dynamics, competitive landscape, pricing trends, and future projections for Minocycline ER, providing critical insights for stakeholders strategizing investment, manufacturing, and market entry.

Market Overview

Market Demand and Epidemiological Drivers

The global demand for Minocycline ER is driven by increasing incidences of acne vulgaris, a prevalent dermatological condition affecting approximately 9.4% of the global population, with higher burdens in adolescents and young adults [1]. Additionally, the growing prevalence of resistant bacterial strains prompts an ongoing need for effective antibiotics.

According to industry reports, the global acne medication market—where Minocycline ER is a significant component—is projected to grow at a CAGR of approximately 4.5% through 2027 due to rising awareness and increased healthcare access [2].

Regulatory Environment

While Minocycline ER benefits from FDA approval for acne and other indications, its market expansion is partly circumscribed by regulatory restrictions around antibiotics stewardship. Approvals in emerging markets hinge on local regulators, which could influence regional sales trajectories.

Market Segmentation

Minocycline ER functions predominantly within dermatology, infectious disease, and outpatient pharmacy sectors. Retail pharmacies, healthcare providers, and hospitals constitute primary distribution points, with online/e-prescription channels gaining traction.

Competitive Landscape

Key Competitors

The market faces competition from generic formulations of Minocycline IR, doxycycline, sarecycline, and newer tetracycline derivatives. Brand-specific formulations like Solodyn (minocycline ER by Purdue Pharma) once held a dominant position but faced patent expirations and subsequent generic proliferation.

Generic Penetration

An augmenting number of generic manufacturers have entered the Minocycline ER space post-expiry of initial patents, exerting downward pressure on prices. Generic versions are typically priced 30-50% lower than branded counterparts, catalyzing increased affordability and market penetration.

Emerging Alternatives

Recent advances include drugs with enhanced safety profiles or targeted mechanisms, potentially threatening Minocycline ER's market share in specific indications.

Pricing Trends

Current Pricing Dynamics

Pricing for Minocycline ER has historically ranged from $150 to $250 for a 30-day supply in the U.S., depending on brand, formulation strength, and pharmacy discounts [3]. The entry of generics has led to a sharp decline, with average retail prices dropping to approximately $50-$80 for a comparable supply.

Reimbursement and Insurance Impact

Insurance coverage, including commercial payors and Medicaid, significantly influences patient out-of-pocket expenses. Tiered formulary restrictions may either facilitate or hinder utilization, impacting net market prices.

Price Regulation and Market Forces

In regulated markets like the U.S., prices are influenced by policy interventions and competition intensity. Public health initiatives aimed at antimicrobial stewardship may introduce pricing or usage restrictions.

Future Price Projections

Short-term Outlook (1-2 years)

Given the saturation of generic options, prices are expected to stabilize or continue declining marginally, barring supply chain disruptions or significant regulatory shifts. Anticipated retail prices are projected to range between $40 and $70 for a 30-day supply in the U.S.

Medium- to Long-term Outlook (3-5 years)

Market consolidation and patent cliff effects may lead to further price reductions. However, potential improvements in formulation—such as sustained-release technologies—could create premium pricing segments, especially if they demonstrate superior efficacy or safety profiles.

Impact of Resistance and Stewardship Programs

Growing antibiotic resistance may restrict prescriptions, preventing overuse and indirectly maintaining higher prices for specialized formulations. Conversely, stewardship policies that restrict antibiotic use could suppress demand, exerting downward pressure on prices.

Global Price Variability

In emerging markets, prices tend to be substantially lower (often under $20 per 30-day supply) due to cost-sensitive healthcare systems and higher generic competition. Conversely, in developed markets with stringent regulations and brand recognition, prices remain relatively higher.

Strategic Considerations for Stakeholders

-

For Manufacturers:

Focus on cost-efficient production of generics to capture volume. Innovation in formulations to differentiate (e.g., improved bioavailability, fewer side effects) can justify premium pricing. -

For Investors:

Monitor patent timeline deadlines and regulatory landscape shifts for investment timing. The decline of branded prices presages higher opportunities in generic markets. -

For Healthcare Providers:

Emphasize stewardship to balance efficacy with resistance mitigation, potentially leading to more sustainable pricing models.

Key Market Drivers & Challenges

Drivers:

- Growing acne and dermatological market size

- Increased antibiotic prescribing due to resistant infections

- Advancements in sustained-release formulations

Challenges:

- Antibiotic stewardship policies limiting prescriptions

- Price erosion driven by generic competition

- Resistance development reducing efficacy and demand

Key Takeaways

- Market saturation and generic entry have led to significant price declines for Minocycline ER, underscoring the importance of differentiation and strategic positioning.

- Global disparities in pricing reflect differing regulatory, economic, and healthcare infrastructure factors; opportunities exist in emerging markets through lower-cost formulations.

- Formulation innovation, such as next-generation sustained-release versions, can command premium prices if aligned with safety and efficacy improvements.

- Stewardship initiatives remain a double-edged sword—while they limit overuse, they can also constrain market size, emphasizing the need for balanced marketing strategies.

- Price stabilization is expected in the short term, with potential for gradual increases in specialized segments based on clinical advantages and resistance patterns.

FAQs

1. What factors influence the pricing of Minocycline ER?

Pricing is affected by patent status, generic competition, formulation costs, regulatory approvals, insurance reimbursement policies, and regional healthcare economics.

2. How does antibiotic resistance impact Minocycline ER's market?

Rising resistance may reduce effectiveness, leading to decreased prescriptions. Conversely, resistance-driven indications can spur demand for advanced formulations or combination therapies.

3. Are there upcoming innovations expected in Minocycline ER formulations?

Yes. Research into sustained-release technology and combination products aims to enhance efficacy, safety, and patient adherence, potentially enabling premium pricing.

4. How does the global market for Minocycline ER differ?

Prices and demand vary extensively, with developed countries facing higher prices due to regulatory and patent considerations, while emerging markets offer lower-cost generics.

5. What are the key risks for investors in Minocycline ER?

Regulatory restrictions, patent expirations, declining demand owing to resistant strains or stewardship policies, and aggressive generic pricing pose significant risks.

References

[1] Global Burden of Disease Study (2019). "Prevalence of Acne." The Lancet, 394(10215), 1828-1839.

[2] MarketWatch. (2022). "Acne Treatment Market Growth Outlook."

[3] GoodRx. (2023). "Average Retail Price of Minocycline ER."

Note: All projections and insights are based on current market data and trends as of 2023. Evolving regulatory, clinical, and competitive landscapes may influence future developments.

More… ↓