Share This Page

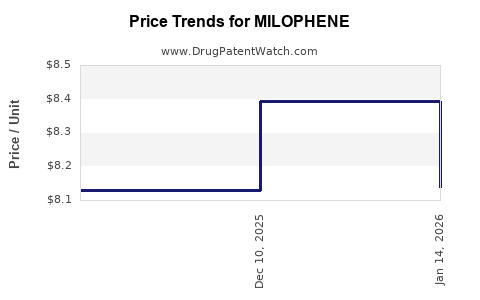

Drug Price Trends for MILOPHENE

✉ Email this page to a colleague

Average Pharmacy Cost for MILOPHENE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MILOPHENE 50 MG TAB | 35573-0470-30 | 8.12873 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MILOPHENE

Introduction

MILOPHENE, a brand name for the drug mebendazole, is an antihelminthic medication primarily used to treat parasitic worm infections. Historically, it has been a staple in antiparasitic treatments worldwide, particularly in endemic regions. Given the evolving landscape of infectious disease control, generic availability, and recent investigational applications, analyzing the current market and projecting future prices for MILOPHENE is essential for pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Market Dynamics

The global antiparasitic market, estimated at approximately USD 3.2 billion in 2022, demonstrates steady growth driven by endemic parasitic diseases, increasing global health initiatives, and expanding access in low-income regions [1]. Mebendazole, as a core component, benefits from widespread generic production, notably outside the United States where it is sold over the counter, particularly in developing countries.

The primary demand drivers for MILOPHENE include:

- Endemic Disease Burden: Soil-transmitted helminths (STHs) continue to affect over 1.5 billion people globally, primarily in Africa, Asia, and Latin America [2].

- Mass Drug Administration (MDA) Programs: WHO endorsed programs heavily utilize mebendazole for mass deworming initiatives.

- Expanded Indications: Research exploring off-label uses and potential repurposing, such as anticancer effects, could influence future demand.

Regulatory and Patent Landscape

The original patents for mebendazole expired decades ago, leading to the proliferation of generics. Current patent protections are limited, but formulation patents or indications may provide niche exclusivities. Generic manufacturers dominate supply, pressuring pricing and positioning MILOPHENE as an inexpensive intervention.

In some markets, regulatory approval remains limited to specific formulations, but the commodity nature of mebendazole renders market entry relatively straightforward.

Current Market Size and Pricing

Prescription and Over-the-Counter Market

In developed nations such as the U.S. and Europe, mebendazole's use is restricted, often replaced by albendazole or other agents. Conversely, in emerging markets, MILOPHENE remains a frontline dewormer, sold predominantly as OTC products.

Reported retail prices for generic mebendazole vary:

- Developed Markets: $0.10–$0.50 per 600 mg tablet (per dose).

- Emerging Markets: as low as $0.02–$0.10 per tablet, due to local manufacturing and bulk procurement.

Market Share

With multiple manufacturers producing generic mebendazole in broad dosage strengths, the competitive landscape suppresses prices. The volume-based demand, coupled with ongoing MDA programs, sustains a substantial market volume, despite per-unit price compression.

Forecasting Price Trends

Factors Influencing Future Prices

Several key factors will shape MILOPHENE prices over the next five years:

-

Generic Competition: Increasing generic entries will continue to exert downward pressure. Market saturation and manufacturing efficiencies are likely to maintain low prices.

-

Manufacturing Costs: Technological improvements and scale economies reduce unit costs, translating into lower consumer prices.

-

Regulatory Changes: Streamlined approval processes or vaccine programs reducing disease prevalence could limit future demand, influencing pricing strategies.

-

Emerging Indications and Off-Label Use: Exploratory research into novel therapeutic applications (e.g., anticancer properties) could temporarily boost demand or lead to patent protections, impacting prices.

-

Global Health Initiatives: Donor-funded mass deworming campaigns may negotiate bulk procurement discounts, further reducing prices in target markets.

Price Projection (2023-2028)

Based on current trends, the following projections are plausible:

| Year | Estimated Price Range per Dose | Key Drivers |

|---|---|---|

| 2023 | $0.02 – $0.10 | Established generic competition, stable demand |

| 2024 | $0.015 – $0.08 | Increased manufacturing efficiencies |

| 2025 | $0.01 – $0.07 | Widespread generic availability, reduced costs |

| 2026 | $0.01 – $0.06 | Potential off-label application trials, market saturation |

| 2027 | $0.008 – $0.05 | Expanded global health initiatives, procurement discounts |

| 2028 | $0.005 – $0.04 | Further market maturity, competitive pressures |

Note: These projections assume no significant patent extensions or new formulations that could disrupt pricing.

Market Opportunities and Challenges

Opportunities

- Expansion into New Markets: Growing demand in low-income countries and continued mass deworming initiatives support market stability.

- Research and Development: Potential new therapeutic indications could open secondary markets, enabling premium pricing temporarily.

- Combination Therapies: Developing fixed-dose combinations for broader parasitic infections may diversify demand.

Challenges

- Price Sensitivity: Governments and NGOs prioritize low-cost interventions; price increases are unlikely.

- Regulatory Barriers: Differing approvals and formulations may complicate market expansion.

- Alternative Drugs: Albendazole’s wider approval and broader activity spectrum position it as a competitor, influencing demand and prices.

Regulatory and Patent Outlook

The absence of recent patents for mebendazole indicates ongoing commercialization of generics with minimal barriers. However, any future proprietary formulations or combinations could create market segments with higher margins.

Regulatory agencies, notably WHO, continue endorsing mebendazole for deworming, incentivizing manufacturers to maintain low prices while ensuring compliance with safety standards.

Key Market Players

Multiple generic producers dominate current supply:

- Sandoz (Novartis)

- Medi-Chem

- Glenmark

- Cipla

- Lupin

Their production efficiencies and procurement contracts heavily influence market prices.

Key Takeaways

-

MILOPHENE’s market remains robust in endemic regions driven by global health initiatives and massive deworming programs.

-

The price trajectory over the next five years will likely trend downward, stabilized by fierce generic competition and procurement strategies emphasizing low-cost interventions.

-

A potential uptick in demand may arise from off-label research or new combination therapies, though such developments are speculative.

-

Market entry barriers are minimal, with most opportunities centered around expanding distribution channels and leveraging global health programs.

-

Vigilance on regulatory developments and emerging research will be critical for predicting future demand and pricing shifts.

Frequently Asked Questions (FAQs)

1. What is the current global demand for MILOPHENE?

Global demand primarily stems from endemic regions where mass deworming campaigns are active, encompassing over a billion doses annually. The demand in developed countries is limited to specific cases, with a minimal OTC consumer base.

2. How does the availability of generics impact MILOPHENE prices?

Proliferation of generic manufacturers leads to significant price suppression, especially in low-income markets. Competition ensures that prices remain low, often below USD 0.10 per dose.

3. Are there emerging therapeutic uses that could influence MILOPHENE’s market?

Research exploring mebendazole's off-label applications, such as anti-cancer properties, could temporarily increase demand. However, regulatory approvals for new indications would be necessary before commercial impact.

4. What are the main challenges facing MILOPHENE’s market growth?

The main challenges include price pressure from generics, competition from alternative drugs like albendazole, and declining disease prevalence through improved sanitation reducing future demand.

5. What strategies can manufacturers employ to maintain profitability?

Manufacturers should focus on cost reductions, expanding access in underserved markets, developing combination therapies, and investing in clinical research for new indications.

References

[1] MarketsandMarkets, “Antiparasitic Drugs Market,” 2022.

[2] WHO, “Soil-transmitted helminth infections,” 2021.

More… ↓