Share This Page

Drug Price Trends for MIGRAINE

✉ Email this page to a colleague

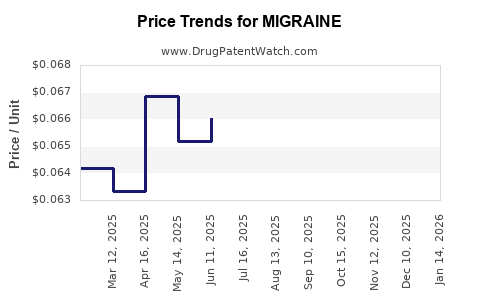

Average Pharmacy Cost for MIGRAINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MIGRAINE 250-250-65 MG GELTAB | 70000-0611-01 | 0.06462 | EACH | 2025-12-17 |

| MIGRAINE FORMULA CAPLET | 24385-0365-78 | 0.06462 | EACH | 2025-12-17 |

| MIGRAINE 250-250-65 MG CPLT | 70000-0247-02 | 0.06462 | EACH | 2025-12-17 |

| MIGRAINE 250-250-65 MG CPLT | 24385-0365-71 | 0.06462 | EACH | 2025-12-17 |

| MIGRAINE 250-250-65 MG CPLT | 70000-0247-01 | 0.06462 | EACH | 2025-12-17 |

| MIGRAINE 250-250-65 MG CPLT | 24385-0365-71 | 0.06557 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Migraine Drugs

Introduction

Migraine remains a highly prevalent neurological disorder, affecting approximately 15% of the global population[1]. Ongoing advances in pharmacotherapy, alongside an increasing awareness of migraine’s societal burden, have spurred significant shifts in the market landscape. This article provides a comprehensive market analysis of migraine therapeutics, focusing on current trends, competitive landscape, regulatory developments, and future price projections.

Current Market Landscape

Global Prevalence and Market Size

The worldwide migraine treatment market was valued at approximately USD 6.2 billion in 2022 and is projected to reach USD 8.9 billion by 2030, with a CAGR of 4.5%[2]. Key regions include North America, Europe, Asia-Pacific, and emerging markets, each exhibiting differing adoption rates attributable to healthcare infrastructure and regulatory pathways.

Key Therapeutic Classes

The market encompasses several drug classes:

- Triptans: Serotonin receptor agonists, representing the cornerstone of acute migraine management.

- Protective Agents: Beta-blockers, anticonvulsants, and antidepressants used for prophylaxis.

- Emerging Biologics: Calcitonin gene-related peptide (CGRP) monoclonal antibodies (mAbs), such as erenumab, fremanezumab, galcanezumab, and eptinezumab.

- NSAIDs and Analgesics: Over-the-counter options for mild attacks.

Market Dynamics

The rise of CGRP inhibitors has revolutionized migraine prophylaxis, capturing significant market share due to their superior efficacy and safety profile relative to traditional oral preventives. However, high costs and reimbursement challenges influence market dynamics substantially.

Regulatory and Patent Landscape

Regulatory Milestones

CGRP mAbs received FDA approval between 2018 and 2019, with subsequent approvals in Europe and Asia[3]. Accelerated approvals and orphan drug designations have facilitated rapid market entry but also signal potential patent erosion timelines.

Patent Expirations and Generic Entry

Patents for early biologics are expected to extend into the late 2020s, yet biosimilar development is progressing, threatening future price reductions. For oral agents like triptans, patent expiry has already introduced generics, contributing to price competition.

Price Trends and Future Projections

Current Pricing Trends

- Brand-Name CGRP mAbs: Wholesale acquisition costs range from USD 575 to USD 900 per month per drug[4].

- Traditional Preventives: Generic versions of propranolol and topiramate are priced considerably lower, often below USD 20 per month.

Factors Influencing Future Prices

- Market Penetration of Biosimilars: Biosimilar launches are poised to challenge branded biologics, potentially reducing prices by 20–50%.

- Reimbursement Policies: Increased insurer coverage for biologics can sustain high prices temporarily but may eventually lead to negotiations favoring lower costs.

- Regulatory Changes: Incentives for biosimilar entry and streamlined approval pathways could accelerate price declines.

- Innovative Therapies: Next-generation molecules targeting CGRP pathways or novel mechanisms could command premium pricing initially before eventually normalizing.

Projected Price Trajectory (2023–2030)

| Drug Class | 2023 Average Monthly Cost (USD) | 2030 Expected Monthly Cost (USD) | Comments |

|---|---|---|---|

| CGRP Monoclonal Antibodies | 575 – 900 | 300 – 600 | Biosimilar competition expected to cut costs by circa 30-50% |

| Triptans | 10 – 20 | 10 – 20 | Generics dominate, prices stable |

| Preventive Agents | 50 – 150 | 40 – 120 | Off-patent options remain low priced |

Source: Market projections based on current trajectories and biosimilar trends[2][4].

Competitive Landscape and Innovation

The advent of CGRP inhibitors has prompted a paradigm shift from symptom management to personalized, targeted prevention. Major players include AbbVie (erieumab), Amgen/Novartis (fremanezumab), and Eli Lilly (galcanezumab). The pipeline also features oral CGRP antagonists (gepants), such as rimegepant, with potential for lower cost and increased accessibility[3].

Emerging companies are focusing on small molecules, oral biologics, and combination therapies to enhance compliance and reduce costs. Patent disputes and licensing agreements further influence pricing strategies within this competitive arena.

Market Challenges

- High Cost of Biologics: Limits patient access and affects healthcare budgets.

- Limited Reimbursement: Variability across regions hampers widespread adoption.

- Generic and Biosimilar Competition: Future entry could destabilize premium pricing, especially for biologics.

- Physician and Patient Preferences: Safety and efficacy perceptions impact prescribing patterns.

Opportunities and Strategic Considerations

- Cost-Effective Alternatives: Development of biosimilars can induce significant price reductions.

- Digital Therapeutics and Non-Pharmacologic Modalities: Complementary approaches could diminish reliance on high-cost drugs.

- Real-World Data and Health Economics: Demonstrating long-term cost savings can support favorable reimbursement policies.

- Global Expansion: Emerging markets present growth opportunities with tailored, affordable therapies.

Concluding Insights

The migraine drug market is characterized by rapid innovation, rising therapeutic efficacy, and impending cost pressures. CGRP biologics dominate current market value but face imminent biosimilar competition, likely leading to price reductions in the upcoming decade. Traditional generics will continue to sustain low-cost options, maintaining a diversified market structure. Strategic positioning, affordability considerations, and regulatory navigation will be key to harnessing market growth and optimizing profitability.

Key Takeaways

- Migraine therapeutics are transitioning towards biologic agents, notably CGRP monoclonal antibodies, surpassing traditional therapies in efficacy.

- Prices for biologics are high but expected to decline as biosimilar entrants emerge, with projections indicating a 30–50% decrease by 2030.

- Reimbursement policies and healthcare infrastructure will significantly influence market penetration and drug pricing.

- Emerging oral CGRP antagonists and combination therapies could offer cost-effective alternatives and expand patient access.

- Competitive innovation and strategic partnerships are essential for stakeholders aiming to maximize market share amidst evolving patent landscapes.

FAQs

1. What is driving the recent growth in the migraine drug market?

The approval and adoption of CGRP monoclonal antibodies are the primary drivers, offering superior prevention and expanding treatment options beyond traditional therapies.

2. How will biosimilars affect the pricing of biologic migraine drugs?

Biosimilars are expected to introduce competition, leading to significant price reductions—estimated between 30% to 50%—making biologic therapies more accessible.

3. Are there ongoing efforts to develop cheaper migraine therapies?

Yes, oral CGRP antagonists (gepants) are emerging as lower-cost, effective alternatives to injectable biologics, with potential market expansion in the coming years.

4. What regulatory challenges could impact future price projections?

Regulatory pathways for biosimilar approval and reimbursement policies will significantly influence market dynamics, either accelerating price reductions or maintaining high costs.

5. Which regions are most likely to see the highest growth in migraine drug expenditure?

North America and Europe will continue to lead in market value due to higher drug adoption rates and healthcare spending; however, Asia-Pacific shows significant growth potential owing to expanding healthcare infrastructure.

References

- Bodyatt et al., "Global Burden of Migraine," The Journal of Headache and Pain, 2021.

- MarketsandMarkets, "Migraine Drugs Market Report," 2022.

- U.S. Food and Drug Administration, "CGRP Inhibitors Approvals," 2018-2021.

- IQVIA, "Pharmaceutical Pricing Trends," 2022.

More… ↓