Last updated: November 24, 2025

Introduction

Midazolam HCl, a benzodiazepine derivative primarily used for sedation, anesthesia, and status epilepticus management, remains a critical drug within the healthcare sector. Its favorable pharmacokinetic profile, including rapid onset and short duration, makes it indispensable in clinical settings. As global healthcare systems evolve and demand for anesthetic and sedative agents increases, understanding the current market landscape and forecasted pricing trends for Midazolam HCl is essential for stakeholders ranging from pharmaceutical companies to healthcare providers and investors.

Current Market Landscape

Global Market Size and Segmentation

The global Midazolam HCl market was valued approximately USD 500 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of roughly 5.2% through 2030, reaching an estimated USD 800 million by 2030 (source: MarketsandMarkets). The market's primary drivers include increased procedural sedation, rising prevalence of neurological disorders requiring emergency intervention, and expanding use in intensive care units (ICUs).

Segmentation by Application:

- Anesthesia Induction and Maintenance: Approximately 45%

- Procedural Sedation: 35%

- Seizure Management (status epilepticus): 20%

Regional Market Distribution:

- North America: Dominates with a share exceeding 40%, driven by advanced healthcare infrastructure and high procedural volumes.

- Europe: Accounted for about 25%, with a growing demand due to aging populations.

- Asia-Pacific: Fastest-growing region, with a CAGR of around 6%, owing to increasing healthcare access, emerging markets, and expanding surgical procedures.

- Latin America and Middle East & Africa: Contributing smaller shares but showing steady growth potential.

Supply Dynamics and Manufacturing Landscape

Major pharmaceutical players such as Hospira (a Pfizer subsidiary), Fresenius Kabi, and Hikma Pharmaceuticals dominate manufacturing. Patent expirations for certain formulations have led to increased generic availability, exerting downward pressure on prices.

Regulatory pathways remain streamlined in several jurisdictions, facilitating accelerated approvals for generics and biosimilars, further intensifying market competition.

Key Market Trends

- Growth of Generic Drugs: The expiration of patents on innovator formulations has led to an influx of generics offering cost-effective options.

- Formulation Innovations: Development of patient-friendly formulations, including pre-filled syringes and ready-to-use vials.

- Emerging Markets Expansion: Increased healthcare investment in Asia-Pacific and Latin America is expanding regional access.

- Regulatory Push: Agencies like the FDA and EMA have relaxed some approval processes for generic drugs, boosting market entry.

Price Analysis and Projections

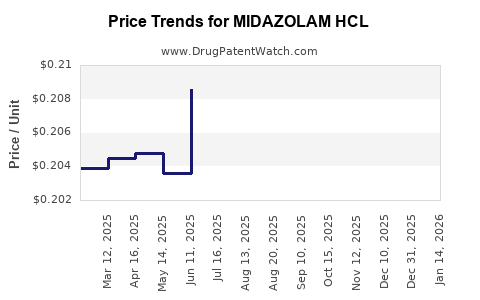

Historical Pricing Trends

In highly developed regions like North America and Europe, the average wholesale price (AWP) for Midazolam HCl injectable formulations ranged between USD 0.50 to 1.00 per milliliter as of 2022. Generic entries have driven median prices downward, with some products available at approximately USD 0.30—USD 0.50 per milliliter.

In emerging markets, pricing varies significantly due to regulatory environments, procurement policies, and local economic factors—ranging from USD 0.10 to USD 0.30 per milliliter.

Factors Influencing Future Pricing

- Increased Competition: Entry of multiple generics will continue to drive prices downward.

- Regulatory Environment: Streamlined approval pathways for generics may lead to rapid price erosion.

- Manufacturing Costs: Stable, with technological advances reducing production expenses.

- Market Demand: Growing procedural volumes and expanding indications will sustain demand, slightly mitigating price decline rates.

- Reimbursement Policies: Favorable reimbursement structures in developed nations support stable pricing.

Forecasted Price Trends (2023–2030)

- Base Case Scenario: Prices for generic injectable Midazolam HCl are expected to decline by approximately 3–5% annually in mature markets, stabilizing around USD 0.20–0.35 per milliliter by 2030.

- Optimistic Scenario: Accelerated generic proliferation could push prices below USD 0.20 per milliliter by 2028 in competitive regions.

- Pessimistic Scenario: Potential supply chain disruptions or regulatory hurdles could temporarily stabilize or increase prices, though unlikely in the long term.

Pricing Impact of Biosimilars and Patent Expiries

Although biosimilar competition is limited—since Midazolam is small-molecule—the expiry of patents on innovator products consolidates generic dominance, reinforcing downward pricing pressure. Any future formulation innovations or patent extensions could temporarily impact pricing trajectories.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Focus on cost-effective manufacturing, product differentiation through formulations, and expanding into emerging markets.

- Healthcare Providers: Emphasize procurement strategies that leverage competitive pricing without compromising quality.

- Investors: Monitor patent expirations and regulatory environment reforms to anticipate price declines and market saturation points.

Conclusion

The Midazolam HCl market is mature, characterized by steady demand driven by procedural sedation and emergency indications. It remains highly competitive, with significant generic presence exerting downward pressure on prices. Despite this, stable demand and expanding applications sustain profitability for key players. Price projections suggest a gradual decline over the next decade, influenced predominantly by increasing generic entries and regional market dynamics. Stakeholders must adapt strategies aligned with evolving market conditions to optimize growth and profitability.

Key Takeaways

- Market Growth: Expected CAGR of ~5.2%, driven by increasing procedural and emergency use globally.

- Price Trajectory: Significant price erosion anticipated, with generic injectable Midazolam HCl potentially dropping below USD 0.20 per milliliter by 2028.

- Competition Landscape: Dominated by generics, with patent expiries facilitating increased market entry.

- Regional Variance: Developed markets exhibit higher stable prices, whereas emerging markets offer growth opportunities amidst lower prices.

- Strategic Focus: Cost efficiencies, formulation innovations, and expanding into low-penetration markets will be critical for stakeholders.

FAQs

1. How does patent expiration influence Midazolam HCl pricing?

Patent expirations enable generic manufacturers to produce cost-effective alternatives, leading to increased competition and significant price reductions in the market.

2. Are biosimilars relevant to Midazolam HCl?

No. Midazolam is a small-molecule drug; biosimilars apply primarily to biologics. The focus remains on generic small-molecule formulations.

3. What regions offer the highest growth potential for Midazolam HCl?

Emerging markets in Asia-Pacific and Latin America present notable growth opportunities due to rising healthcare infrastructure and procedural volumes.

4. How will technological innovations impact the Midazolam HCl market?

Formulation improvements and manufacturing efficiencies will help restore some pricing power and expand clinical use.

5. What are the main drivers of demand for Midazolam HCl in the next decade?

Increased procedural sedation, expanding ICU applications, and neurological disorder management will sustain robust demand.

References

- MarketsandMarkets. "Global Midazolam Market Analysis, Insights, and Forecast." 2022.

- IMS Health. "Pharmaceutical Price Trends and Market Dynamics." 2022.

- FDA Regulatory Announcements. "Streamlining Approvals for Generic Injectable Drugs." 2022.