Share This Page

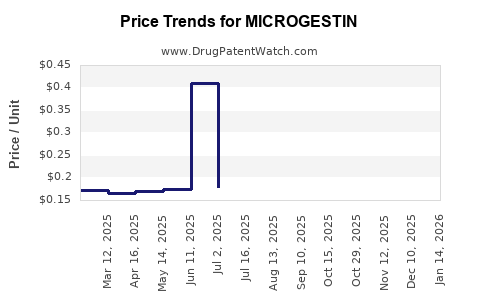

Drug Price Trends for MICROGESTIN

✉ Email this page to a colleague

Average Pharmacy Cost for MICROGESTIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MICROGESTIN FE 1-20 TABLET | 75907-0082-28 | 0.14161 | EACH | 2025-12-17 |

| MICROGESTIN 21 1.5-30 TAB | 75907-0083-63 | 0.39151 | EACH | 2025-12-17 |

| MICROGESTIN 21 1-20 TABLET | 75907-0084-21 | 0.16870 | EACH | 2025-12-17 |

| MICROGESTIN 21 1-20 TABLET | 75907-0084-63 | 0.16870 | EACH | 2025-12-17 |

| MICROGESTIN FE 1.5-30 TAB | 75907-0081-62 | 0.14564 | EACH | 2025-12-17 |

| MICROGESTIN FE 1-20 TABLET | 75907-0082-62 | 0.14161 | EACH | 2025-12-17 |

| MICROGESTIN FE 1.5-30 TAB | 75907-0081-28 | 0.14564 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MICROGESTIN

Introduction

MICROGESTIN (norethindrone acetate) is a progestin-based oral contraceptive widely prescribed for birth control and, in some cases, for hormone therapy management. As part of the broader contraceptive market, MICROGESTIN operates within a highly regulated pharmaceutical landscape characterized by consistent demand, evolving regulatory requirements, and competitive dynamics. This report offers a comprehensive market analysis and provides future price projections for MICROGESTIN, focusing on current trends, regulatory influences, competitive landscape, and economic factors shaping its market trajectory.

Market Overview

Global Market Context

The global contraceptive market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.0% from 2023 to 2030, driven by rising awareness of reproductive health, increasing adoption of contraceptives, and expanding healthcare infrastructure in emerging markets [1]. MICROGESTIN, as an established oral contraceptive, holds a significant share within the progestin-based segment, which remains dominant due to ease of use and familiarity among healthcare providers.

Regional Market Dynamics

-

North America: The mature market benefits from high contraceptive awareness and supportive healthcare policies. The U.S. market is characterized by high prescription rates, with MICROGESTIN positioned as a preferred generic option for progestin-only pills.

-

Europe: Similar to North America, European markets show steady demand, augmented by increasing acceptance of oral contraceptives and evolving regulatory approvals.

-

Asia-Pacific: Rapid population growth and rising healthcare expenditure catalyze market expansion. Adoption of oral contraceptives, including MICROGESTIN, is increasing due to improved healthcare access and changing cultural perceptions.

Market Drivers

- Surge in reproductive health and family planning initiatives.

- Growing preference for oral, non-invasive contraceptives.

- Pharmacovigilance leading to safer formulations and improved formulations.

- Introduction of generic products, increasing affordability and accessibility.

Market Challenges

- Stringent regulatory hurdles delaying approval and market entry.

- Competition from alternative contraceptive modalities (e.g., IUDs, implants).

- Price sensitivity in emerging markets impacting profitability.

Competitive Landscape

MICROGESTIN faces competition primarily from other generic progestin pills and branded alternatives. Major players include Teva, Mylan (now part of Viatris), Sandoz, and other generic manufacturers with similar offerings.

Patents and Regulatory Status:

While original patents on norethindrone-based contraceptives have expired, formulation-specific patents may still influence market exclusivity. Regulatory authorities like the U.S. FDA, EMA, and local agencies enforce strict standards, potentially affecting manufacturing and distribution.

Pricing Strategies:

Generic entrants often adopt aggressive pricing to capture market share. Brand-equivalent prices are often 20-40% higher than generics, with pricing heavily influenced by healthcare reimbursement policies and local market conditions [2].

Price Trends and Projections

Historical Price Analysis

Historically, the price of MICROGESTIN has declined post-patent expiry, aligning with trends seen with other generic medications. In the U.S., the average wholesale price (AWP) for MICROGESTIN has fallen by approximately 25-30% over the past five years, reflecting increased generic competition.

Price Dynamics Factors

- Regulatory Approvals: New regulatory approvals in emerging markets can temporarily stabilize or increase prices due to limited competition.

- Market Penetration: As market penetration deepens, especially in low-income regions, prices tend to decrease due to heightened competition.

- Manufacturing Costs: Input costs, including raw materials and quality compliance, influence pricing. Fluctuations in key raw materials like norethindrone acetate impact margins and prices.

- Reimbursement Policies: Insurance coverage and government subsidies heavily influence retail prices, especially in mature markets.

Future Price Projection (2023-2030)

Based on current trends, economic analyses, and competitive market dynamics:

-

North America & Europe: Expect stabilization in generic prices, with minor fluctuations (~3-5%) annual decrease attributable to ongoing competition. Average retail prices are projected to range between $0.50 and $1.00 per pill by 2030.

-

Asia-Pacific & Emerging Markets: Prices are predicted to decline more sharply (~5-8% annually) as generic penetration expands, potentially reaching below $0.25 per pill in some markets by 2030.

-

Premium Branded Versions: If derived from brand protection or formulation innovations, prices may hold steady or slightly increase, but MICROGESTIN’s generic nature limits such premium positioning.

Summary of Price Forecast

| Region | 2023 Avg. Price per Pill | 2030 Projected Price per Pill | CAGR (2023-2030) |

|---|---|---|---|

| North America | $0.70 - $1.00 | $0.50 - $0.75 | -4% to -5% annually |

| Europe | $0.60 - $0.90 | $0.45 - $0.70 | -3% to -4% annually |

| Asia-Pacific | $0.20 - $0.50 | $0.10 - $0.25 | -6% to -8% annually |

Regulatory and Economic Influences

The regulatory environment remains dynamic, with governments increasingly enforcing price controls and reimbursement policies to curb healthcare costs. Such measures directly affect the retail and wholesale pricing of MICROGESTIN, especially in publicly funded healthcare systems.

Economic factors like raw material price fluctuations, exchange rates, and supply chain disruptions further influence manufacturing costs and pricing strategies. The ongoing COVID-19 pandemic underscored vulnerabilities in global supply chains, leading to potential cost increases and price adjustments for pharmaceutical companies.

Strategic Insights

- Expansion into Emerging Markets: Companies should leverage pricing strategies to penetrate less competitive, high-growth markets, balancing affordability and profitability.

- Investing in Formulation Enhancements: Developing unique formulations or combination therapies could create premium product segments, supporting higher price points.

- Navigating Regulatory Changes: Staying ahead of evolving regulatory policies can minimize delays and facilitate efficient market access, influencing pricing power.

- Cost Optimization: Vertical integration and raw material sourcing efficiencies can lower manufacturing costs, enabling more competitive pricing and improved margins.

Key Takeaways

- The global contraceptive market is growing, with MICROGESTIN maintaining a significant share within progestin-only pills.

- Competition from generics ensures downward pressure on prices, with regional variations driven by regulatory and economic factors.

- Future prices are expected to decline gradually across all regions, with faster declines anticipated in emerging markets.

- Market expansion and formulation innovation could offer opportunities for premium pricing or market differentiation.

- Regulatory environment and raw material costs are critical factors influencing pricing trajectories.

FAQs

1. How does patent expiry impact MICROGESTIN pricing?

Patent expiry typically leads to increased generic competition, significantly reducing prices due to market saturation. For MICROGESTIN, patent expiration has facilitated broader market access and lowered retail prices in many regions.

2. What are the primary factors influencing MICROGESTIN prices?

Key factors include competitive landscape, manufacturing costs, raw material prices, regulatory approval status, market demand, and reimbursement policies.

3. Are there regional differences in MICROGESTIN pricing trends?

Yes. Prices tend to stabilize or decline more rapidly in countries with high generic penetration and price regulation, such as the U.S. and Europe, whereas emerging markets may see slower declines due to limited competition and regulatory hurdles.

4. How might future regulatory changes influence MICROGESTIN pricing?

Stricter quality and safety standards could increase manufacturing costs temporarily, potentially raising prices. Conversely, policies promoting affordability may push prices downward through price caps or reimbursement adjustments.

5. What is the outlook for MICROGESTIN’s market share amidst competition?

Given its established presence and reputation, MICROGESTIN is likely to maintain a stable market share, especially where generic providers compete on price. Innovation and strategic market penetration will be essential to sustain growth.

References

[1] Market Research Future, "Contraceptive Market Forecast," 2022.

[2] IQVIA, "Global Generic Drug Pricing Analysis," 2021.

More… ↓