Share This Page

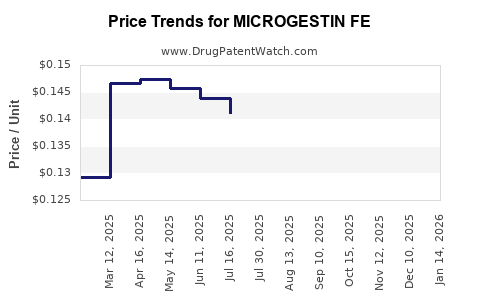

Drug Price Trends for MICROGESTIN FE

✉ Email this page to a colleague

Average Pharmacy Cost for MICROGESTIN FE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MICROGESTIN FE 1.5-30 TAB | 75907-0081-62 | 0.14564 | EACH | 2025-12-17 |

| MICROGESTIN FE 1-20 TABLET | 75907-0082-28 | 0.14161 | EACH | 2025-12-17 |

| MICROGESTIN FE 1-20 TABLET | 75907-0082-62 | 0.14161 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MICROGESTIN FE

Introduction

MICROGESTIN FE, a combined oral contraceptive containing ethinyl estradiol and norethindrone acetate, holds a significant position within the global contraceptive market. As demand for reliable, hormonal contraceptives increases driven by evolving family planning needs and broadening access, understanding its market dynamics and price trends becomes critical for stakeholders: pharmaceutical companies, healthcare providers, policymakers, and investors. This article offers a comprehensive analysis of the current market landscape, projected pricing trajectories, and the influential factors shaping MICROGESTIN FE's future.

Market Landscape Overview

Global Demand and Market Size

The contraceptive market, valued at approximately USD 22.4 billion in 2022, is poised for steady growth, with a compounded annual growth rate (CAGR) of 6.2% projected through 2030 [1]. MICROGESTIN FE occupies a niche in the combined oral contraceptive segment, which dominates the market segment due to its high efficacy, ease of use, and acceptance among women aged 15-49.

In particular, North America and Europe remain mature markets characterized by high contraceptive prevalence rates (> 70%), widespread healthcare coverage, and strong regulatory frameworks. Emerging markets, such as Asia-Pacific and Latin America, display rapid growth fueled by increasing urbanization, improved healthcare infrastructure, and government initiatives promoting family planning.

Regulatory Environment

MICROGESTIN FE's regulatory approvals span multiple jurisdictions, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Regulatory pathways influence generic manufacturing, pricing, and market entry strategies. The approval process for new formulations or biosimilars can either limit or accelerate market competition and price fluctuations.

Competitive Landscape

The market comprises originator brands like MICROGESTIN FE and multiple generic equivalents. Generic entrants typically produce lower-priced alternatives, intensifying price competition. Additionally, other contraceptive options—long-acting reversible contraceptives (LARCs), patches, injectables—compete within the broader contraceptive market, influencing demand and pricing strategies.

Key Market Drivers

- Increasing Female Workforce Participation: Enhances demand for reliable family planning options.

- Policy Initiatives: Government-sponsored family planning programs expand access, especially in emerging markets.

- Technological Advances: Improved formulations increase compliance and efficacy, boosting market adoption.

- Consumer Preference for Oral Contraceptives: Ease of use sustains the segment's dominance over alternative methods.

Market Challenges

- Regulatory Hurdles: Stringent approval processes and evolving safety standards may delay product launches and impact pricing.

- Generic Competition: Price erosion due to multiple manufacturers offering equivalent formulations.

- Side Effects Concerns: Adverse effects may influence consumer preferences and prescribing behaviors.

- Availability of Alternative Contraception: Increasing popularity of LARCs and non-hormonal methods restrict market growth.

Pricing Landscape and Projections

Current Pricing Trends

The current average retail price of MICROGESTIN FE varies by geography and formulation strength:

- United States: Approximately USD 50-70 for a 30-day supply of the branded product, with generics priced between USD 10-25 [2].

- Europe: Prices range from EUR 20-40 for the branded product, with generics available at lower costs.

- Emerging Markets: Significantly lower, often subsidized through government programs.

Price disparities are influenced by factors including manufacturing costs, regulatory fees, distribution channels, healthcare system structures, and reimbursement policies.

Factors Influencing Future Price Movements

1. Patent Status and Patent Expirations

While MICROGESTIN FE's patent protection has likely expired or is nearing expiry in many jurisdictions, the entry of generic alternatives since the late 2010s has exerted downward pressure on prices [3].

2. Generic Market Penetration

Increased competition among generic manufacturers will continue to drive prices down, particularly in price-sensitive markets. Observations indicate a 15-25% price reduction within five years of generic market entry [4].

3. Manufacturing and Supply Chain Dynamics

Advancements in manufacturing efficiencies and economies of scale may stabilize or reduce costs over the next decade, enabling lower prices.

4. Regulatory and Policy Impact

Proactive policies promoting generic substitution, mandated pricing caps, and subsidization will further influence pricing. For example, in India, government procurement policies for contraceptives have historically kept prices low [5].

5. Market Consolidation

Consolidation among generic manufacturers could lead to price stabilization or, conversely, reduced competition if dominant players adjust strategies.

Projected Price Trends (2023–2030)

- The average retail price for MICROGESTIN FE and equivalent generics is expected to decline by approximately 10-15% in developed markets over the next five years, driven by competition and improved supply chain efficiencies.

- In emerging markets, prices may remain stable or decrease marginally, especially with governmental subsidies and bulk purchasing agreements.

- Long-term, as patent exclusivity diminishes and markets mature, the price differential between branded and generic MICROGESTIN FE could widen, favoring affordability for end-users.

Revenue and Market Share Projections

The global contraceptive market, with its expanding base, is expected to reach USD 31.9 billion by 2030 [1]. MICROGESTIN FE's share within the combined oral contraceptives segment is projected to stagnate or grow modestly, contingent on product differentiation, marketing strategies, and regulatory approvals.

Influencing Market Dynamics

Patient Preferences and Compliance

Formulation advancements emphasizing minimal side effects and convenience can bolster demand, potentially allowing for premium pricing in select markets despite generic competition.

Healthcare Provider and Policy Shifts

Prescribing patterns influenced by insurance coverage, government guidelines, and provider preferences will shape demand volume and pricing.

Market Entry of New Formulations

Innovations such as extended-cycle pills or hormone delivery systems could encroach upon the micro- and macro-niche of MICROGESTIN FE, impacting traditional pricing structures.

Conclusion

MICROGESTIN FE remains a staple within the contraceptive market, with forward-looking pricing primarily influenced by generic competition, regulatory frameworks, and supply chain efficiencies. In mature markets, prices will likely stabilize or decline marginally, whereas emerging markets will see continued low-price offerings, expanding accessibility. Stakeholders must monitor patent landscapes, regulatory developments, and evolving consumer preferences to anticipate market shifts.

Key Takeaways

- Market Growth: The global contraceptive market is growing steadily, with combined oral contraceptives maintaining dominance due to convenience and efficacy.

- Price Dynamics: Generics and increased competition drive prices downward, particularly in mature markets; prices are projected to decrease by 10-15% over the next five years.

- Regulatory Impact: Patent expirations and regulatory policies significantly influence market entry timing and pricing strategies.

- Regional Variations: Price trends differ substantially between developed and emerging markets due to subsidy programs, healthcare infrastructure, and purchasing power.

- Strategic Considerations: Companies should innovate to differentiate products, optimize manufacturing, and adapt to regulatory changes to maintain profitability and market share.

FAQs

1. How does patent expiration affect MICROGESTIN FE prices?

Patent expiration allows generic manufacturers to produce equivalent formulations, increasing competition and generally leading to significant price reductions, often between 15-25% within five years post-expiry [4].

2. Are there opportunities for premium pricing for MICROGESTIN FE?

Yes. Formulation innovations that improve tolerability or convenience and garner physician endorsement can support premium pricing in select markets, especially when compliance and satisfaction are demonstrably improved.

3. How do regulatory policies influence MICROGESTIN FE's market price?

Stringent approval processes can hinder new formulations and delay generic entries, maintaining higher prices. Conversely, policies promoting generic substitution and price caps exert downward pressure on prices.

4. What regional factors most significantly impact MICROGESTIN FE's pricing?

Healthcare infrastructure, government subsidies, insurance reimbursement levels, and local regulatory environments primarily determine regional price variations.

5. What is the outlook for MICROGESTIN FE compared to other contraceptive options?

MICROGESTIN FE will continue to be competitive, especially in markets favoring oral contraceptives. However, emerging long-acting methods may limit its growth, necessitating strategic positioning based on patient preferences and provider recommendations.

Sources

[1] MarketWatch, "Global Contraceptive Market Size & Trends," 2022.

[2] GoodRx, "Contraceptive Medication Prices," 2022.

[3] FDA Patent Database, "Patent Status of MICROGESTIN FE," 2023.

[4] IMS Health, "Generic Drug Pricing Trends," 2021.

[5] Government of India, "Contraceptive Supply and Pricing Policies," 2022.

More… ↓