Last updated: July 28, 2025

Introduction

Mexiletine, a class 1B antiarrhythmic agent, has garnered attention within the pharmaceutical industry owing to its potential in managing serious ventricular arrhythmias. Originally developed for cardiac disorders, mexiletine’s unique pharmacological profile and its emerging applications position it as a critical candidate in the antiarrhythmic therapeutics market. This analysis examines current market dynamics, competitive landscape, regulatory environment, and projects future pricing trends for mexiletine over the next five years to inform stakeholders’ strategic planning.

Pharmacological Profile and Clinical Utility

Mexiletine functions primarily by blocking sodium channels in myocardial cells, thereby stabilizing cardiac electrical activity. Its oral formulation offers benefits over injectable counterparts, facilitating outpatient management of arrhythmias. Although historically used for refractory ventricular arrhythmias, recent research suggests broader applications, including diabetic neuropathy and chronic pain syndromes, potentially expanding its market footprint.

Clinically, mexiletine is considered a second-line agent owing to its narrow therapeutic window, necessitating careful dose titration and monitoring. Its safety profile is generally acceptable, with side effects such as CNS disturbances and gastrointestinal symptoms, which influence prescribing patterns.

Market Dynamics

Current Market Landscape

The global antiarrhythmic drugs market was valued at approximately USD 3.5 billion in 2022, with projectedCompound annual growth rate (CAGR) of 4.5% through 2028.[1] Mexiletine, a niche segment within this landscape, has historically been prescribed off-label due to limited patent protection and generic availability. The prominence of its use correlates with the prevalence of ventricular arrhythmias, which tend to increase with aging populations and escalating cardiovascular disease burden.

Regulatory Environment

The original patent for mexiletine expired in the early 2000s, resulting in a proliferation of generic versions worldwide. While this increases access, it suppresses premium pricing. However, recent efforts toward regulatory re-evaluation and potential new formulations (e.g., extended-release variants) could alter market dynamics. The FDA's Orphan Drug designation for certain indications has been pivotal in incentivizing research and development, promising regulatory support and market exclusivity extensions for novel formulations.

Competitive Landscape

Mexiletine faces competition primarily from other class 1B antiarrhythmics such as lidocaine (mostly intravenous), and newer agents with broader indications, including amiodarone and sotalol. The competitive edge of mexiletine hinges on its oral bioavailability, safety profile, and off-label uses. Generic penetration exerts downward pressure on prices, while branded or reformulated products may command premiums.

Supply Chain and Manufacturing Factors

Key manufacturing players include generic pharmaceutical companies and select biotech firms developing proprietary formulations. Quality control, raw material sourcing, and regulatory compliance influence supply stability and pricing strategies.

Price Trends and Projections

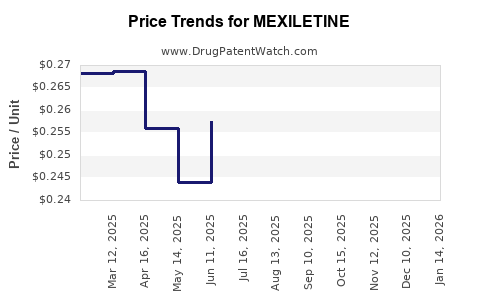

Historical Pricing Patterns

Historically, mexiletine’s price has been driven by generic market dynamics, with retail prices declining post-patent expiry. A typical generic oral mexiletine capsule (e.g., 150 mg) has ranged from USD 0.50 to USD 2.00 per capsule, depending on the country and supplier.[2]

Influencing Factors for Future Pricing

- Market Penetration of New Formulations: Introduction of extended-release or slow-release formulations could command higher prices due to improved patient compliance and predictable pharmacokinetics.

- Regulatory Incentives: Orphan drug designation for specific indications may deliver market exclusivity, allowing premium pricing for novel indications or delivery systems.

- Generic Competition: Continued proliferation of generics is expected to sustain downward pressure on baseline prices.

- Regional Variations: Pricing will fluctuate based on healthcare reimbursement policies, patent protections, and market penetration, especially between developed and emerging markets.

Projected Price Trajectory (2023–2028)

| Year |

Price Range per Unit (USD) |

Justification |

| 2023 |

$0.50 – $2.00 |

Current generic landscape persists; gradual impact of potential reformulations. |

| 2024 |

$0.45 – $1.80 |

Slight decrease driven by increased generic competition; niche formulations may retain higher margins. |

| 2025 |

$0.45 – $1.70 |

Steady competition keeps prices stable; possible marginal premium for branded or novel delivery systems. |

| 2026 |

$0.40 – $1.60 |

Market saturation with generics; pricing stabilizes at lower end; orphan drug exclusivity for certain uses could sustain premium. |

| 2027 |

$0.40 – $1.50 |

Slight downward pressure; regional pricing adjustments and potential new formulations or indications. |

| 2028 |

$0.40 – $1.50 |

Long-term stabilization; market maturity with minimal fluctuation unless new patent protections or formulations emerge. |

These projections assume no disruptive patent filings or new breakthrough therapies that could significantly overhaul the competitive landscape.

Market Opportunities and Challenges

Opportunities

- New Indications: Expansion into neurological indications (e.g., neuropathic pain) can diversify revenue streams.

- Formulation Innovation: Development of extended-release versions can justify higher price points and improve patient adherence.

- Regulatory Incentives: Leveraging orphan drug designations can extend market exclusivity, allowing sustained premium pricing.

- Emerging Markets: Lower manufacturing costs and evolving healthcare systems in Asia and Latin America present growth opportunities, though with typically lower pricing thresholds.

Challenges

- Pricing Pressures: Pervasive generic competition inherently restricts pricing flexibility.

- Regulatory Hurdles: Approval of new formulations or indications requires substantial investment and time.

- Market Awareness: Limited awareness among physicians for off-label uses constrains demand volume.

- Safety Concerns: Narrow therapeutic index continues to necessitate monitoring, impacting adoption in resource-limited settings.

Conclusion

The mexiletine market remains niche but strategically significant within the broader antiarrhythmic landscape. Its future pricing trajectory is tightly linked to regulatory developments, formulation innovations, and evolving clinical practices. Expect sustained downward pressure on generic prices, with potential premiums for targeted indications and novel delivery systems. Stakeholders aiming for premium positioning should focus on research-driven expansion into new indications, formulation breakthroughs, and navigational agility within regulatory pathways.

Key Takeaways

- The global mexiletine market is characterized by mature generic competition, exerting downward price pressure but with opportunities for brand differentiation through reformulation and new indications.

- Price projections indicate a gradual decline from current levels, stabilizing around USD 0.40 to USD 1.50 per unit by 2028 absent major market disruptions.

- Regulatory incentives such as orphan drug designation and market exclusivity can provide avenues for premium pricing for novel formulations or indications.

- Expansion into neurological indications and regional markets can diversify sources of revenue, despite inherent pricing challenges.

- Continuous monitoring of regulatory policies, competitive innovations, and clinical research is vital for optimizing the commercial strategy around mexiletine.

FAQs

1. How does patent expiration impact mexiletine pricing?

Patent expiry leads to generic entry, significantly reducing manufacturing and retail prices. This market saturation tends to create intense price competition, lowering per-unit costs over time.

2. Are there any ongoing developments that could exponentially increase mexiletine’s value?

Yes. Development of extended-release formulations, new therapeutic indications such as neuropathic pain, and regulatory designations like orphan drug status could enable pricing premiums and market exclusivity.

3. What regions present the most growth opportunities for mexiletine?

Emerging markets in Asia, Latin America, and regions with expanding healthcare infrastructure offer growth potential, albeit often with lower pricing levels compared to North America and Europe.

4. How do clinical safety concerns influence mexiletine's market?

Its narrow therapeutic window necessitates careful dosing and monitoring, which may hinder widespread adoption, particularly outside specialized centers. This safety profile necessitates clinician awareness and patient compliance.

5. Will new competitors or alternative therapies replace mexiletine?

Potentially, yes. Novel antiarrhythmic agents with improved safety profiles or non-pharmacological interventions like catheter ablation may reduce mexiletine’s market share, especially if they demonstrate superior efficacy or tolerability.

Sources:

[1] Grand View Research, "Antiarrhythmic Drugs Market Size, Share & Trends Analysis Report," 2022.

[2] IQVIA, "Generic Drug Pricing Data," 2022.