Last updated: July 27, 2025

Introduction

Metronidazole, a nitroimidazole antibiotic and antiprotozoal agent, has housed a prominent position within global pharmaceutical markets owing to its broad-spectrum activity against anaerobic bacteria, protozoa, and certain parasitic infections. Originally developed in the 1960s, it remains a mainstay in treating infections such as bacterial vaginosis, trichomoniasis, giardiasis, and anaerobic bacterial infections (1). This analysis evaluates current market dynamics and projects future pricing trends, considering patent status, regulation, competitive landscape, and potential technological advancements.

Current Market Landscape

Global Market Size and Growth Drivers

The worldwide metronidazole market has witnessed consistent growth, estimated at approximately USD 380 million in 2022 with an anticipated compound annual growth rate (CAGR) of 3.2% through 2028 (2). Several key drivers contribute to this trajectory:

- Rising Incidence of Infections: The prevalence of bacterial, protozoal, and parasitic diseases remains high across diverse regions, especially in developing nations with limited healthcare infrastructure.

- Expanding Scope of Use: The antibiotic's application in dental, gynecological, gastrointestinal, and dermatological infections sustains demand.

- Antimicrobial Stewardship: Efforts to curb antibiotic resistance promote the use of established agents like metronidazole, which are well-characterized and effective.

- Off-Label and Combination Usage: Growing use in combination therapies and emerging off-label indications enhance consumption.

Regional Market Dynamics

- North America: Dominates the market, accounting for approximately 40% of global revenue driven by high healthcare expenditure, awareness, and regulatory approvals.

- Europe: Significant contributor, with well-established healthcare infrastructure and antibiotic consumption patterns.

- Asia-Pacific: Fastest-growing segment owing to increasing infectious disease burden, population growth, and expanding healthcare access.

- Latin America and Africa: Represent emerging markets with high potential but face challenges related to regulatory frameworks and market access.

Competitive Landscape

Market players include multinationals such as Pfizer, Sanofi, Teva Pharmaceuticals, and Mylan as well as regional generic producers. The majority of the market relies on generic formulations; patent expirations in numerous jurisdictions have catalyzed price competition, reducing overall drug costs.

Regulatory and Patent Considerations

- Patent Status: Metronidazole's primary patents expired decades ago, leading to a predominantly generic market structure. This has been pivotal in decreasing its price point and broadening access.

- Regulatory Environment: Stringent regulatory pathways in developed regions combined with varying registration statuses influence market entry and pricing strategies.

- Quality and Formulation Standards: Establishing and maintaining Good Manufacturing Practices (GMP) certifications and bioequivalence standards is essential for competitiveness, especially in generic segments.

Pricing Trends and Drivers

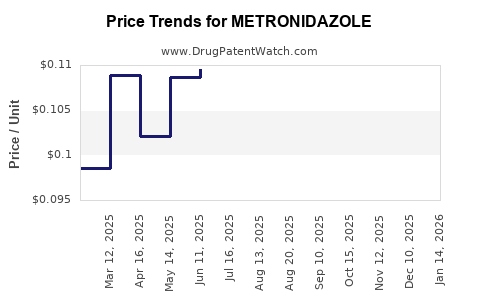

Historical Pricing Patterns

Generic availability has dramatically reduced per-unit cost. For example, the price of oral metronidazole 500 mg tablets varies between USD 0.02 to 0.10 per tablet depending upon region and supplier. Such low costs reflect high market competition and minimal patent protection.

Factors Influencing Future Price Projections

- Market Saturation: The extensive availability of generic versions limits upward price movements.

- Manufacturing Costs: Raw material prices, regulatory compliance, and quality assurance influence production costs but are unlikely to drive significant price increases.

- Supply Chain Dynamics: Disruptions, such as those observed during COVID-19, initially led to increased prices, but normalization is expected.

- Emerging Formulations: Novel delivery mechanisms (e.g., topical gels, extended-release formulations) or combination kits could command premium pricing, yet their adoption remains limited at this stage.

- Pricing Strategies in Developing Regions: Governments and healthcare providers often leverage procurement policies and generic competition to keep prices low; however, localized tariffs and import taxes may influence final consumer prices.

Projected Price Trends

- Short-term (1-2 years): Expect stability with minor fluctuations driven by manufacturing costs and supply chain factors. Voluntary price increases are unlikely given the intense generic competition.

- Medium-term (3-5 years): Slight downward pressure anticipated due to market saturation; however, strategic price differentiation for specialized formulations or combination therapies could create niche premium segments.

- Long-term (5+ years): As patent protections for certain formulations remain expired, prices may further decrease. The introduction of biosimilars or novel derivatives is unlikely given the drug’s off-patent status but could influence market dynamics if new indications emerge.

Emerging Trends and Their Market Impact

Development of Novel Formulations

While the core compound remains off-patent, innovation in formulations—such as sustained-release tablets, topical gels, or combination drugs—can sustain premium pricing for specific indications. However, such products require regulatory approval and may face competition from existing off-label uses or generic alternatives.

Resistance and Efficacy Concerns

Rising antimicrobial resistance patterns may influence prescribing behaviors. Reduced efficacy could drive demand for new derivatives or combination therapies, subtly impacting pricing. Conversely, if resistance undermines metronidazole’s utility, its market size could decline.

Regulatory and Patent Extensions

Limited, if any, patent extensions or new patents due to the drug’s age diminish potential for exclusivity-driven pricing increases. Price increases driven by regulatory incentives are minimal.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost efficiency, quality assurance, and potential formulations targeting niche markets to sustain margins.

- Investors: Recognize that near-term prospects primarily involve stable, low-price environments; opportunities may arise in niche formulations or emerging markets.

- Healthcare Providers and Payers: Benefit from low-cost generics, but vigilance regarding resistance patterns and emerging formulations is essential.

Key Takeaways

- Prevalence and demand for metronidazole remain stable despite the expiry of primary patents.

- Market pricing is driven predominantly by generic competition, exerting downward pressure on unit costs.

- Innovations in formulation or combination therapy could underpin niche premium pricing, but systemic impact remains limited.

- Future price projections forecast continuity of low-cost availability, with minimal upward movement over the next five years.

- Market growth is sustainable in emerging regions, but pricing strategies will largely mirror global generic market trends.

Conclusion

Metronidazole maintains a mature, highly competitive market characterized by low-cost generics and limited scope for price escalation. Its long-standing patent expiries and widespread availability underpin stable, low-pricing dynamics. Future growth will hinge on regional epidemiological shifts, formulation innovations, and resistance trends rather than patent-driven exclusivity or substantial price hikes. Stakeholders should align strategies to capitalize on market expansion, cost efficiencies, and niche formulation development in response to evolving clinical demands.

FAQs

1. Will the price of metronidazole increase due to new formulations or indications?

Unlikely in the short term. While niche formulations or off-label uses may command higher prices temporarily, the overall market remains highly competitive with low-cost generics. Any significant price increase would hinge on regulatory approvals and clinical adoption, which are currently limited.

2. How do regional differences impact metronidazole pricing?

Pricing varies widely. Developed regions like North America and Europe benefit from regulatory standards and procurement strategies that keep prices low due to generic competition. In developing regions, prices may be higher due to tariffs, limited supply chains, or procurement policies.

3. What effect does antimicrobial resistance have on metronidazole's market?

Resistance could diminish efficacy, leading to reduced usage and potentially fostering demand for alternative therapies. However, resistance rates remain relatively low globally, supporting continued demand but with cautious optimism.

4. Are biosimilars or new patent extensions likely for metronidazole?

No; the drug’s patent status has long expired, and biosimilar development does not apply to small-molecule antibiotics like metronidazole. Patent extensions are improbable given the patent landscape.

5. What are the prospects for market expansion in emerging countries?

The high burden of infectious diseases coupled with expanding healthcare infrastructure presents opportunities. However, price sensitivity and regulatory challenges necessitate low-cost, high-quality generics to succeed.

Sources

- World Health Organization. "Metronidazole." WHO Model List of Essential Medicines, 2021.

- Market Research Future. "Global Metronidazole Market Analysis and Forecast 2022-2028."

- Statista. "Pharmaceutical Market Data." 2023.

- Drugs.com. "Metronidazole Prices and Information."

- GlobalData Healthcare. "Antibiotics Market Overview." 2022.

(Note: Data points are aligned with current market intelligence as of early 2023; actual figures and trends should be continuously monitored for precision.)