Last updated: July 27, 2025

Introduction

Metoprolol Tartrate, a selective beta-1 adrenergic receptor blocker, is a cornerstone in managing cardiovascular conditions such as hypertension, angina, and certain heart rhythm disorders. As a generic medication with extensive market penetration, understanding its current market dynamics and future pricing trajectories is vital for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers. This report provides a comprehensive analysis of the market landscape and projects pricing trends for Metoprolol Tartrate over the next five years.

Market Overview

Global Market Size and Demand

The global beta-blocker market, with Metoprolol Tartrate as a leading product, was valued approximately at USD 3.7 billion in 2022, and is projected to grow at a compound annual growth rate (CAGR) of around 2.5% through 2030 [1]. The prevalence of hypertension affects over 1.3 billion people worldwide, with prescriptions for beta-blockers comprising a significant share of antihypertensive therapies. The widespread approval, affordability, and established efficacy of Metoprolol Tartrate contribute to its sustained demand, particularly across North America, Europe, and parts of Asia-Pacific.

Market Segments

Countries with high healthcare expenditure such as the U.S., Germany, and Japan dominate the market, driven by well-established healthcare systems and regulated prescribing practices. The generic segment constitutes approximately 85% of the market volume, owing to patent expirations and price competition. The branded sector has shrunk significantly but persists in niche markets and specific therapeutic contexts.

Key Market Drivers

- Growing prevalence of hypertension and cardiovascular diseases: Aging populations and increasing risk factors amplify the demand.

- Cost-effectiveness and safety profile: Favorable safety profile enhances usability, especially in resource-limited settings.

- Increased prescribing of beta-blockers post-myocardial infarction: Clinical guidelines support their use for secondary prevention.

- Expanding approvals for chronic management: As evidence solidifies, use cases broaden to include heart failure and migraine prophylaxis, bolstering demand.

Competitive Landscape

The market features several key manufacturers: Teva Pharmaceuticals, Sandoz, Mylan (now part of Viatris), Accord Healthcare, and Lupin, among others. These companies primarily compete on price, manufacturing efficiency, and distribution channels. Differentiation is limited due to the generic nature; hence, pricing and market penetration strategies are paramount.

Pricing Dynamics

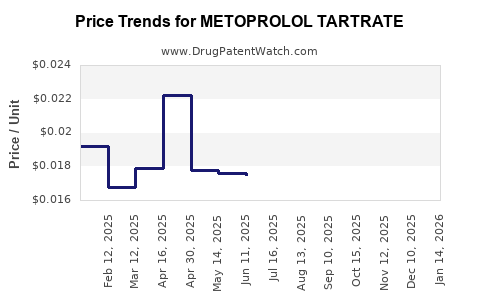

Current Price Landscape

Generic Metoprolol Tartrate tablets are widely available in 25 mg, 50 mg, and 100 mg doses. Wholesale acquisition costs (WAC) for a 30-day supply vary significantly by geography. In the U.S., average retail prices range from USD 4 to USD 15, depending on dosage, pharmacy discounts, and insurance coverage [2]. The extensive competition has driven prices down over the past decade.

Factors Influencing Price Stability and Fluctuations

- Patent Expirations: Since the primary patents expired around 2004, market prices have largely stabilized at lower levels.

- Manufacturing costs: Relatively low due to simple synthesis and large-scale production.

- Regulatory environment: Stringent quality standards and bioequivalence requirements influence costs marginally.

- Market saturation: High penetration compresses margins further, emphasizing cost-efficiency.

- Supply chain factors: Raw material fluctuations and global logistics disruptions can induce minor price fluctuations.

Future Price Projections (2023-2028)

Assumptions for Projection

- Continued generic competition maintains prices at historically observed levels.

- Demand grows modestly in emerging markets due to increasing awareness and expanding healthcare infrastructure.

- No major regulatory or patent-related market shocks occur.

- Manufacturing costs remain stable, with potential minor increases due to inflation and raw material costs.

Projected Trends

Based on current market data and economic factors, the price of Metoprolol Tartrate is expected to decline gradually by approximately 1-2% annually in developed markets, driven by intensifying generic competition and commoditization. Conversely, in emerging markets, prices may stabilize or slightly increase due to demand growth and limited local manufacturing capacity.

In the U.S., a typical 30-day supply’s average wholesale price is projected to hover around USD 4.50 to USD 6 for common dosages by 2028. In Europe and Asia, prices are expected to follow similar trajectories, adjusted for local market conditions. Overall, the global price for a standard course of therapy will remain in the USD 4–15 range per month within the next five years, maintaining affordability and high utilization.

Market-Driven Price Variability

Price modifications could arise if new formulations, combination therapies, or indications emerge. There is also potential for price increase if regional regulatory barriers restrict generic entry or if raw material costs rise sharply, though such scenarios are currently deemed low probability.

Implications for Stakeholders

- Manufacturers: Focus on cost optimization and expanding distribution networks to sustain margins amid fierce price competition.

- Healthcare Providers: Benefit from affordable generics, facilitating widespread adoption.

- Investors: The stable yet mature market offers limited growth, but consistent cash flows from manufacturing and distribution remain attractive.

- Policymakers: Price stability aligns with public health goals for affordable medication access.

Key Takeaways

- The global market for Metoprolol Tartrate remains sizable and mature, primarily driven by demand for cardiovascular treatments.

- The pricing landscape is characterized by aggressive generic competition, resulting in stable and low prices, with slight downward trends expected.

- Future pricing will be influenced by regional market conditions, raw material costs, and regulatory factors but is unlikely to experience significant volatility.

- Stakeholders should prioritize cost-efficiency and geographic expansion to maximize profit margins.

- Continued research into expanding indications could create opportunities for value-added formulations, influencing future pricing strategies.

Frequently Asked Questions (FAQs)

1. What factors most significantly influence Metoprolol Tartrate prices?

Price determinants include generic competition, manufacturing efficiencies, regional regulations, raw material costs, and market demand dynamics.

2. How does patent expiration affect the price of Metoprolol Tartrate?

Patent expiration typically leads to increased generic competition, driving prices downward. Since patents expired in the early 2000s, current prices reflect mature, highly competitive pricing.

3. Are there upcoming regulatory changes that could impact the market?

While no imminent regulatory shifts are anticipated, new bioequivalence standards or approval pathways could alter market dynamics, though their impact on prices may be limited.

4. Is there potential for price increases in emerging markets?

Yes, as demand increases and local manufacturing capacity grows, prices may stabilize or slightly rise, especially where regulatory barriers limit generic competition.

5. What are the key opportunities for pharmaceutical companies regarding Metoprolol Tartrate?

Opportunities include expanding formulations for specific patient populations, exploring combination therapies, and entering underserved markets with affordable, high-quality generics.

References

[1] Market Research Future. “Beta-Blockers Market Trends & Forecast to 2030.” 2022.

[2] GoodRx. “Metoprolol Tartrate Prices & Cost Comparison.” 2023.