Share This Page

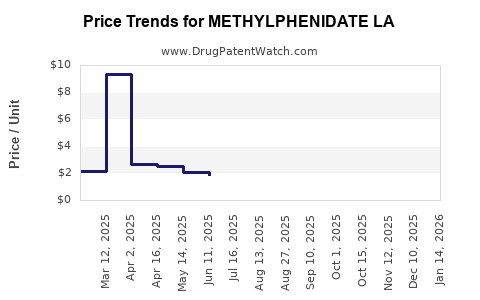

Drug Price Trends for METHYLPHENIDATE LA

✉ Email this page to a colleague

Average Pharmacy Cost for METHYLPHENIDATE LA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METHYLPHENIDATE LA 20 MG CAP | 51862-0610-01 | 2.88738 | EACH | 2025-02-19 |

| METHYLPHENIDATE LA 10 MG CAP | 51862-0609-01 | 3.99845 | EACH | 2025-02-19 |

| METHYLPHENIDATE LA 30 MG CAP | 00093-5347-01 | 2.46813 | EACH | 2025-02-19 |

| METHYLPHENIDATE LA 10 MG CAP | 70010-0012-01 | 3.99845 | EACH | 2025-02-19 |

| METHYLPHENIDATE LA 20 MG CAP | 70010-0013-01 | 2.88738 | EACH | 2025-02-19 |

| METHYLPHENIDATE LA 20 MG CAP | 00093-5346-01 | 2.88738 | EACH | 2025-02-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Methylphenidate LA

Introduction

Methylphenidate Long-Acting (LA) formulations, primarily marketed under brands such as Concerta, Metadate ER, and others, are widely prescribed in the treatment of Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. As the market for ADHD therapeutics expands globally, analyzing the current landscape and projecting future price trends for Methylphenidate LA offers key insights for pharmaceutical manufacturers, investors, and healthcare stakeholders.

Market Landscape Overview

Global Market Size and Growth Dynamics

The ADHD therapeutics market, encompassing both immediate-release and extended-release formulations, was valued at approximately USD 9-10 billion in 2022, with Methylphenidate-based products accounting for a significant share (around 40-45%) [1]. Factors fueling growth include increasing ADHD diagnosis rates, rising awareness, and expanding treatment guidelines across developed and emerging markets.

The Compound Annual Growth Rate (CAGR) for the ADHD market is projected at approximately 6-8% from 2023 through 2030 [2], driven by innovations in drug delivery, demographic shifts favoring pediatric treatments, and expanding off-label uses.

Regional Market Analysis

-

North America: Dominates the market with over 50% share, supported by high diagnosis and treatment rates—particularly in the U.S., where methylphenidate remains a first-line therapy.

-

Europe: Accounts for roughly 25-30%, with increasing adoption of generic formulations and evolving prescribing practices.

-

Asia-Pacific: Offers significant growth potential due to rising prevalence and improving healthcare infrastructures, though currently lower market penetration.

Competitive Landscape

Major players include Janssen Pharmaceuticals (Concerta), Novartis (Metadate), and Teva Pharmaceutical Industries. Generics constitute a sizable segment, exerting downward pressure on prices but also fostering broader accessibility.

Pricing Dynamics of Methylphenidate LA

Factors Influencing Price Variability

-

Brand vs. Generic: Brand-name formulations typically retail at 2-3 times the price of generics, with variations based on patent status and market exclusivity.

-

Patent Expiry and Generic Entry: The expiration of patents (e.g., Concerta’s U.S. patent expired in 2019) catalyzes price reductions due to increased generic competition.

-

Regulatory Policies: Reimbursement policies, pricing regulations, and negotiations with health authorities influence final consumer prices.

-

Formulation and Delivery Innovations: Extended-release formulations with proprietary delivery mechanisms tend to command premium pricing—e.g., OROS delivery systems in Concerta.

Historical Price Trends

-

Brand Name: In the U.S., the retail price of Concerta (18 mg) ranged from USD 250-300 for a 30-day supply in 2020, though copayments and insurance substantially mitigate out-of-pocket costs.

-

Generics: Post-patent expiration, generic methylphenidate LA saw prices drop by 50-70%, with some markets reporting prices below USD 100 per month.

Impact of Biosimilar and Alternative Formulations

Although biosimilars are not yet prevalent for methylphenidate, the potential introduction of lower-cost alternatives could further influence pricing structures, especially in price-sensitive markets.

Future Price Projections (2023-2030)

Factors Supporting Price Stabilization and Potential Increase

-

Market Maturity: In developed markets, the mature state and high brand loyalty may maintain relatively high prices for branded formulations.

-

Innovation and Patent Strategies: Extended patent protections via formulation enhancements or new delivery mechanisms (e.g., novel transdermal patches) can sustain premium prices.

-

Regulatory and Reimbursement Policies: Policies favoring branded drugs or reducing out-of-pocket expenses through subsidies may stabilize or elevate prices.

Price Trajectory Predictions

-

Short-term (2023-2025): Prices are expected to decline modestly owing to widespread generic availability, with a potential minor stabilization for premium formulations.

-

Medium to Long-term (2026-2030): Prices could stabilize or slightly increase if new, differentiated, and patent-protected formulations gain traction. Market penetration in emerging economies may cause prices to decline further due to competitive pressures.

Emerging Trends Influencing Prices

-

Market Expansion in Asia: Cost-sensitive markets will likely favor generics, exerting downward pressure overall.

-

Digital and Personalized Medicine: Advances in drug delivery and monitoring may lead to premium-priced personalized treatments, impacting the potential for price increases.

-

Regulation and Negotiation: Governments and payers imposing price caps or negotiating rebates may cap potential price escalations; however, premium innovations may still command higher prices.

Conclusion

The Methylphenidate LA market is poised for moderate growth driven by increasing ADHD prevalence and therapeutic diversification. Price trends post-generic entry show significant declines, with future prices stabilizing or rising in niche segments—particularly for innovation-driven formulations. Stakeholders must monitor patent strategies, regulatory shifts, and new technological developments to anticipate pricing trajectories effectively.

Key Takeaways

-

The global Methylphenidate LA market is mature, with considerable growth driven by demographic and technological factors.

-

Generic competition has significantly reduced prices, making methylphenidate formulations more accessible and transforming commercial strategies.

-

Future prices will hinge on innovation, patent protections, and market expansion efforts, with a tendency toward stabilization in mature markets.

-

Cost pressures in emerging economies may sustain downward pricing trends, while high-integration formulations maintain premium pricing in developed markets.

-

Strategic planning should consider regulatory environments, patent landscapes, and emerging delivery technologies to optimize pricing and market positioning.

FAQs

1. How does patent expiry influence methylphenidate LA pricing?

Patent expiry typically leads to increased generic competition, resulting in substantial price reductions. For methylphenidate LA, the expiration of key patents (e.g., Concerta’s in 2019) has contributed to a drop in retail prices and wider accessibility.

2. What are the key factors impacting future methylphenidate LA prices?

Factors include patent protection, innovation in delivery mechanisms, regulatory policies, market penetration in emerging economies, and competitive generic pricing strategies.

3. Will new formulations command higher prices?

Yes. Innovations such as novel delivery systems or extended-release mechanisms with proven efficacy and patent protection may sustain premium pricing.

4. How do regional differences affect methylphenidate LA prices?

Prices are higher in regions with patent protections and robust healthcare reimbursement, such as North America, whereas emerging markets favor generics, leading to lower prices.

5. What is the potential for biosimilars in the methylphenidate LA market?

Currently limited, but as patents expire and biosimilar technology advances, biosimilars could provide cost-effective alternatives, further influencing prices and market competition.

References

- GlobalData. (2022). ADHD Therapeutics Market Report.

- Market Research Future. (2023). ADHD Market Analysis and Forecast.

More… ↓