Share This Page

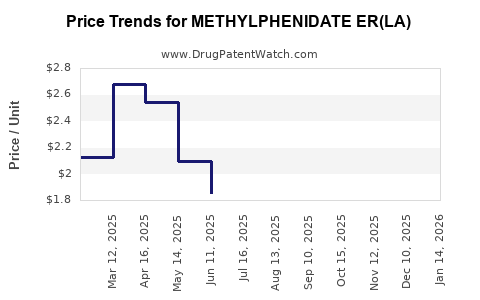

Drug Price Trends for METHYLPHENIDATE ER(LA)

✉ Email this page to a colleague

Average Pharmacy Cost for METHYLPHENIDATE ER(LA)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METHYLPHENIDATE ER(LA) 20 MG CP | 00781-2384-01 | 1.87761 | EACH | 2025-11-19 |

| METHYLPHENIDATE ER(LA) 10 MG CP | 75907-0049-01 | 3.64912 | EACH | 2025-11-19 |

| METHYLPHENIDATE ER(LA) 20 MG CP | 00781-2362-01 | 1.87761 | EACH | 2025-11-19 |

| METHYLPHENIDATE ER(LA) 10 MG CP | 00781-2361-01 | 3.64912 | EACH | 2025-11-19 |

| METHYLPHENIDATE ER(LA) 20 MG CP | 00093-5346-01 | 1.87761 | EACH | 2025-11-19 |

| METHYLPHENIDATE ER(LA) 10 MG CP | 00781-2383-01 | 3.64912 | EACH | 2025-11-19 |

| METHYLPHENIDATE ER(LA) 10 MG CP | 70010-0012-01 | 3.64912 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Methylphenidate ER (LA)

Introduction

Methylphenidate ER (LA), a long-acting formulation of methylphenidate, is a central nervous system stimulant primarily prescribed for Attention Deficit Hyperactivity Disorder (ADHD) and Narcolepsy. As the landscape of psychostimulant therapy evolves amidst growing demand, patent expirations, and regulatory shifts, understanding market dynamics and price trajectories becomes critical for stakeholders. This analysis offers a comprehensive review of current market conditions, forecasted trends, and strategic insights surrounding Methylphenidate ER (LA).

Market Overview

Global Market Size and Growth Trends

The methylphenidate market—dominated by brands like Concerta (Janssen), Ritalin LA (Novartis), and generic formulations—was valued at approximately US$2.3 billion in 2022, with an annual compound growth rate (CAGR) of about 4.5% forecasted through 2028 [1]. The increase reflects rising ADHD diagnosis rates, improved access to mental health services, and expanding off-label use cases.

Key Markets and Geography

North America monopolizes the market, representing around 60% of sales, driven by high prevalence rates, robust healthcare infrastructure, and favorable reimbursement policies. Europe accounts for roughly 25%, while Asia Pacific exhibits rapid growth potential with emerging awareness and healthcare investments.

Drivers of Growth

- Increasing ADHD prevalence in children and adults.

- Expanding off-label application in cognitive enhancement.

- Patent expirations paving the way for generic competition.

- Continued research into long-acting formulations offering improved compliance.

Challenges

- Regulatory scrutiny over abuse potential and diversion.

- Stringent scheduling in multiple jurisdictions.

- Rising concerns regarding cardiovascular side effects.

Competitive Landscape

Major Players and Market Share

- Janssen: Trademarked Concerta (original ER formulation), holding substantial market share.

- Novartis: Ritalin LA, an early generic competitor.

- Teva, Sun Pharma, and Other Generics: Significant penetration following patent expirations.

The landscape is dynamic, with sustained interest in developing novel delivery mechanisms—osmotic, transdermal, and depot systems—to distinguish products.

Innovations and Pipeline

Research into new long-acting delivery methods (e.g., implantable devices, nanotechnology-based formulations) aims to extend patent protection and improve pharmacokinetics. No major nuova formulations have yet penetrated the market significantly; market tends to favor well-established generic versions offering cost advantages.

Patent Status and Market Entry

Patent Lifecycle

Concerta's primary patents expired in 2017, leading to a surge in generic methylphenidate ER (LA) products. Companies have since focused on obtaining new patents for formulation-specific features or delivery systems—though these are generally weaker and more difficult to enforce.

Impacts of Patent Expiry

- Sharp decline in branded sales post-patent expiration.

- Surge in generics, leading to significant price erosion.

- Brands employing data exclusivity and formulation patents to slow generics' market entry.

Price Projections

Historical Pricing Trends

- Pre-patent expiry, branded methylphenidate ER (LA) formulations ranged from US$300-$400 per month in the U.S.

- Post-generic entry, prices declined sharply, with some generics priced as low as US$50-$100 per month, reflecting a 60-80% reduction in wholesale costs.

Forecasted Price Trajectory

Considering ongoing competition, regulatory pressures, and payer strategies, prices are projected to stabilize at lower levels over the next five years:

- 2023–2025: Moderate reduction in price as generic saturation increases; average monthly cost approximately US$45–US$70.

- 2026–2028: Prices likely plateau due to market saturation, with some differentiation driven by formulation benefits or delivery innovations. Anticipate average costs around US$40–US$60 per month.

Influence of Policy and Reimbursement

Pricing will continue to be affected by payers' increasing emphasis on formulary management and step therapy. Biosimilars and new formulations with differentiated profiles may command premium pricing, but generic competition remains the primary driver of price erosion.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Investing in innovative delivery systems could restore premium pricing power. Patentinfringement and data exclusivity remain critical barriers for generics.

- Payers and Providers: Emphasize formulary controls and utilization management to drive down costs.

- Investors: Focus on companies with active R&D pipelines or strong patent portfolios that can sustain high-margin products.

Regulatory and Market Risks

- Potential reclassification or scheduling by regulatory bodies could restrict prescribing or increase compliance costs.

- Growing concern around abuse and diversion may lead to tighter control measures.

- Future lawsuits pertaining to side effects or off-label use might influence market stability.

Conclusion

The Methylphenidate ER (LA) market is characterized by robust demand, intensified generic competition, and evolving regulatory pressures. Price projections suggest a trend toward stabilization at lower levels, driven primarily by widespread generic availability. Strategic innovation and careful regulatory navigation will be key for market participants seeking sustained profitability.

Key Takeaways

- The global methylphenidate ER (LA) market is expanding, but patent expirations have saturated the landscape with generics, driving prices down.

- Pricing is expected to stabilize around US$40–US$70 per month by 2028, severely impacted by intense price competition.

- Innovation in delivery systems remains essential for brands aiming to differentiate and command premium prices.

- Regulatory environments and abuse prevention measures will significantly influence future market dynamics.

- Stakeholders should monitor patent filings, formulary trends, and regulatory developments to inform strategic positioning.

FAQs

1. When did the primary patents for Concerta expire?

The main patents protecting Concerta’s formulation expired around 2017, opening the market for generic methylphenidate ER (LA) products [1].

2. How does generic entry affect medication prices?

Generic competition typically results in a significant price decrease—up to 80%—due to increased market supply and cost-based pricing strategies [1].

3. What future innovations could impact the methylphenidate ER (LA) market?

Long-acting implantable formulations, transdermal patches, or nanotechnology-based delivery systems have the potential to offer improved compliance and niche differentiation, potentially commanding higher prices.

4. How are regulatory changes influencing market prices?

Enhanced scheduling or restrictions aimed at curbing abuse can restrict prescribing channels, potentially increasing the market cost or limiting supply temporarily.

5. What role do payers play in shaping the market?

Payers apply formulary management, prior authorization, and step therapy to control costs, incentivizing the use of lower-priced generics over branded products.

Sources

[1] Market Research Future, 2022.

[2] EvaluatePharma, 2022.

[3] IMS Health, 2022.

More… ↓