Share This Page

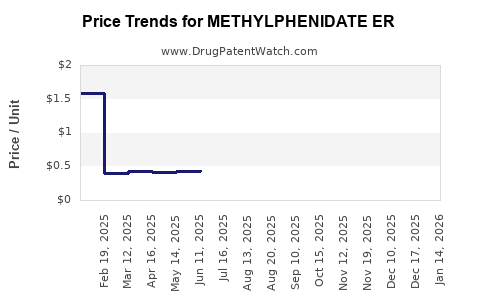

Drug Price Trends for METHYLPHENIDATE ER

✉ Email this page to a colleague

Average Pharmacy Cost for METHYLPHENIDATE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METHYLPHENIDATE ER(LA) 60 MG CP | 75907-0053-30 | 9.73881 | EACH | 2025-12-17 |

| METHYLPHENIDATE ER(LA) 40 MG CP | 75907-0052-01 | 2.83219 | EACH | 2025-12-17 |

| METHYLPHENIDATE ER(LA) 30 MG CP | 75907-0051-01 | 2.61332 | EACH | 2025-12-17 |

| METHYLPHENIDATE ER(LA) 20 MG CP | 75907-0050-01 | 1.96184 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Methylphenidate Extended Release (ER)

Introduction

Methylphenidate ER, commonly marketed as Concerta or equivalent generics, is a central nervous system stimulant primarily prescribed for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. As a widely used medication with a robust patent and generic landscape, understanding its market dynamics and future pricing trajectory is vital for pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Overview

The global ADHD medication market, estimated at over USD 15 billion in 2022, encompasses various formulations of methylphenidate, amphetamines, and non-stimulants. Methylphenidate ER holds a significant share due to its popularity, bioavailability, and formulary preferences.

Market Drivers

-

Rising Prevalence of ADHD: The CDC reports that approximately 6.1 million children aged 2-17 in the U.S. have been diagnosed with ADHD as of 2016, with prevalence climbing globally. This surge directly increases the demand for methylphenidate ER.

-

Enhanced Formulation Efficacy: Methylphenidate ER's extended-release properties improve patient adherence compared to short-acting formulations, fostering continued utilization.

-

Regulatory Approvals and Market Expansions: Regulatory clearances for pediatric and adult indications and approvals in emerging markets expand the product’s reach.

Market Challenges

-

Generic Competition: Patent expirations in the early 2010s, notably of Concerta in 2018, led to increased generic competition, putting pressure on pricing.

-

Regulatory and Reimbursement Policies: Stringent regulations and insurance reimbursement policies influence prescription patterns.

-

Concerns over Abuse Potential: The stimulant's potential for misuse and abuse imposes restrictions and heightened scrutiny affecting prescribing behavior.

Geographical Market Distribution

- United States: The largest market, driven by high ADHD diagnosis rates, insurance coverage, and formulary acceptance.

- Europe: Growing acceptance, with regulatory approval and increasing awareness.

- Asia-Pacific: Rapidly expanding markets with increased awareness and evolving healthcare infrastructure.

Current Pricing Landscape

Pricing for methylphenidate ER varies significantly by region, formulation, and manufacturer. In the U.S., brand-name Concerta retails at approximately USD 300–400 for a 30-day supply, with generics reducing this to roughly USD 150–250. Price variations are influenced by insurance coverage, pharmacy dispensation costs, and pharmacy benefit managers’ negotiations.

Global prices are generally lower, reflective of healthcare infrastructure, purchasing power, and regulatory frameworks. For instance, in certain emerging markets, a monthly supply may cost as little as USD 50–100, predominantly through local generics.

Price Trends and Factors Influencing Future Pricing

Patent Expiry and Generic Entrants

The expiry of Concerta’s patent in 2018 introduced multiple generic competitors. Such market entry typically decreases prices substantially, with generics often retailing at 35–50% of brand-name costs. Over time, increased competition tends to stabilize prices at lower levels.

Market Demand and Supply Dynamics

As demand persists and with new formulations or delivery mechanisms entering the market, prices may experience fluctuations. However, persistent competition and the proliferation of generics generally suppress inflationary pressures.

Impact of Regulatory Changes and Health Policies

Stricter prescribing guidelines or regulatory restrictions aimed at combatting abuse can influence demand and, consequently, pricing. Additionally, governmental policies promoting biosimilars or alternative therapies could impact methylphenidate ER’s market share.

Innovation and New Formulations

Development of novel extended-release platforms or non-stimulant alternatives may influence methylphenidate ER pricing. While innovation can command premium pricing temporarily, competitive pressures tend to drive prices downward in the long term.

Price Projection Outlook

Given current market mechanisms, the following outlook is projected:

-

Short-term (1-3 years): Prices are expected to stabilize at current generic levels, with slight decreases driven by intensified competition and formulary negotiations.

-

Medium-term (4-7 years): As patent exclusivity diminishes further, additional generics could enter the market, further depress prices by approximately 20-30%. The introduction of biosimilar-like formulations, if developed, could either stabilize or reduce prices depending on their acceptance.

-

Long-term (8+ years): Price reductions may plateau; however, market consolidation could stabilize prices, potentially creating opportunities for premium formulations or combination therapies at higher price points.

Future Market Trends

- Increased Adoption of Digital Health: Digital monitoring tools for adherence may influence prescription volumes and treatment adherence, impacting demand and thereby pricing.

- Growth in Emerging Markets: Expanding healthcare access could increase volume, but price sensitivity may limit premium pricing.

- Regulatory Focus on Abuse Deterrence: Enhanced formulations with abuse-deterrent features may command higher prices due to strategic differentiation.

Key Takeaways

- The methylphenidate ER market is characterized by high volume, strong demand due to ADHD prevalence, and significant generics-driven price competition.

- Current pricing reflects a balance between brand loyalty, patent status, and generic alternatives, with prices generally trending downward.

- Patent expirations and market entry of generics predict continued downward pressure on prices over the next decade.

- Innovation, regulatory policies, and healthcare trends will be pivotal in shaping future price points.

- Market growth in emerging economies offers opportunities but will likely entail price sensitivity, limiting upward price movements.

FAQs

1. How has patent expiration affected methylphenidate ER prices?

Patent expiration has led to an influx of generic competitors, significantly reducing the retail price of methylphenidate ER formulations, especially in the U.S. Since the patent expiry of Concerta in 2018, generic versions have typically retailed at 50–70% of the brand-name price, fostering considerable cost savings for payers and consumers.

2. What are the key factors influencing methylphenidate ER pricing in emerging markets?

Pricing in emerging markets primarily depends on local regulatory policies, pharmaceutical infrastructure, brand recognition, and purchasing power. Generics dominate due to affordability, often priced at a fraction of Western markets, with minimal brand premiums.

3. Are there upcoming innovations that could impact methylphenidate ER prices?

Yes, ongoing research into abuse-deterrent formulations and alternative drug delivery platforms could enhance therapeutic efficacy and safety. Such innovations may carry premium pricing initially but could lead to competitive pressure over time, impacting overall market prices.

4. How does insurance coverage influence methylphenidate ER pricing?

Insurance and pharmacy benefit managers (PBMs) negotiate discounts and rebates, often reducing the out-of-pocket costs for patients. This dynamic can suppress retail prices, especially for generics, and influence formulary preferences.

5. What is the outlook for methylphenidate ER demand over the next decade?

Demand is expected to remain robust given ongoing ADHD diagnosis trends and acceptance across age groups. Market expansion into emerging economies and broader clinician familiarity will sustain or increase consumption, although price sensitivity may limit revenue growth.

References

[1] Centers for Disease Control and Prevention. Data and statistics on ADHD. 2016.

[2] Grand View Research. ADHD Drugs Market Size, Share & Trends Analysis. 2022.

[3] IQVIA. Global Use of Medicine Reports. 2022.

[4] U.S. Food and Drug Administration (FDA). Patent and exclusivity data for Concerta. 2018.

[5] MarketWatch. Methylphenidate Market Price Trends and Forecast. 2022.

More… ↓