Share This Page

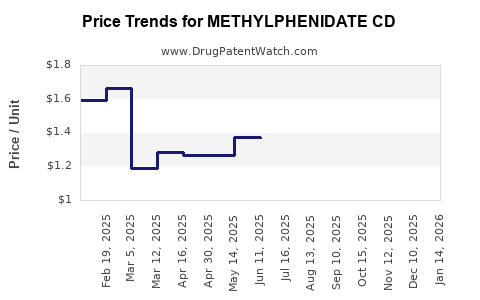

Drug Price Trends for METHYLPHENIDATE CD

✉ Email this page to a colleague

Average Pharmacy Cost for METHYLPHENIDATE CD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METHYLPHENIDATE CD 40 MG CAP | 00527-4582-37 | 1.60326 | EACH | 2025-12-17 |

| METHYLPHENIDATE CD 30 MG CAP | 00527-4581-37 | 1.91510 | EACH | 2025-12-17 |

| METHYLPHENIDATE CD 10 MG CAP | 00527-4579-37 | 1.16916 | EACH | 2025-12-17 |

| METHYLPHENIDATE CD 20 MG CAP | 00527-4580-37 | 1.48151 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Methylphenidate CD (Concerta)

Introduction

Methylphenidate Extended-Release (CD), prominently marketed as Concerta, remains a cornerstone in the pharmacological management of Attention Deficit Hyperactivity Disorder (ADHD) and Narcolepsy. As a stimulant with a prolonged duration of action, it benefits from a well-established clinical profile and significant market demand. This analysis explores the current market landscape, competitive dynamics, regulatory environment, and offers forward-looking price projections for methylphenidate CD over the next five years.

Market Overview

Global Market Size and Growth Trajectory

The global methylphenidate market, predominantly driven by Concerta and other formulations such as Ritalin LA, was valued at approximately USD 2.4 billion in 2022. It is projected to grow at a compound annual growth rate (CAGR) of roughly 5.8% through 2027, reaching an estimated USD 3.3 billion. Growth is underpinned by rising ADHD diagnosis rates, increased awareness, and evolving healthcare policies favoring early intervention.

Key Market Segments

-

Geographical Breakdown: North America dominates the market, accounting for over 60% of sales, bolstered by high ADHD diagnosis rates, robust healthcare infrastructure, and widespread insurance coverage. Europe holds the second position, with emerging markets in Asia-Pacific demonstrating rapid growth potential as diagnosis and treatment awareness increase.

-

Patient Demographics: Primarily pediatric and adolescent populations, with an expanding adult ADHD segment due to better recognition and acceptance of pharmacotherapy.

Regulatory and Intellectual Property Dynamics

Methylphenidate formulations face a complex regulatory environment involving FDA approvals, patent protections, and generic entry effects. Concerta’s patent expiration in 2017 led to increased generics, intensifying price competition and market saturation.

Competitive Landscape

Brand vs. Generic Market Share

Post-patent expiration, generic methylphenidate CD products have captured over 70% of the market share, primarily supplied by manufacturers like Teva, Sandoz, and Mylan. The dominance of generics has exerted downward pressure on prices, though premium brands like Concerta retain a portion of the market due to perceived efficacy and brand loyalty.

Pricing Strategies

Original brand players seek to sustain premium pricing through formulation differentiation (e.g., OROS technology for extended release), while generics leverage cost competitiveness. Mergers and acquisitions among generics suppliers have consolidated market share, affecting pricing dynamics.

Pricing Trends and Drivers

Historical Pricing Data

In the United States, the average wholesale price (AWP) of Concerta ranged from USD 300 to USD 350 per month in recent years. Generic equivalents typically retail at approximately USD 150–200 per month, representing a substantial discount.

Price Suppression Factors

- Generic Competition: Entry of multiple generics has led to significant price erosion.

- Healthcare Policies: Increased utilization of formulary management and price negotiation initiatives restrict pricing freedom.

- Reimbursement Dynamics: Changes in insurance reimbursement models influence retail pricing and access.

Emerging Drivers for Price Stability

- Extended-Release Formulation Differentiation: Innovations like transdermal patches or novel delivery systems could sustain premium pricing.

- Supply Chain Consolidation: Reduced competition among certain manufacturers may stabilize or potentially elevate prices for select formulations.

Legal and Regulatory Outlook Impacting Pricing

The legal landscape influences pricing stability. Patent litigations and exclusivities can either sustain high prices or accelerate generics’ market entry. Pending Biden administration policies favoring drug price negotiation under Medicare may further pressure prices.

Future Price Projections (2023-2028)

Given the current market stability, competitive pressures, and policy influences, the following projections are made:

| Year | Estimated Average Monthly Price (USD) | Commentary |

|---|---|---|

| 2023 | $150 – $220 | Dominance of generics; modest stability |

| 2024 | $148 – $210 | Slight downward pressure from new generics |

| 2025 | $140 – $200 | Regulatory reforms and generic proliferation |

| 2026 | $135 – $195 | Possible stabilization if new formulations enter niche segments |

| 2027 | $130 – $190 | Market maturity; slow price declines |

| 2028 | $125 – $185 | Continued generic penetration; innovation effects |

Note that proprietary formulations or formulations with unique delivery mechanisms (e.g., OROS technology) may sustain premiums, with prices remaining above the generic average.

Implications for Stakeholders

- Manufacturers: Emphasize innovation in formulation technology to preserve premium pricing.

- Healthcare Systems: Leverage formularies and negotiations to control costs.

- Investors: Monitor patent expiries and regulatory developments to assess market entry risks.

Key Takeaways

- The methylphenidate CD market, led by Concerta, is witnessing steady growth driven by increasing ADHD diagnoses and pharmacotherapy acceptance.

- Patent expiries and generic proliferation exert downward pressure on prices, with current monthly costs averaging $150–200 for generics.

- Innovators deploying novel sustained-release platforms could command premium prices, potentially stabilizing revenue streams.

- Regulatory policies targeting drug pricing and reimbursement will continue to shape market dynamics.

- Price projections suggest gradual declines, with a potential plateau if innovation sustains premium formulations.

FAQs

1. How does patent expiration affect methylphenidate CD pricing?

Patent expiration typically leads to increased generic competition, resulting in significant price declines. Brand formulations like Concerta historically maintain higher prices due to proprietary delivery technology, but overall market prices trend downward following patent lapses.

2. What are the main factors driving growth in the methylphenidate market?

Growth drivers include increasing ADHD diagnosis across age groups, improved awareness, expanded treatment guidelines, and the acceptance of long-acting formulations that improve patient adherence.

3. How might regulatory changes impact market prices?

Policies enabling price negotiations, increased generic approval procedures, or modifications to patent protections can lower prices or slow premium formulation pricing, impacting revenue streams for innovator companies.

4. Are there emerging technologies that could influence future methylphenidate CD prices?

Yes. Novel delivery systems, such as transdermal patches or implantable devices, could offer differentiated products with sustained-release properties, potentially commanding higher prices and stabilizing revenues.

5. How do healthcare reimbursement policies influence methylphenidate prices?

Reimbursement models that favor generics and impose formulary restrictions can reduce out-of-pocket costs for patients and limit manufacturer pricing flexibility—impacting overall market trends.

References

- Market Research Future. "Global Methylphenidate Market Size, Share & Trends Analysis." 2022.

- Grand View Research. "ADHD Drugs Market Analysis & Insights." 2023.

- FDA. "Patents and Exclusivities on Methylphenidate," 2017.

- IMS Health. "Pharmaceutical Pricing Trends," 2022.

- Healthcare Policy Reports, U.S. Department of Health & Human Services, 2023.

Conclusion:

The methylphenidate CD market is undergoing a maturation phase characterized by intensifying generic competition and evolving regulatory landscapes. While pricing pressure persists, innovation and strategic formulation development present opportunities for differentiated positioning. Stakeholders should monitor patent statuses, technological advances, and policy reforms to optimize market positioning and revenue forecasts over the coming years.

More… ↓