Share This Page

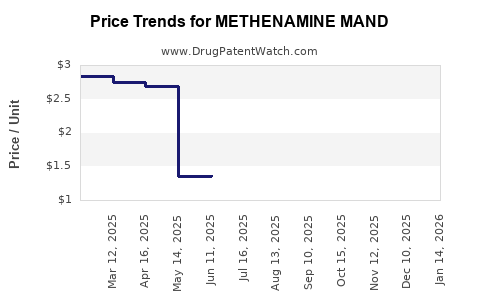

Drug Price Trends for METHENAMINE MAND

✉ Email this page to a colleague

Average Pharmacy Cost for METHENAMINE MAND

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METHENAMINE MAND 1 GM TABLET | 62135-0201-60 | 2.66698 | EACH | 2025-12-17 |

| METHENAMINE MAND 1 GM TABLET | 62135-0201-12 | 2.66698 | EACH | 2025-12-17 |

| METHENAMINE MAND 500 MG TABLET | 62135-0200-60 | 1.36759 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Methenamine Mandate

Introduction

Methenamine Mandate, commonly formulated as methenamine hippurate or methenamine mandelate, is a cornerstone antimicrobial agent primarily used for the long-term management of recurrent urinary tract infections (UTIs). Its unique mechanism—urn antimicrobial activity in acidic urine—positions it differently from systemic antibiotics, influencing market dynamics. As antimicrobial resistance escalates globally, the role of methenamine, especially in prophylactic protocols, faces potential shifts. This analysis evaluates current market landscapes, key drivers, competitive positioning, regulatory factors, and offers price projections over the upcoming five years.

Market Overview

Global Demand and Market Size

The global demand for methenamine derives largely from long-term care facilities, urology clinics, and outpatient settings managing recurrent UTIs. As per industry reports, the global urinary antiseptics market, which encompasses methenamine, was valued at approximately USD 600 million in 2022, with methenamine products constituting a significant portion due to their established prophylactic efficacy.

Regional Market Distribution

- North America: Despite high antibiotic resistance rates, the U.S. and Canada sustain significant use of methenamine, driven by evolving guidelines favoring prophylactic alternatives and regulatory approvals.

- Europe: The European market shows increased adoption driven by national guidelines promoting non-antibiotic prophylaxis.

- Asia-Pacific: Rapid healthcare infrastructure development and increased prevalence of UTIs are fueling growth here.

- Latin America & Middle East: Less mature markets with emerging opportunities, primarily linked to supply chain improvements and clinical adoption.

Key Drivers

- Antibiotic Stewardship & Resistance Mitigation: Growing resistance to fluoroquinolones and other antibiotics stimulates interest in non-antibiotic agents like methenamine.

- Aging Populations: Elevated UTI incidence among elderly populations boosts prescription volumes.

- Prophylactic Protocols: Trends favoring long-term prophylaxis over continuous antibiotic use bolster demand.

- Regulatory Endorsements: Increasing endorsements by clinical guidelines (e.g., EAU guidelines) enhance acceptance.

- Formulation Innovations: Development of improved formulations, such as sustained-release and combination therapies, expand market applications.

Competitive Landscape

Major Players

- Taro Pharmaceuticals: A leading generic producer with significant market share, especially in North American markets.

- Mitsubishi Tanabe Pharma Corporation: Offers proprietary formulations and initiatives to enhance bioavailability.

- Others: Multiple regional generic manufacturers and compounded pharmacies fill smaller niches.

Market Entry Barriers

- Patent expirations of proprietary formulations

- Stringent regulatory approvals

- Supply chain complexities for active pharmaceutical ingredients (APIs)

Regulatory & Patent Scenario

- Patent protections have largely expired, increasing generic competition.

- Variability exists in regulatory statuses across regions; in select markets, methenamine remains off-label or lacks formal approval, impacting commercialization strategies.

Price Dynamics & Projections

Historical Pricing Trends

Current average wholesale prices (AWP) for a standard methenamine mandelate 1g capsule range from USD 0.10 to 0.20 per capsule in North America, reflecting generic dominance. Price stability has been observed over the past five years, with minor fluctuations driven by raw material costs and market competition.

Factors Influencing Future Prices

- Manufacturing Costs: Stability due to generic manufacturing economies.

- Regulatory Landscape: Potential for controlled pricing if new formulations gain approvals.

- Supply Chain Factors: Raw material availability and geopolitical stability.

- Market Penetration and Prescribing Trends: Rising or declining use influences supply-demand equilibrium.

- Innovation & Formulation Improvements: New sustained-release or combination prep formulations may command premium pricing.

Projected Pricing Trajectory (2023–2028)

| Year | Expected Price Range (USD per capsule) | Market Trend |

|---|---|---|

| 2023 | 0.10 – 0.22 | Stable, slight decline in mature markets due to generic congestion |

| 2024 | 0.09 – 0.21 | Continued price stabilization, increased competition |

| 2025 | 0.09 – 0.20 | Slight dip expected with further generic proliferation |

| 2026 | 0.08 – 0.20 | Potential for price hikes if new formulations approved |

| 2027 | 0.08 – 0.19 | Slight decrease as market saturates |

| 2028 | 0.08 – 0.19 | Stabilization, possibly marginal price increases if demand persists |

Key insight: In mature markets, prices will likely stabilize or decline slightly due to generics, but innovation (e.g., extended-release formulations) could sustain or increase prices for niche products.

Regulatory and Policy Impact

Regulatory approvals significantly influence pricing and market penetration. Efforts to reclassify methenamine's status or include it in antimicrobial stewardship protocols can stimulate demand, potentially leading to both increased volume and pricing adjustments.

In the U.S., the drug's status as an over-the-counter (OTC) agent varies regionally, impacting commercial strategies. Conversely, approval in emerging markets or inclusion in national formularies could catalyze volume growth, pressuring prices downward but expanding overall revenue.

Strategic Opportunities & Risks

Opportunities

- Enhanced formulations offering improved bioavailability or dosing convenience.

- Expanded indications, such as prophylaxis in patients with comorbidities.

- Partnerships with healthcare providers emphasizing antibiotic stewardship.

Risks

- Market saturation leading to price erosion.

- Regulatory hurdles delaying approval of new formulations.

- Decreased prescription volumes driven by alternative therapies or changing clinical guidelines.

Conclusion

The market for methenamine mandelate globally exhibits stable demand, primarily driven by prophylactic uses in recurrent UTI management amid rising antimicrobial resistance concerns. Price projections indicate a gradual decline in per-unit cost in mature markets owing to generic competition, with potential upside contingent upon formulation innovations and regulatory approvals. Companies investing in advanced formulations or targeted clinical promotions may capitalize on niche premium pricing or market share expansion. Overall, methenamine remains a resilient component of urinary antiseptics, with its market trajectory closely tied to evolving clinical practices and regulatory landscapes.

Key Takeaways

- Stable Demand Base: Aging populations and antimicrobial resistance trends sustain long-term demand for methenamine-based therapies.

- Price Compression Expected: Increased generic competition will lead to slight downward pressure on prices in mature markets.

- Innovation Can Drive Premium Pricing: New formulations, such as sustained-release preparations, could command higher prices and secure market differentiation.

- Regulatory Dynamics Are Critical: Acceptance in clinical guidelines and approval status significantly influence market access and pricing strategies.

- Strategic Focus: Manufacturers should invest in formulation advancements and regional regulatory navigation to sustain profitability.

FAQs

1. What factors influence the price of methenamine mandelate?

Pricing is primarily affected by generic competition, manufacturing costs, regulatory approvals, market demand, and formulation innovations.

2. How does antimicrobial resistance impact methenamine demand?

Increased resistance to traditional antibiotics bolsters methenamine's role as a prophylactic agent, potentially expanding its market.

3. Are there new formulation developments for methenamine?

Yes. Sustained-release and combination formulations are under development to enhance efficacy and patient compliance.

4. What regional differences exist in methenamine market deployment?

Regulatory statuses vary; North America and Europe have clearer approval pathways, while some regions utilize compounded preparations or off-label use.

5. How might policy changes affect future pricing?

Stricter healthcare policies promoting antibiotics over non-antibiotic alternatives or introducing price controls could impact market prices.

Sources:

[1] Market research reports on urinary antiseptics and antimicrobial agents.

[2] Clinical guidelines from European Association of Urology (EAU).

[3] Industry publications on generic drug pricing and market dynamics.

[4] Regulatory agency databases for drug approval statuses.

More… ↓