Last updated: July 27, 2025

Introduction

Methadone Hydrochloride (HCl) is a synthetic opioid primarily used in pain management and as a substitution therapy for opioid dependence. Given its dual applications and regulatory status, understanding its market landscape and future pricing dynamics is crucial for pharmaceutical companies, investors, and healthcare policymakers. This report offers a comprehensive market analysis and price projections for Methadone HCl, considering current demand, regulatory influences, competitive landscape, manufacturing trends, and global health developments.

Market Overview

Global Demand Drivers

The global demand for Methadone HCl is primarily driven by:

- Opioid dependence treatment: As opioid addiction persists, especially in regions with high prescription rates, methadone remains a frontline medication in opioid substitution therapy (OST). Organizations like the WHO recognize methadone as an essential medicine [1].

- Pain management market: Chronic pain, especially cancer-related, sustains a consistent demand from hospitals and pain clinics worldwide.

- Regulatory frameworks: Stringent regulations on opioid prescriptions influence supply chains, with markets like the US and Europe maintaining controlled but steady demand.

Regional Market Dynamics

- North America: Dominates the market owing to high opioid dependency rates, extensive healthcare infrastructure, and established OST programs. The U.S., with over 2 million people suffering from opioid use disorder (OUD), accounts for a significant share [2].

- Europe: Also significant, with widespread acceptance of methadone in addiction therapy, especially in countries like the UK, Germany, and France.

- Asia-Pacific: Emerging growth prospects due to increasing awareness, regulatory relaxation, and expanding addiction treatment programs.

- Latin America and Africa: Limited but growing markets, constrained by regulatory and supply chain challenges.

Competitive Landscape

Due to its established status, the market comprises:

- Generic manufacturers: Key players include Hikma Pharmaceuticals, Sun Pharmaceutical Industries, and Dr. Reddy's Laboratories.

- Regional producers: Many regional generic companies produce methadone HCl, often under regulatory licenses.

- Limited innovation: The market mainly features generic products, with little R&D for new formulations, due to regulatory bottlenecks and clinical concerns around opioids.

Manufacturing and Supply Chain Considerations

Methadone HCl synthesis involves complex chemical processes primarily reliant on precursors like 4-Dimethylamino-2,2-diphenylbutanone. High regulatory oversight is applied to prevent diversion. Major manufacturing hubs include China, India, and Europe, with export restrictions sometimes limiting supply stability.

Manufacturers are increasingly adopting process efficiencies and quality control advancements to sustain margins amid growing competition and regulatory challenges.

Regulatory and Legal Factors

The regulation of methadone HCl varies globally:

- United States: Controlled under the Controlled Substances Act (CSA) as a Schedule II drug, with strict prescribing and distribution controls.

- Europe: Regulated under the European Medicines Agency (EMA), with country-specific implementation.

- Developing nations: Often face legal and infrastructural barriers limiting access and distribution.

Regulations heavily influence pricing, as compliance costs and legal constraints add to manufacturing and distribution expenses.

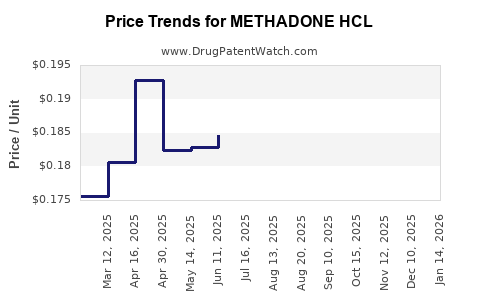

Price Trends and Projections

Current Pricing Landscape

The price of Methadone HCl varies significantly by formulation, source, and market conditions. In the US, the average wholesale price (AWP) for generic methadone hydrochloride tablets ranges between $0.10 and $0.20 per mg [3]. The injectable formulations are more expensive, averaging $2-4 per mL.

Factors Influencing Future Prices

- Regulatory tightening: Enhanced controls may restrict supply and elevate costs.

- Manufacturing costs: Raw material price fluctuations and compliance expenses pressure prices upward.

- Generic competition: Increased production capacity and market entry of generics exert downward pressure.

- Demand dynamics: Persistent opioid dependency and pain management needs ensure steady demand, providing stability.

- Geopolitical factors: Trade restrictions and export controls in key manufacturing regions could constrict supply and elevate prices.

Price Projections (2023-2030)

Based on current trends:

- Short-term (2023-2025): Prices are likely to remain stable with minor fluctuations, influenced by manufacturer capacity and regulatory policies. Any tightening regulations could raise prices marginally by 2-5%.

- Mid-term (2025-2027): Market saturation of generics and increased production could gradually push prices down by approximately 3-7% annually.

- Long-term (2027-2030): Advances in manufacturing, potential biosimilar developments, and global market expansion may stabilize prices, with overall declines of around 10% from 2023 levels.

Potential Price Drivers

- Introduction of biosimilar-like formulations or extended-release formulations could command premium pricing initially.

- Regulatory clampdowns or diversion reductions may cause volatility.

- Emerging markets' growth could lead to lower prices due to increased competition and improved procurement capabilities.

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets with unmet opioid dependence treatments.

- Development of new formulations, such as extended-release variants, to capture premium segments.

- Partnerships with governments and NGOs for expansion in low-resource settings.

Challenges

- Stringent regulatory environment and risk of diversion.

- Societal and legal scrutiny over opioid distribution and abuse.

- Market saturation in developed regions limiting volume growth.

Key Takeaways

- The global methadone HCl market is robust, driven by opioid dependency treatment needs primarily in North America and Europe.

- Current prices are relatively stable, with slight downward trends anticipated due to rising generic competition.

- Supply chain regulation, manufacturing costs, and geopolitical factors will significantly influence price trajectories.

- Long-term outlook suggests gradual price declines, with potential for premium pricing in innovative formulations or untapped markets.

- Strategic positioning in emerging markets and product differentiation through formulations may unlock growth amid competitive pressures.

Conclusion

Methadone HCl remains a critical component of opioid dependency therapy and pain management. Its market exhibits stability driven by persistent demand, but also faces regulatory and competitive challenges that influence pricing dynamics. Stakeholders should monitor regulatory developments closely, explore innovation in formulations, and optimize supply chains to capitalize on evolving market opportunities.

FAQs

1. How does regulatory environment impact Methadone HCl pricing?

Regulatory restrictions increase compliance costs and limit supply, often elevating prices. Conversely, deregulation or relaxed controls can lead to price reductions due to increased competition and supply availability.

2. What are the main factors influencing the supply of Methadone HCl?

Major factors include raw material availability, manufacturing capacity, geopolitical stability, export/import restrictions, and enforcement efforts to prevent diversion.

3. Are there upcoming innovations in Methadone HCl formulations?

While current market focus remains on generic formulations, extended-release and combination formulations are under development to improve compliance and reduce diversion risks.

4. How does the global demand for Methadone HCl vary across regions?

Demand is highest in North America and Europe. Emerging markets demonstrate increasing interest, driven by expanding addiction treatment programs.

5. What is the outlook for generic vs. branded Methadone HCl products?

Generics dominate the market due to cost advantages. Branded versions are less common, primarily focusing on specialized formulations or markets with tighter regulation.

References

[1] World Health Organization. Essential Medicines List. 21st Report, 2019.

[2] Substance Abuse and Mental Health Services Administration (SAMHSA). 2022 National Survey on Drug Use and Health.

[3] Red Book. Pharmacological Pricing Data, 2023 Edition.