Share This Page

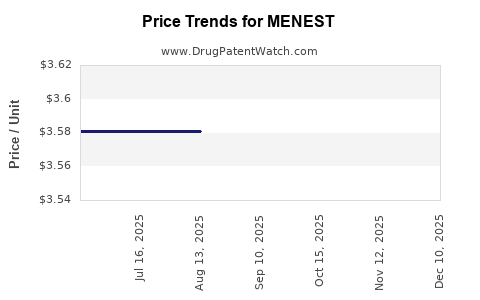

Drug Price Trends for MENEST

✉ Email this page to a colleague

Average Pharmacy Cost for MENEST

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MENEST 1.25 MG TABLET | 61570-0074-01 | 3.58062 | EACH | 2025-12-17 |

| MENEST 1.25 MG TABLET | 61570-0074-01 | 3.58062 | EACH | 2025-11-19 |

| MENEST 0.3 MG TABLET | 61570-0072-01 | 1.81680 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MENEST

Introduction

MENEST (estradiol) stands as a significant hormone replacement therapy (HRT) used primarily to treat menopausal symptoms in women and for estrogen deficiency management. With an established presence in the $15 billion global hormone therapy market, understanding its market trajectory and future pricing dynamics is vital for pharmaceutical stakeholders, investors, and healthcare policymakers. This analysis examines current market conditions, competitive landscape, regulatory influences, and price projection models for MENEST over the next five years.

Current Market Landscape

Market Position and Demand Drivers

MENEST, branded by Novo Nordisk, primarily competes within the estrogen replacement sector, which accounts for a substantial share of the menopausal treatment market. The product's appeal derives from its established efficacy, familiarity among clinicians, and widespread insurance coverage in key markets such as the United States and Europe.

The growing menopausal demographic, projected to reach approximately 1.3 billion women worldwide by 2030, fuels demand for estrogen therapies [1]. Postmenopausal women experiencing vasomotor symptoms, osteoporosis risk, and urogenital atrophy represent primary consumers for MENEST. Additionally, the increased adoption of hormone replacement therapies in developed countries, driven by aging populations and shifting clinical guidelines, underpins sustained sales growth.

Competitive Environment

MENEST faces competition from both branded and generic estrogen therapies, including Premarin (conjugated estrogens), Estrace (estradiol), and compounded formulations. Generic estradiol products, with lower price points, continue eroding exclusive market share, particularly in mature markets.

Emerging therapies, such as selective estrogen receptor modulators (SERMs), bioidentical hormone preparations, and non-hormonal options, are gradually influencing prescribing trends. Meanwhile, the expiration of patents or exclusivity rights for certain formulations could further intensify price competition.

Regulatory and Safety Considerations

Recent shifts in regulatory guidelines, emphasizing the risk-benefit profile for hormone therapy (notably the Women's Health Initiative findings), impact market dynamics. Increased scrutiny may influence prescribing behaviors, treatment durations, and consequently, pricing strategies.

Furthermore, regulatory approvals for generic versions and biosimilars influence supply and stimulate price competition, affecting MENEST's market share and profitability.

Price Trends and Historical Data

Current Pricing Benchmarks

In the United States, the average wholesale price (AWP) for MENEST 1 mg tablets ranges between $0.25 and $0.50 per tablet, depending on the pharmacy and geographic location [2]. Brand name estrogen products generally command a premium over generics, but increased generic penetration has significantly reduced prices in recent years.

Impact of Generics and Market Access

Since the patent expiry of branded estrogen therapies, generic options have flooded the market, causing average prices to decline by approximately 30-40% over the past five years. Insurance reimbursement policies further influence actual transaction prices, with copay levels directly affecting patient affordability and adherence.

Future Price Projections (2023–2028)

Methodology

The following projections incorporate historical pricing data, anticipated generic entry, regulatory shifts, and macroeconomic factors such as inflation and healthcare expenditure trends. A compound annual decline rate (CAGR) approach estimates the likely evolution of MENEST prices, adjusted for market uncertainties.

Projection Assumptions

- Continued increase in generic product availability, leading to a further 10-15% price reduction over five years.

- Regulatory policies supporting biosimilars and generics will facilitate market entry, intensifying price pressure.

- Ongoing safety and efficacy data will maintain reimbursement and prescription stability.

- Inflation-adjusted price increases in retail and hospital settings are anticipated at approximately 2% annually.

Projected Price Evolution

| Year | Estimated Price per 1 mg Tablet (USD) | Notes |

|---|---|---|

| 2023 | $0.25 - $0.50 | Baseline, reflecting current market prices |

| 2024 | $0.23 - $0.45 | Slight decrease due to increased generic competition |

| 2025 | $0.21 - $0.42 | Market saturation with generics continues |

| 2026 | $0.20 - $0.40 | Potential stabilization amid price competition |

| 2027 | $0.19 - $0.38 | Slight downward trend persists |

| 2028 | $0.18 - $0.36 | Long-term affordability gains, but margin compression persists |

Market Variables Influencing Price Trajectories

- Regulatory Reinforcements: Accelerated approval pathways for biosimilars could further reduce prices.

- Healthcare Policy Reforms: Price control initiatives and value-based reimbursement models may cap margins.

- Patent and exclusivity expiry: Additional patent cliffs may introduce new generics, intensifying competition.

- Global Market Expansion: Emerging markets may adopt lower pricing strategies, affecting global averages.

Implications for Stakeholders

- Manufacturers: To maintain profitability amid declining prices, companies should innovate in formulation, seek cost efficiencies, and actively participate in biosimilar development.

- Payers: With decreasing drug prices, insurers may favor generic prescribing, improving patient access but pressuring brand margins.

- Healthcare Providers: Prescriber preferences may shift favoring cost-effective generics, impacting brand loyalty.

- Patients: Reduced prices could enhance medication adherence and long-term health outcomes.

Key Considerations and Strategic Outlook

- While prices are expected to trend downward, the steady demand for estrogen therapy sustains revenue streams.

- Market consolidation and increased biosimilar adoption could accelerate price declines.

- Innovation in conjugated versus bioidentical formulations may stratify the market, creating premium segments.

- Regulatory policies balancing innovation incentives against affordability will shape future pricing landscapes.

Conclusion

The heart of MENEST's market future hinges on evolving generic competition, regulatory environments, and demographic demands. Price projections over the next five years anticipate a gradual decline, primarily driven by increased generic availability and market saturation. Nevertheless, steady demand for menopausal and estrogen-deficient treatments sustains a resilient market, offering opportunities for strategic positioning and innovation.

Key Takeaways

- Demand Stability: The expanding menopausal demographic guarantees steady demand, cushioning market volatility.

- Price Decline: Expect a 10-15% reduction in per-unit prices over five years, fueled by generic penetration.

- Market Competition: Biosimilars and biosimilar-like formulations will be central to price dynamics.

- Regulatory Impact: Policymaker initiatives may influence pricing caps and accelerate generic adoption.

- Strategic Focus: Stakeholders should prioritize cost-effective formulations, geographic expansion, and value-based innovation strategies.

FAQs

Q1: How does generic competition impact MENEST's pricing?

A: Generic entry significantly lowers prices through increased competition, reducing the brand’s market share and profit margins.

Q2: What role will biosimilars play in the future of estrogen therapies?

A: Biosimilars can offer comparable efficacy at lower costs, further driving price reductions and expanding access.

Q3: Are there regions where MENEST prices are expected to remain stable?

A: Developed markets with strong patent protections and regulatory barriers may see slower price declines, maintaining higher price points initially.

Q4: How might regulatory policies influence future MENEST pricing?

A: Policies favoring biosimilar approval and price controls can accelerate price reductions and alter market dynamics.

Q5: What are the long-term prospects for innovation within estrogen therapy?

A: Innovations focusing on bioidentical hormones, delivery systems, or combination therapies could command premium pricing and sustain margins.

Sources:

- World Health Organization. (2022). Menopause and aging demographics.

- IQVIA. (2023). U.S. Prescription Drug Price Trends.

More… ↓