Share This Page

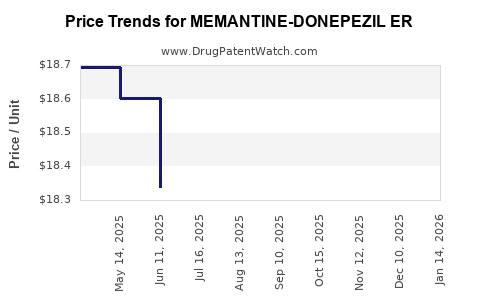

Drug Price Trends for MEMANTINE-DONEPEZIL ER

✉ Email this page to a colleague

Average Pharmacy Cost for MEMANTINE-DONEPEZIL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MEMANTINE-DONEPEZIL ER 28-10 MG | 69238-1247-03 | 16.05406 | EACH | 2025-12-17 |

| MEMANTINE-DONEPEZIL ER 14-10 MG | 69238-1248-03 | 14.84314 | EACH | 2025-12-17 |

| MEMANTINE-DONEPEZIL ER 14-10 MG | 69680-0183-30 | 14.84314 | EACH | 2025-12-17 |

| MEMANTINE-DONEPEZIL ER 28-10 MG | 69680-0185-30 | 16.05406 | EACH | 2025-12-17 |

| MEMANTINE-DONEPEZIL ER 14-10 MG | 69680-0183-30 | 14.99391 | EACH | 2025-11-19 |

| MEMANTINE-DONEPEZIL ER 28-10 MG | 69238-1247-03 | 16.21932 | EACH | 2025-11-19 |

| MEMANTINE-DONEPEZIL ER 28-10 MG | 69680-0185-30 | 16.21932 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MEMANTINE-DONEPEZIL ER

Introduction

Memantine-Donepezil ER (extended-release), a combination therapy for Alzheimer’s disease, represents a significant advancement in neurodegenerative treatment. Combining memantine, an NMDA receptor antagonist, with donepezil, a cholinesterase inhibitor, aims to optimize symptomatic management of moderate to severe Alzheimer’s disease. Given the aging global population and increasing prevalence of dementia, understanding the market landscape and price trajectory for Memantine-Donepezil ER is crucial for stakeholders, including pharmaceutical companies, investors, payers, and healthcare providers.

Market Landscape Overview

Epidemiology and Demand Drivers

Alzheimer’s disease affects approximately 55 million individuals worldwide, projected to reach 78 million by 2030 [1]. As the most common form of dementia, this disease constitutes a vast market for pharmacological interventions. The incremental shift from monotherapies to combination treatments, such as Memantine-Donepezil ER, reflects a strategic effort to enhance patient outcomes, especially in moderate to severe stages.

The aging demographic, especially in developed markets such as the United States, Europe, and Japan, significantly amplifies demand. The Alzheimer’s Association estimates that nearly 80% of dementia patients are prescribed cholinesterase inhibitors or memantine-based therapies, underscoring the importance of combination regimens [2].

Competitive Landscape

Currently, the therapeutic arsenal encompasses branded drugs like Namzaric (combination of memantine and donepezil) marketed by Eisai and Biogen, which has captured substantial market share since its 2014 approval in the US. The extension of formulations into ER versions aims to boost adherence and convenience, creating an incremental demand pull.

Key competitors include:

- Namzaric (memantine/donepezil combination)

- Donepezil monotherapy

- Memantine monotherapy

- Other emerging combination therapies

The market’s growth hinges on the approval and adoption of new formulations, differentiated by pharmacokinetics, ease of use, and reimbursement pathways.

Regulatory and Patent Environment

The current patent landscape influences market exclusivity and pricing strategies. Namzaric’s patent was challenged but remains protected through patent extensions and formulation patenting, delaying generic entry until approximately 2030 [3].

Developing a novel ER formulation like Memantine-Donepezil ER involves navigating regulatory pathways focused on demonstrating bioequivalence, safety, and efficacy. Secure regulatory approval enhances market penetration and supports premium pricing strategies.

Pricing Strategy and Cost Factors

Pricing Benchmarks

As of 2023, Namzaric's average wholesale price (AWP) is approximately $520–$550 per month, reflecting a premium due to formulation convenience and branded status [4]. Generic memantine and donepezil are substantially cheaper, yet the market predominantly uses branded combinations in moderate to severe disease stages.

Cost Components

- Development and manufacturing expenses for ER formulations are higher relative to immediate-release versions, owing to technology and formulation complexities.

- Regulatory compliance costs impact initial pricing but are spread over expected sales volume.

- Reimbursement policies influence net pricing, with payers negotiating discounts, formulary placements, and prior authorizations.

Price Projection Factors

- Market penetration depends on regulatory approval in various territories and physician prescribing habits.

- Competitor pricing and patent protections impact premium positioning.

- Cost of goods sold (COGS) and manufacturing efficiencies may reduce unit costs in the long term.

- Market access and reimbursement landscape will determine patient affordability and utilization rates.

Future Price Trends and Projections

Based on current market factors, technological considerations, and competitive dynamics:

-

Short-term (1-2 years): Prices are expected to remain stable or slightly elevated, contingent upon regulatory approval and initial adoption. The price premium over generic monotherapies may range from 30% to 50%, reflecting combination benefits and ER formulation advantages.

-

Mid-term (3-5 years): As patents for Namzaric and similar formulations face expiration, generic versions are likely to enter the market, exerting downward pressure on branded prices. The ER formulation’s niche positioning might sustain a higher price point if clinical advantages are demonstrated convincingly.

-

Long-term (5+ years): With increased generic competition, prices could decline by 50–70%, aligning with typical pharmaceutical price erosion patterns post-patent expiry. However, differentiated formulations with proven adherence benefits could maintain a premium in select markets.

Market Dynamics Impacting Pricing

Regulatory Approvals and Clinical Evidence

Rapid and broad regulatory acceptance with positive clinical trial data demonstrating improved adherence and cognitive outcomes will support premium pricing. Conversely, lackluster real-world effectiveness data may undermine premium positioning.

Insurance and Reimbursement

Payer policies will critically influence net prices. Countries with centralized national health systems may negotiate strict discounts, whereas private insurers in the U.S. might offer higher reimbursement for innovative ER formulations, buffering initial high price points.

Manufacturing Scalability

Improvements in manufacturing processes over time could lower costs, enabling more competitive pricing, especially if a significant patient base adopts the ER formulation.

Implications for Stakeholders

- Pharmaceutical Companies: Focus on securing patent extensions, demonstrating clinical advantages, and optimizing manufacturing efficiency for sustained premium pricing.

- Payers: Emphasize cost-effectiveness analyses to determine reimbursement levels, advocating for value-based formularies.

- Healthcare Providers: Educate about the benefits of ER formulations, influencing prescribing choice, and impacting market share.

- Investors: Monitor patent strategies, regulatory approvals, and competitive launches to forecast revenue streams.

Key Takeaways

- The global Alzheimer's market is robust, driven by demographic shifts and unmet needs in moderate to severe stages.

- Memantine-Donepezil ER aims to capture demand through improved compliance and clinical differentiation.

- Current market leaders, like Namzaric, set a benchmark with prices around $520–$550/month; new formulations are positioned to command premium prices temporarily.

- Patent protections extending into the 2030s delay generic incursion, enabling sustained premium pricing, but mid-term price erosion is inevitable with patent expiry.

- Success hinges on regulatory approval, demonstrated clinical benefits, manufacturer scale, and payer reimbursement strategies, all shaping future price trajectories.

FAQs

Q1. When is Memantine-Donepezil ER expected to enter the market?

A1. Regulatory approval timelines vary by region, with U.S. filings anticipated within 1-2 years, depending on clinical trial outcomes and submission readiness.

Q2. How does Memantine-Donepezil ER compare cost-wise to existing treatments?

A2. It is priced higher than generic monotherapies, with a premium of approximately 30–50%, reflecting benefits like improved adherence and dosing convenience.

Q3. What factors could accelerate the market adoption of Memantine-Donepezil ER?

A3. Strong clinical trial results demonstrating superior efficacy, favorable reimbursement policies, and clinician awareness drive adoption.

Q4. Will generic versions of Memantine-Donepezil ER reduce prices significantly?

A4. Yes, patent expiries around 2030 are expected to lead to substantial price reductions, typical of biosimilar and generic entry.

Q5. How do international markets influence the potential of Memantine-Donepezil ER?

A5. Market size, regulatory pathways, and reimbursement structures differ, influencing regional pricing and adoption rates—advanced economies tend to adopt higher prices earlier, while developing markets may prioritize cost-effectiveness.

References

[1] World Health Organization. Dementia Fact Sheet. 2022.

[2] Alzheimer's Association. 2022 Alzheimer's Disease Facts and Figures.

[3] U.S. Patent and Trademark Office. Patent applications related to memantine and donepezil formulations.

[4] IQVIA. June 2023 Global Prescription Price Data.

This comprehensive market analysis offers a strategic foundation for making informed decisions regarding the commercialization, investment, and policy development surrounding Memantine-Donepezil ER.

More… ↓