Last updated: July 27, 2025

Introduction

Meloxicam, a non-steroidal anti-inflammatory drug (NSAID), is extensively utilized for the treatment of osteoarthritis, rheumatoid arthritis, and other inflammatory musculoskeletal conditions. Approved by regulatory agencies such as the U.S. Food and Drug Administration (FDA), the drug's market dynamics are shaped by its therapeutic efficacy, patent status, generic competition, regulatory landscape, and evolving healthcare policies. This report provides a comprehensive analysis of the current market landscape and offers price projections for meloxicam over the next five years, highlighting key factors influencing its valuation.

Market Overview

Global Market Size

The global NSAID market, of which meloxicam constitutes a significant segment, is valued at approximately USD 13 billion in 2022, with a compound annual growth rate (CAGR) projected at 4-6% until 2027 [1]. Meloxicam's market share within this segment is substantial, driven by its favorable safety profile relative to other NSAIDs and its once-daily dosing convenience.

Therapeutic Applications

Meloxicam primarily treats chronic inflammatory conditions, with projected growth correlating with aging populations and increasing prevalence of osteoarthritis and rheumatoid arthritis. The rising adoption of biologic treatments for autoimmune conditions may slightly temper growth but leave NSAIDs still as frontline options.

Market Players

Key manufacturers include Boehringer Ingelheim, Mylan (now part of Viatris), and Hikma Pharmaceuticals. The entry of generics following patent expiration has intensified competition, considerably lowering prices and expanding accessibility.

Regulatory and Patent Landscape

Patent Status

Boehringer Ingelheim held patents protecting meloxicam until 2014-2015 in major markets such as the U.S. and EU. Post-expiration, generic versions flooded the market, significantly reducing prices. Patent litigation delays and regulatory exclusivities in emerging markets further influence market entry and pricing strategies.

Regulatory Developments

Regulatory scrutiny of NSAID safety profiles, particularly concerning gastrointestinal and cardiovascular risks, influences prescribing patterns. Recent guidelines emphasizing personalized medicine approaches could alter market share distributions.

Market Trends and Drivers

-

Generic Market Penetration: The expiration of primary patents catalyzed price declines and increased availability of generics, with generics accounting for over 85% of prescriptions in the U.S. by 2020 [2].

-

Pricing Strategies: Patent cliff and intense competition have driven prices down, but manufacturers explore biosimilars and combination therapies to sustain margins.

-

Healthcare Policy Influence: Price regulations in certain regions (e.g., price caps in hospitals) and reimbursement policies influence retail and institutional sales.

-

Patient and Physician Preferences: Safety concerns and side effect profiles impact prescription volumes, with newer formulations or formulations with improved safety potentially gaining market share.

Price Trends and Projections

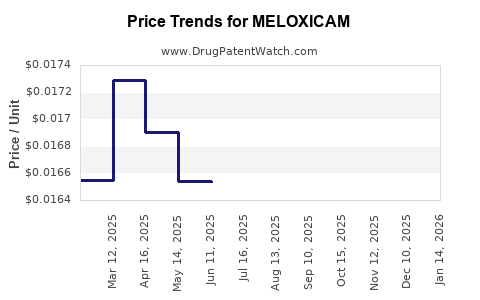

Historical Price Movements

Average wholesale prices (AWP) for meloxicam tablets in the U.S. have decreased from approximately USD 50 per 30-count bottle pre-patent expiry to about USD 10-15 in the generic-dominated era (2022). Similar trends are observed globally, although regional disparities exist due to local regulations and market dynamics [3].

Projected Price Trajectory (2023–2028)

Given current trends, the following price projections are anticipated:

-

Short-term (2023–2025): Stabilization of generic supply is likely, with prices maintaining at USD 10-15 per bottle but with potential seasonal fluctuations due to supply chain dynamics or market interventions.

-

Medium-term (2026–2028): Prices could decline marginally to USD 8-12, especially if biosimilars or alternative NSAIDs with improved safety profiles gain clinician preference. Conversely, shortages or regulatory changes could temporarily push prices upward.

Factors Influencing Price Dynamics

-

Market Competition: Entry of high-quality biosimilars or targeted formulations might pressure prices further.

-

Regulatory Actions: Potential safety warnings or maintenance of current guidelines could alter demand elasticity.

-

Emerging Markets: Growth in emerging economies with expanding healthcare infrastructure may open new demand channels with variable pricing based on local purchasing power.

-

Supply Chain Factors: Raw material availability and geopolitical factors could induce price volatility.

Market Opportunities and Risks

Opportunities

-

Development of Fixed-Dose Combinations: Combining meloxicam with gastroprotective agents to address safety concerns may command premium pricing.

-

Formulation Innovations: Topical or extended-release formulations can improve patient compliance and expand market share.

-

Expansion in Emerging Markets: Growing healthcare access presents long-term growth prospects.

Risks

-

Safety Concerns: Risks associated with NSAIDs, including cardiovascular and gastrointestinal adverse events, could restrict market growth.

-

Generic Competition: Intense price competition erodes margins and limits potential revenue.

-

Regulatory Changes: Stringent safety evaluations could lead to restrictions or additional labeling requirements, affecting sales.

Strategic Recommendations

-

Pricing Optimization: Companies should adjust prices dynamically based on regional market conditions and competitive actions.

-

Invest in Formulation Development: Innovating safer, more effective formulations can create differentiation.

-

Focus on Emerging Markets: Tailoring pricing and marketing strategies for growth regions will enhance revenue streams.

-

Monitor Regulatory Trends: Staying ahead of safety data developments and compliance requirements minimizes market disruption risks.

Key Takeaways

-

The meloxicam market is characterized by significant price declines post-patent expiry, with current average prices in the USD 10-15 range in the U.S., trending downward with competition.

-

Industry players should anticipate stabilized but gradually declining prices over the next five years, influenced heavily by generics, biosimilars, safety concerns, and regional policies.

-

Innovations in formulation, combination therapies, and targeting emerging markets represent strategic avenues to sustain profitability amid pricing pressures.

-

Regulatory oversight focusing on NSAID safety remains a critical factor, capable of altering market trajectories significantly.

-

Active market monitoring and adaptive pricing strategies are essential for optimizing revenue and market share in the evolving landscape.

FAQs

-

What is the current market price of meloxicam in the U.S.?

The average wholesale price (AWP) for a 30-count bottle of meloxicam (15 mg) is approximately USD 10-15, reflecting intense generic competition ([3]).

-

Are there notable patent protections still affecting meloxicam?

No. Major patents expired around 2014-2015, enabling generic manufacturers to enter the market and accelerate price declines.

-

What factors could influence meloxicam's future price trends?

Factors include regulatory safety reviews, patent and exclusivity statuses, emergence of biosimilars or alternative NSAIDs, supply chain stability, and regional pricing regulations.

-

How does regional variation impact meloxicam pricing?

Prices tend to be higher in markets with less generic penetration or stringent regulation, while highly competitive regions see lower prices. Healthcare reimbursement models also influence retail prices.

-

Is meloxicam expected to retain its market share amid new NSAID therapies?

Yes, due to its favorable safety profile and convenience, but its market share may decline if new formulations or safer alternatives prove more effective or preferable.

References

[1] MarketWatch, "NSAID Market Size & Share Report," 2022.

[2] IQVIA, "Pharmaceutical Market Trends," 2020.

[3] RedBook, "Average Wholesale Prices (AWP)," 2022.