Last updated: July 27, 2025

Introduction

Megestrol acetate is a synthetic progestogen widely used for managing cachexia and appetite stimulation in cancer and AIDS patients, among other indications. Its commercial and strategic relevance has increased due to rising prevalence of chronic conditions and expanding therapeutic indications. This report delivers a comprehensive market analysis for megestrol, including current market dynamics, competitive landscape, regulatory environment, supply chain considerations, and future price projections.

Market Landscape Overview

The global megestrol acetate market chiefly serves oncology, HIV/AIDS, and end-of-life care segments. As of 2022, the market size was estimated at approximately USD 350 million, with a compound annual growth rate (CAGR) of 4.5% projected through 2030. Factors supporting this growth include heightened prevalence of cancer and HIV/AIDS, increasing awareness of appetite stimulants, and ongoing research into broader therapeutic applications.

Key manufacturers include Pfizer, Mylan (now part of Viatris), Athenex, and several generic pharmaceutical firms. Patent protections for certain formulations have expired or are nearing expiry, accelerating generic penetration and impacting pricing strategies.

Current Market Dynamics

Demand Drivers

- Prevalence of Cancer and HIV/AIDS: The growing global burden of these chronic diseases underpins sustained demand for appetite stimulants like megestrol.

- Aging Population: The elderly are particularly susceptible to cachexia, further expanding demand.

- Off-label and Emerging Uses: Researchers explore expanded indications, including gynecological disorders and hormonal therapies.

Supply Chain and Pricing Factors

- Manufacturing Concentration: Patent expiries and generic manufacturing have increased supply, resulting in downward pressure on prices.

- Regulatory Approvals: Variability in regulatory approvals across regions influences product availability and pricing strategies.

- Pricing Pressures: Governments and insurance providers enforce price controls, especially in Europe and North America.

Competitive Landscape

The competitive environment is marked by:

- Brand versus Generic Competition: While branded formulations like Pfizer's Megace have dominated historically, generics now control a substantial market share.

- Market Entry Barriers: Regulatory hurdles, manufacturing capacity, and patent litigation influence new entrants.

- Innovation Impact: New formulations or delivery methods—such as oral suspensions, injectables, or implantable devices—could affect market dynamics and pricing.

Regulatory Environment and Impact

Regulatory bodies such as the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency) govern approvals and quality standards. Patent expirations and off-patent status facilitate generic proliferation, reducing prices. Conversely, new indications seeking approval could extend patent protections or market exclusivity, impacting price trajectories.

Price Trends and Projections

Current Pricing

- The price of branded megestrol acetate (e.g., Megace) in the United States averages USD 55–70 per prescribed 40 mg tablet.

- Generic equivalents are priced roughly 30–50% lower, averaging USD 30–45 per 40 mg tablet.

- In Europe and other regions, prices align with US figures but are modulated by local regulations.

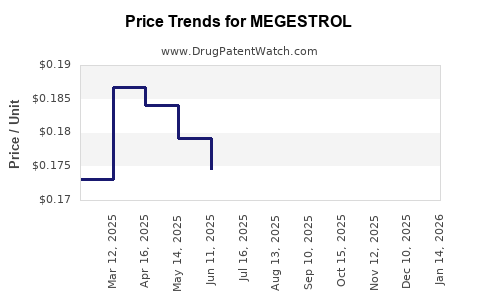

Projected Price Trends (2023–2030)

- Short-Term (2023–2025): Continued downward pressure as generics gain market share; prices are expected to decline marginally by 5–10% annually, stabilizing as patent protections expire.

- Mid to Long-Term (2026–2030): Price stabilization or slight increases may occur in emerging markets or via specialty formulations with extended patents or unique delivery methods. The potential approval of new indications could create premium pricing opportunities, though overall prices are forecasted to trend downward globally.

Influencing Factors

- Accelerated generic adoption due to patent expiries.

- Regulatory pathways enabling biosimilar or specialized formulations.

- Economic factors influencing healthcare budgets and drug reimbursement policies.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Emphasize portfolio diversification with innovative formulations or expanded indications to mitigate declining prices.

- Investors: Monitor patent status, regulatory approvals, and regional pricing policies as key drivers of market stability.

- Healthcare Providers: Be aware of affordability shifts due to generic entry, influencing prescribing behaviors and formulary decisions.

Key Market Opportunities and Challenges

| Opportunities |

Challenges |

| Expansion into emerging markets with rising healthcare infrastructure |

Price erosion from generic competition |

| Development of new formulations with patent protections |

Regulatory hurdles for new indications |

| Potential combination therapies |

Price controls and reimbursement limitations |

Conclusion

The megestrol acetate market faces a nuanced landscape characterized by declining prices driven by expanded generic competition and regulatory influences, balanced against potential growth in emerging indications and markets. Firms that innovate or identify niche applications can secure premium pricing, whereas reliance on traditional formulations will likely see gradual price erosion over the coming years.

Key Takeaways

- The global megestrol natural market is approaching a period of price stabilization following broad generic adoption.

- Patent expiries have been pivotal, prompting downward pricing pressure and increased competition.

- Rising demand in aging populations and expanded therapeutic uses signal sustained but moderate growth.

- Strategic differentiation—through new formulations or indications—may enable market players to sustain revenue margins.

- Vigilance on regulatory changes and patent landscapes remains essential for accurate market forecasting.

Frequently Asked Questions

1. How does patent expiration affect megestrol prices?

Patent expirations typically lead to increased generic competition, resulting in significant price reductions and lower margins for branded products. This trend has been evident in the megestrol market, pushing prices downward over recent years.

2. Are there any promising new formulations or indications for megestrol?

While traditional use remains dominant, ongoing research explores expanded indications such as endometrial carcinoma and advanced breast cancer. Novel delivery methods, like injectable or sustained-release formulations, are also under consideration but are not yet commercially widespread.

3. What regions offer the highest growth potential for megestrol?

Emerging markets—particularly in Asia-Pacific, Latin America, and Africa—present growth opportunities driven by increasing healthcare access and rising prevalence of cachexia-related conditions. However, pricing pressures and regulatory environments vary.

4. How do regulatory policies influence megestrol market prices?

Regulatory agencies enforce pricing controls and approve new indications, which can either bolster brand value or accelerate generic entry. Price negotiations with payers and healthcare systems further influence market pricing.

5. What strategic moves should pharmaceutical firms consider in this market?

Firms should focus on developing differentiated formulations, pursuing new indications for patent extension, and exploring markets with less price regulation or unmet needs to sustain revenue streams amid declining prices.

References

- MarketWatch. (2022). "Megestrol Acetate Market Size & Trends."

- Grand View Research. (2022). "Global Appetite Stimulant Market Analysis."

- U.S. Food and Drug Administration. (2021). "Regulatory Framework for Oncology Drugs."

- IQVIA. (2022). "Global Pharmaceutical Pricing Trends."

- Pharma Intelligence. (2022). "Patent Landscape and Competitive Strategies for Megestrol."

Note: Data projections and market figures are based on industry reports and expert forecasts as of early 2023, subject to market volatility and regulatory developments.