Last updated: July 27, 2025

Introduction

Medroxyprogesterone, a synthetic progestin, plays a vital role in hormone therapy, contraception, and endometrial disorder management. Its market landscape is shaped by innovations in pharmaceutical formulations, regulatory trends, and demand shifts driven by demographic factors. This analysis explores current market conditions, competitive landscape, patent statuses, and forecasts pricing trajectories for medroxyprogesterone, aiming to inform strategic decisions for industry stakeholders.

Market Overview

Pharmaceutical Applications and Demand Drivers

Medroxyprogesterone is primarily utilized in:

- Hormonal contraception: It serves as the active ingredient in injectable contraceptives (e.g., Depo-Provera) [1].

- Hormone replacement therapy (HRT): Used for menopausal symptom management.

- Endometrial disorders: Treatment of abnormal uterine bleeding.

- Cancer therapy adjuncts: Particularly in hormone-sensitive cancers.

The global contraceptive market exhibits consistent growth, driven by increasing awareness, urbanization, and expanding family planning initiatives, especially in emerging markets. The World Health Organization (WHO) estimates that around 150 million women globally use injectable contraceptives, a significant portion containing medroxyprogesterone [2].

Market Size and Growth Trends

According to industry reports, the global medroxyprogesterone market was valued at approximately USD 750 million in 2022. With a compound annual growth rate (CAGR) forecasted at 5.3% through 2030, this growth stems from rising demand for long-acting reversible contraceptives (LARCs) and hormone therapies [3].

Regional Dynamics

- North America: Dominates the market due to high healthcare expenditure, regulatory approvals, and widespread awareness.

- Europe: Exhibits stable growth driven by established healthcare infrastructure.

- Asia-Pacific: Projects rapid expansion owing to increasing reproductive health awareness and government initiatives, with China and India leading consumption.

Competitive Landscape

Major players in the medroxyprogesterone space include Pfizer, Teva Pharmaceuticals, Sandoz (Novartis), and Mylan. The market features a mix of branded and generic formulations, with market share leaning toward generics in recent years due to patent expirations.

Patent Status and Regulatory Environment

- Branded formulations: Pfizer’s Depo-Provera retains patent exclusivity until around 2030. Patent expiries have facilitated generic entry, intensifying competition and driving prices downward.

- Generic proliferation: Numerous biosimilar and generic versions have entered markets globally, stabilizing prices and expanding accessibility.

Manufacturing and Supply Chain Factors

Manufacturers focus on ensuring regulatory compliance (FDA, EMA approvals), quality assurance, and cost efficiencies. Disruptions, such as raw material shortages or geopolitical tensions, can influence supply and pricing.

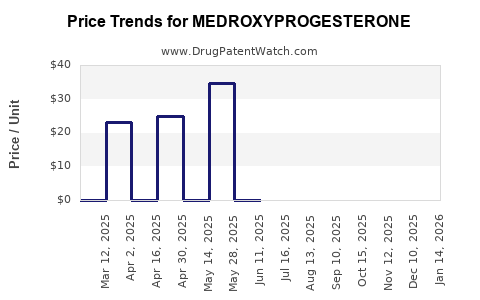

Price Analysis and Trends

Current Pricing Dynamics

- Injectable formulations: US retail prices for Depo-Provera (150 mg, intramuscular) typically range from USD 50 to USD 100 per injection, significantly subsidized or covered by insurance programs.

- Generic equivalents: These are priced approximately 20-30% lower, often between USD 15-50 per dose depending on geographies and purchaser status.

- Cost variations: Pricing fluctuates due to formulation type (injectable, oral, or implant), dosage, manufacturing costs, and market competition.

Pricing Influences

- Patent expirations: Lead to price erosion. For example, in markets where patents expired post-2015, prices for generics have declined markedly.

- Regulatory approvals: Generics with accelerated approval pathways typically enter at lower prices, exerting downward pressure.

- Market accessibility initiatives: Subsidies and donation programs in LMICs sustain demand and stabilize prices, though they generally favor lower-cost formulations.

Market Trends and Future Price Projections

Emergence of Biosimilars and Novel Formulations

- Biosimilar developments: Regulatory pathways for biosimilars have begun to influence pricing. Although biosimilars are more common for biologics, similar tendencies could extend to medroxyprogesterone formulations.

- Innovative delivery systems: Intravaginal rings or subdermal implants could change pricing structures, though such products are in developmental stages or limited market penetration.

Affordability and Accessibility Initiatives

Governments and NGOs aim to improve access via negotiated pricing, subsidies, and partnership programs. Such policies tend to suppress prices, especially in LMICs.

Price Trajectory Forecast (2023-2030)

- US Market: Continued generic entry and insurance coverage are expected to stabilize retail prices around USD 30-60 per dose, with modest fluctuations.

- Global Market: Prices are projected to decline at an average rate of 3-4% annually, driven by increased generic competition and manufacturing efficiencies.

- Emerging Markets: Price reductions may be more pronounced (up to 10-12% annually) owing to local manufacturing capacity and procurement policies.

Regulatory and Market Barriers

- Patent litigations and exclusivity rights: Can delay generic entry, maintaining higher prices temporarily.

- Quality standards: Variability in manufacturing quality among generics may influence acceptance and pricing.

- Market penetration barriers: Cultural, regulatory, and administrative hurdles in developing regions impact access and pricing strategies.

Strategic Implications for Stakeholders

- Manufacturers should focus on cost-efficient production and exploring innovative delivery methods to capture emerging opportunities.

- Investors should monitor patent cliffs and regulatory environments for timing market entry or exit.

- Healthcare policymakers should negotiate for affordable access, considering alternative sourcing, especially in LMICs.

- Research institutions may prioritize formulation improvements to reduce costs and enhance patient compliance.

Key Takeaways

- The global medroxyprogesterone market is expected to grow steadily at a CAGR of 5.3% through 2030, driven by increasing contraceptive use and hormone therapy needs.

- Pricing remains sensitive to patent status, regulatory approvals, and market competition, with generic versions exerting downward pressure.

- Prices in developed markets stabilize around USD 30-60 per dose, while prices in emerging markets may decline more rapidly due to local manufacturing and subsidies.

- Innovative formulations could reshape the pricing landscape but face regulatory and adoption hurdles.

- Affordability initiatives are critical to expanding access, particularly in low-resource settings, shaping future market dynamics.

FAQs

Q1: Will the price of medroxyprogesterone increase due to new formulations?

While innovative delivery systems may command higher prices initially, widespread adoption and competition are likely to stabilize prices over time, especially with patent expirations and generic competition.

Q2: How do patent expiries impact medroxyprogesterone pricing?

Patent expiries open markets to generics, leading to increased competition and significant price reductions, often by 20-50% depending on the region.

Q3: Are biosimilars likely to influence medroxyprogesterone prices?

Currently, biosimilars are less applicable to medroxyprogesterone, which is a small-molecule drug. However, similar competitive dynamics may influence future formulations.

Q4: What factors threaten stable pricing for medroxyprogesterone?

Regulatory changes, supply chain disruptions, patent litigations, and market access restrictions pose risks to price stability.

Q5: How does evolving global health policy affect medroxyprogesterone market prices?

Policies promoting affordable access and contraceptive equity can lead to price negotiations and subsidies, generally lowering prices, especially in low-income markets.

Sources:

- [1] World Health Organization. "Family Planning/Contraception Market Data." 2022.

- [2] WHO. "Contraceptive Use Worldwide." 2021.

- [3] Market Research Future. "Global Medroxyprogesterone Market Outlook 2023-2030." 2023.