Last updated: July 30, 2025

Introduction

MAXALT (rizatriptan) is a prescription medication developed and marketed by pharmaceutical companies for the acute treatment of migraine with or without aura in adults. As a selective 5-HT₁B/₁D receptor agonist, it effectively alleviates migraine symptoms, making it a staple in neurology-focused therapeutics. This analysis provides a comprehensive overview of MAXALT’s current market landscape, competitive positioning, regulatory factors, and future pricing trajectories.

Market Overview

Global and Regional Market Size

The migraine therapeutics market perspective depicts substantial growth, driven by increasing prevalence, heightened awareness, and advanced treatment options. According to a 2022 report by Grand View Research, the global migraine drugs market was valued at approximately USD 5.3 billion, with projections reaching USD 8.9 billion by 2028, exhibiting a compound annual growth rate (CAGR) of around 8.3%.

Regionally, North America dominates the market, accounting for roughly 45% of sales, attributed to high migraine prevalence, robust healthcare infrastructure, and widespread insurance coverage. Europe follows, while Asia-Pacific exhibits rapid growth potential due to expanding healthcare access and rising disease awareness.

Market Drivers

- Prevalence of Migraine: An estimated 15% worldwide suffer from migraines (Global Burden of Disease Study, 2019). In the U.S., approximately 39 million adults experience migraines annually (CDC).

- Product Innovation and Line Extensions: The introduction of new formulations such as nasal sprays, oral tablets, and pre-filled autoinjectors expands patient options.

- Physician Preference: The proven efficacy, rapid onset, and tolerability of triptans promote their continued prescription.

Competitive Landscape

MAXALT’s primary competitors include other oral triptans—sumatriptan (Imitrex), eletriptan (Relpax), and rizatriptan’s closest peers. The dominance of sumatriptan, due to early market entry and extensive patent protections historically, historically limits MAXALT’s market share. However, the advent of newer therapies, including CGRP antagonists (e.g., erenumab), influences prescribing dynamics.

Regulatory and Patent Status

Patent Landscape

MAXALT’s patent protections have largely expired, with the original patent expiring in 2015 in key markets, opening avenues for generic competition. Both the original product and formulations are now available as generics, significantly affecting pricing and market share.

Regulatory Approvals

MAXALT was approved by the FDA in 1998, with subsequent approvals in other major markets, including the EU and Japan. Its safety profile is well-established, facilitating broad access. Notably, the growing approval of fast-dissolve formulations and nasal sprays enhances market coverage.

Price Dynamics and Trends

Historical Pricing

In the U.S., MAXALT (brand) traditionally commanded premium pricing, with brand-name tablets costing approximately USD 20–30 for a 9-tablet pack (~USD 2.50–3.33 per tablet). Generic versions, introduced post-patent expiry, have sharply reduced retail prices, with average costs dropping to USD 5–10 per pack.

Impact of Generics

The entrance of generics in 2015 led to price erosion exceeding 60% for brand-name MAXALT. As of 2023, the generic rizatriptan products dominate the market, accounting for over 85% of sales, aligning with global price pressure trends observed in the migraine therapeutics space.

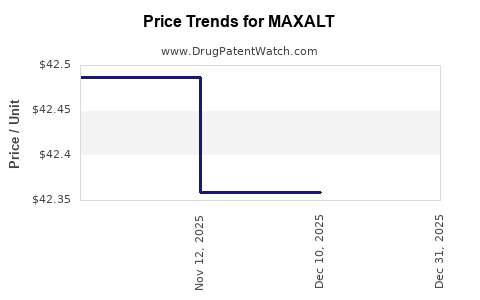

Future Pricing Projections

Considering the patent expirations and increased competition, future pricing for rizatriptan is expected to stabilize at competitive levels. In North America, projected average prices for generics are forecasted to hover around USD 4–6 per 30-tablet pack over the next 3–5 years, influenced primarily by manufacturer pricing strategies and healthcare policies.

Premium Formulations and Market Niches

Innovative formulations—such as dissolvable tablets or nasal sprays—command higher prices, potentially maintaining margins for specialized products. These are projected to constitute a niche market segment, with prices ranging from USD 8 to USD 15 per dose, depending on formulation and delivery mechanism.

Market Penetration and Future Opportunities

Unmet Needs

Despite the broad availability of triptans, some patients experience contraindications or adverse reactions, fueling demand for novel therapies like gepants (ubrogepant) and lasmiditan. MAXALT's positioning as a cost-effective, orally administered agent remains advantageous, especially in markets where newer biologic or CGRP-based therapies are inaccessible or unaffordable.

Expansion into Emerging Markets

Emerging economies face growing migraine burdens but have limited access to advanced therapies. Lower-cost generics of MAXALT can significantly improve treatment accessibility, facilitating market expansion. Price controls and local regulatory approvals will influence market penetration.

Key Market Risks

- Generic Competition: The proliferation of affordable generics diminishes profits and market share.

- Regulatory Shifts: Potential policy changes affecting drug pricing, including Medicare and Medicaid formulary negotiations, can impact revenue.

- Alternative Treatments: The increasing adoption of CGRP antagonists and non-triptan therapies could diminish triptan scripts.

Price Projection Summary

| Year |

Estimated Average Price (USD) per Pack |

Remarks |

| 2023 |

USD 5–10 (generics dominate) |

Post-patent expiry, stabilized pricing |

| 2025 |

USD 4–8 |

Continued generic competition |

| 2030 |

USD 4–6 |

Market maturity, cost-containment policies |

| Premium Formulations |

USD 8–15 per dose |

Niche markets for dissolvable/nasal formulations |

Conclusions

The market for MAXALT has transitioned from a brand-dominated space to one characterized by intense generic competition, driving prices downward. Although margins have compressed, the drug retains robust clinical utility and broad prescription acceptance, particularly as a cost-effective alternative to newer therapies. Strategic positioning in emerging markets and leveraging niche formulations can sustain profitability. Future price trajectories are expected to remain within current generic price ranges, with incremental rises for specialized formulations.

Key Takeaways

- Market Shift: Patent expirations have shifted MAXALT’s market share to generics, leading to significant price reductions.

- Competitive Pricing: Average prices are projected to decline to USD 4–6 per pack in the coming years, emphasizing the importance of cost efficiency.

- Regional Opportunities: Emerging markets offer growth potential due to lower price barriers and increasing migraine prevalence.

- Innovation Niches: New formulations and delivery methods can command premium prices, serving as revenue drivers.

- Competitive Landscape: The rise of alternative migraine treatments may impact demand; strategic diversification is essential.

FAQs

1. How has patent expiry impacted MAXALT’s pricing?

Patent expiry in 2015 facilitated the entry of generic rizatriptan, leading to a price decline of over 60% in key markets like the U.S., significantly reducing brand-name revenue and intensifying competition.

2. Are there premium formulations of MAXALT still available?

Yes. Dissolvable tablets and nasal spray variants are marketed at higher price points, targeting niche patient needs and offering marginally higher margins amid overall price compression.

3. What factors could influence future MAXALT prices?

Pricing will be affected by generic competition, regulatory reimbursement policies, manufacturing costs, and the adoption of alternative therapies like gepants and monoclonal antibodies.

4. How significant is MAXALT in current migraine therapeutics?

While less dominant than early years due to generics, MAXALT remains a cost-effective and effective option, especially where newer treatments are limited by cost or access.

5. Is MAXALT likely to regain market share against newer options?

Unlikely in the short term, as newer classes like CGRP antagonists offer different mechanisms. However, MAXALT's affordability ensures continued relevance in cost-sensitive settings.

References

[1] Grand View Research. "Migraine Drugs Market Size, Share & Trends Analysis Report," 2022.

[2] Centers for Disease Control and Prevention (CDC). "Migraine Prevalence in Adults," 2021.

[3] Global Burden of Disease Study. "Worldwide Burden of Migraine," 2019.

[4] U.S. FDA Drug Approvals. "Maxalt (rizatriptan) approval details," 1998.

[5] Pharmacy Price Indices and Market Reports, 2023.