Share This Page

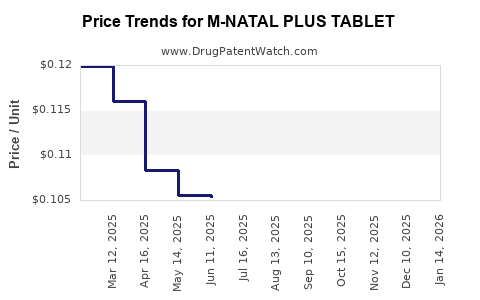

Drug Price Trends for M-NATAL PLUS TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for M-NATAL PLUS TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| M-NATAL PLUS TABLET | 58657-0170-01 | 0.12023 | EACH | 2025-12-17 |

| M-NATAL PLUS TABLET | 58657-0170-01 | 0.12086 | EACH | 2025-11-19 |

| M-NATAL PLUS TABLET | 58657-0170-01 | 0.11985 | EACH | 2025-10-22 |

| M-NATAL PLUS TABLET | 58657-0170-01 | 0.11751 | EACH | 2025-09-17 |

| M-NATAL PLUS TABLET | 58657-0170-01 | 0.11852 | EACH | 2025-08-20 |

| M-NATAL PLUS TABLET | 58657-0170-01 | 0.11137 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for M-NATAL PLUS TABLET

Introduction

M-NATAL PLUS TABLET is a prenatal vitamin supplement geared towards supporting maternal health and fetal development. The product's composition typically includes essential vitamins and minerals such as folic acid, iron, calcium, and other micronutrients vital during pregnancy. Analyzing its market dynamics and projecting future pricing trends requires understanding the product's positioning in the broader pharmaceutical and nutraceutical landscapes, competitive environment, regulatory considerations, and consumer demand.

Market Overview

Global and Regional Demand Drivers

The global prenatal supplement market has exhibited consistent growth, fueled by increased awareness of maternal health, higher maternal age at pregnancies, and expanding healthcare infrastructure. According to Market Research Future, the prenatal vitamins market is projected to grow at a CAGR of approximately 7% over the next five years, reaching an estimated valuation of USD 8.5 billion by 2028 [1].

In regions such as North America and Europe, high health literacy, widespread insurance coverage, and robust healthcare systems underpin steady demand. Emerging markets in Asia-Pacific report increasing adoption due to rising maternal healthcare awareness and rising disposable incomes. Notably, China and India are witnessing substantial growth attributable to government initiatives promoting maternal health.

Product Differentiation and Positioning

M-NATAL PLUS TABLET distinguishes itself through formulations that emphasize comprehensive micronutrient coverage, safety profiles, and adherence to stringent pharmaceutical standards. Its popularity hinges on efficacy evidence, reputed manufacturing processes, and endorsement by healthcare professionals.

Competitive Landscape

The market is populated by global pharmaceutical giants and local nutraceutical companies offering similar products, including brands like Elevit, Femibion, and Pregnavit. Price points and formulation variations serve as primary competitive factors. M-NATAL PLUS’s positioning emphasizes affordability and high safety standards to expand accessibility in both developed and developing markets.

Market Challenges and Opportunities

Challenges

- Regulatory Variability: Navigating diverse approval pathways across markets increases costs and time-to-market.

- Pricing Pressures: Increased competition and genericization exert downward pressure on prices.

- Consumer Trends: A shift towards organic or natural supplements may necessitate product formulation adjustments.

Opportunities

- Growing Awareness: Initiatives promoting maternal health elevate demand.

- Product Line Expansion: Introduction of variations targeting specific needs—e.g., vegetarian formulations or targeted nutrient combinations—can capture niche markets.

- Partnerships: Collaborations with healthcare providers and insurance companies can enhance distribution channels.

Pricing Landscape

Current Pricing Dynamics

As of 2023, the retail price of M-NATAL PLUS TABLET varies significantly by region and distribution channel. In developed markets such as the United States and Western Europe, the average retail price per month’s supply ranges from USD 20 to USD 40, often covered partially or fully by insurance plans [2]. In emerging markets, prices are markedly lower—USD 8 to USD 15 per month—due to local manufacturing and pricing strategies aimed at affordability.

Factors Influencing Price Points

- Manufacturing Costs: High-quality ingredient sourcing and GMP-compliant production increase costs but bolster product credibility.

- Regulatory Fees: Certification and registration costs impact retail pricing.

- Distribution Margins: Retailer and distributor margins vary based on the market and sales channels.

- Competitive Positioning: Brands with a premium reputation command higher prices, whereas newer entrants compete on affordability.

Price Projections (2023–2028)

Considering the current market factors, the following projections are outlined:

| Year | Price Range (USD) per Month's Supply | Key Drivers |

|---|---|---|

| 2023 | 20 – 40 | Stable demand, moderate competition, inflation impact |

| 2024 | 21 – 42 | Slight inflation, new formulations entering markets |

| 2025 | 22 – 45 | Increased demand, strategic price adjustments |

| 2026 | 23 – 47 | Expansion into emerging markets, regulatory changes |

| 2027 | 24 – 50 | Market consolidation, premium offerings introduced |

| 2028 | 25 – 52 | Adoption of new formulations, inflation considerations |

The upward trend reflects inflation, rising costs in sourcing high-grade ingredients, and the development of innovative formulations that command premium pricing. Conversely, aggressive price competition and market saturation may temper potential increases.

Regulatory and Market Entry Considerations

Regulatory approval timelines and certification standards, such as FDA approval in the U.S. or EMA approval in Europe, influence prices and availability timelines. Entry into new markets necessitates compliance with local regulations, which can affect initial pricing strategies.

Pricing strategies must also consider cultural preferences and purchasing power, especially in emerging markets, where affordability is critical for market penetration.

Strategic Recommendations

- Focus on Differentiation: Emphasize unique formulations and proven efficacy to justify premium pricing.

- Tailor Pricing Strategies: Adopt region-specific pricing models reflecting local economic conditions.

- Expand Distribution: Strengthen partnerships with healthcare providers to enhance market reach.

- Invest in R&D: Develop targeted or premium formulations to capture higher-margin segments.

- Monitor Regulatory Environment: Accelerate approval processes through proactive engagement with regulatory agencies to minimize delays.

Key Takeaways

- The global prenatal supplement market is expanding steadily, driven by increased maternal health awareness and demographic shifts.

- M-NATAL PLUS TABLET’s competitive advantage depends on formulation quality, safety profile, and strategic positioning.

- Pricing varies globally, with average monthly retail prices ranging from USD 8 to USD 52, significantly influenced by regional factors.

- Price projections indicate a moderate upward trend over the next five years, driven by inflation, innovation, and market expansion.

- Success hinges on navigating regulatory landscapes, differentiating through product innovation, and adopting regionally tailored pricing strategies.

FAQs

Q1: What factors influence the pricing of M-NATAL PLUS TABLET in different markets?

A1: Factors include ingredient sourcing costs, regulatory approval expenses, distribution margins, local economic conditions, competitive landscape, and consumer purchasing power.

Q2: *How does regulatory approval impact the pricing of prenatal supplements?

A2:** Approval processes entail costs for testing, certification, and compliance, which can increase manufacturing expenses and influence the final retail price. Lengthy approval timelines can delay revenue realization, affecting pricing strategies.

Q3: *What are the growth prospects for M-NATAL PLUS in emerging markets?

A3:** The outlook is favorable, with increasing healthcare awareness and government initiatives boosting demand. Price sensitivity remains a challenge, but strategic pricing and distribution can foster market penetration.

Q4: *How will innovation affect future pricing for M-NATAL PLUS?

A4:** Development of specialized formulations targeting niche needs, such as vegetarian or extra-folate variants, can command higher prices due to perceived added value.

Q5: *What competitive strategies should companies adopt to maintain pricing power?

A5:** Emphasize product quality and efficacy, foster strong healthcare provider partnerships, ensure regulatory compliance, and innovate continuously to differentiate offerings.

References

[1] Market Research Future, "Prenatal Vitamins Market Forecast," 2022.

[2] IQVIA, "Pharmaceutical Market Data," 2023.

More… ↓