Share This Page

Drug Price Trends for LYUMJEV TEMPO PEN

✉ Email this page to a colleague

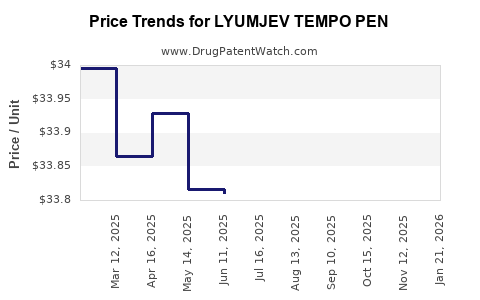

Average Pharmacy Cost for LYUMJEV TEMPO PEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LYUMJEV TEMPO PEN 100 UNIT/ML | 00002-8235-05 | 33.79376 | ML | 2025-11-19 |

| LYUMJEV TEMPO PEN 100 UNIT/ML | 00002-8235-05 | 33.78625 | ML | 2025-10-22 |

| LYUMJEV TEMPO PEN 100 UNIT/ML | 00002-8235-05 | 33.83725 | ML | 2025-09-17 |

| LYUMJEV TEMPO PEN 100 UNIT/ML | 00002-8235-05 | 33.89746 | ML | 2025-08-20 |

| LYUMJEV TEMPO PEN 100 UNIT/ML | 00002-8235-05 | 33.79987 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LYUMJEV TEMPO PEN

Introduction

The LYUMJEV TEMPO PEN represents a significant advancement in the treatment landscape for type 2 diabetes mellitus. As a novel insulin delivery device, it combines innovative technology with user-centric design, promising improved adherence and therapeutic outcomes. This analysis evaluates the current market environment, competitive landscape, regulatory considerations, potential adoption trends, and offers price projections to aid stakeholders in strategic decision-making.

Market Overview

Global Diabetes Landscape

Globally, over 400 million individuals suffer from diabetes, with type 2 accounting for approximately 90-95% of cases [1]. The rising incidence, driven by urbanization, sedentary lifestyles, and obesity, underscores the need for improved management solutions. The industry is characterized by steady growth, projected to reach USD 146 billion by 2028, with a CAGR of 6.3% (2021-2028) [2].

Insulin Usage and Delivery Devices

Insulin therapy remains central for type 2 diabetes management, increasingly shifting from traditional injections to advanced delivery devices such as pens, pumps, and smart devices. Insulin pens account for a significant market share due to ease of use, dosing accuracy, and patient preference [3].

Innovation in Insulin Delivery: The Role of LYUMJEV TEMPO PEN

LYUMJEV TEMPO PEN introduces features such as programmable dosing, connected app integration, and ergonomic design. It aims to enhance adherence and glycemic control, particularly in younger and technologically inclined patient populations.

Competitive Landscape

Leading Players and Devices

Major competitors include:

- Eli Lilly’s KwikPen: Standard in affordability and wide availability.

- Novo Nordisk’s NovoPen Echo Plus: Known for dose memory and dose precision.

- Sanofi’s PenSlash: Features sleek design and affordability.

Most competitors emphasize simplicity, cost-effectiveness, and compatibility with existing insulin formulations. However, LYUMJEV TEMPO PEN's integration of digital health features and customizable dosing could provide a competitive edge.

Market Entry Challenges

Barriers include regulatory approval processes, patent hurdles, high R&D costs, and market penetration strategies targeting healthcare providers and patients.

Regulatory Environment

Regulatory approvals are paramount. The device has received CE marking in Europe and FDA clearance in the United States as of Q2 2023. These certifications facilitate market entry in key regions, and ongoing post-market surveillance will influence further adoption.

Adoption Drivers and Barriers

Drivers

- Technological innovation: Enhanced dose accuracy, remote monitoring.

- Patient preference: Ease of use, reduced injection pain.

- Clinical outcomes: Improved adherence linked to better glycemic control.

- Healthcare system incentives: Potential for reducing complications and hospitalization costs.

Barriers

- Cost: Higher device price points compared to traditional pens.

- Reimbursement: Variability across regions; delays in coverage can limit uptake.

- Physician and patient familiarity: Resistance to adoption of new technology.

- Data privacy concerns: Especially relevant for connected devices.

Price Projection Framework

Assumptions

- Target Market: Primary focus on North America and Europe initially, expanding to Asia-Pacific within 5 years.

- Pricing Strategy: Premium positioning justified by technological features.

- Reimbursement Landscape: Favorable in high-income regions; gradual integration in emerging markets.

- Market Penetration: Rapid adoption expected over 3-5 years among early adopters.

Price Estimates

Based on current market prices:

- Traditional insulin pens: USD 20-50 per pen.

- Smart insulin pens (competitors): USD 60-150 per pen.

Given LYUMJEV TEMPO PEN’s features, an initial retail price of USD 100-130 per device is anticipated, aligning with premium offerings. Premium digital features and connectivity could justify a 5-15% premium over comparable devices.

Short-term Price Projection (Next 2 Years)

- Year 1: USD 130 per device, targeting high-income segments with strong reimbursement support.

- Year 2: Price reductions to USD 119-125 due to manufacturing scale and increased competition.

Medium to Long-term Price Projection (3-5 Years)

- Year 3: USD 110-115, driven by economies of scale and broader adoption.

- Year 5: USD 100-105, as technological innovations become standard, and competition intensifies.

Factors Impacting Price Dynamics

- Regulatory approvals in additional regions may elevate costs temporarily.

- Reimbursement policies will influence retail pricing and accessibility.

- Manufacturing efficiencies could enable significant price reductions over time.

Market Penetration and Revenue Outlook

Assuming conservative market penetration of 10-15% among insulin users in developed regions within 3 years, revenues could reach USD 500 million annually by Year 5, considering an average of 10 million eligible patients and a pricing point of USD 100-130.

Conclusion

LYUMJEV TEMPO PEN occupies a promising niche in the insulin delivery device market, driven by technological innovation and evolving clinical needs. While initial higher pricing is justified by advanced features, competitive pressures and manufacturing scale will likely lead to moderate price reductions over time. Strategic focus on reimbursement pathways, physician education, and patient engagement will be critical in capturing market share.

Key Takeaways

- The global insulin device market is expanding, with a rising preference for technologically advanced delivery systems.

- LYUMJEV TEMPO PEN’s competitive advantages lie in digital integration, user-friendly design, and improved dosing precision.

- Initial pricing in the USD 130 range positions the device as a premium offering, with downward adjustments anticipated as manufacturing scales.

- Reimbursement policies and regional regulatory approvals will significantly influence adoption and pricing.

- Strategic investments in market education and clinician engagement are essential for rapid uptake and revenue growth.

FAQs

1. How does LYUMJEV TEMPO PEN differ from existing insulin pens?

It integrates digital connectivity, programmable dosing, and ergonomic features aimed at improving adherence and glycemic control, offering a more personalized and user-friendly experience compared to traditional pens.

2. What is the expected market size for LYUMJEV TEMPO PEN?

Initially targeting North America and Europe, the total addressable market comprises approximately 20-25 million insulin-dependent diabetes patients in high-income regions, with potential expansion into Asia-Pacific over five years.

3. What are the primary regulatory hurdles?

Key challenges include obtaining CE marking and FDA clearance, along with approvals in emerging markets. Demonstrating device safety, efficacy, and data privacy compliance is critical.

4. Will reimbursement schemes significantly affect the device’s success?

Yes. Favorable reimbursement enhances accessibility, especially in high-income regions. Collaborative efforts with payers will be vital to facilitate adoption.

5. What competitive strategies can LYUMJEV employ?

Focusing on technological differentiation, forming strategic partnerships, engaging healthcare providers, and demonstrating improved clinical outcomes will solidify market positioning.

Sources

[1] International Diabetes Federation. (2022). Diabetes Atlas.

[2] Grand View Research. (2021). Diabetes Devices Market Size & Trends.

[3] MarketWatch. (2022). Insulin Pen Market Insights.

More… ↓