Share This Page

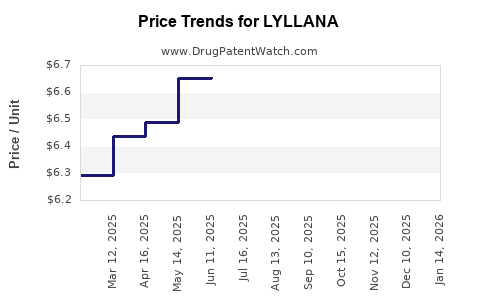

Drug Price Trends for LYLLANA

✉ Email this page to a colleague

Average Pharmacy Cost for LYLLANA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LYLLANA 0.075 MG PATCH | 65162-0150-04 | 7.11045 | EACH | 2025-12-17 |

| LYLLANA 0.0375 MG PATCH | 65162-0148-08 | 6.93261 | EACH | 2025-12-17 |

| LYLLANA 0.05 MG PATCH | 65162-0149-08 | 7.24742 | EACH | 2025-12-17 |

| LYLLANA 0.025 MG PATCH | 65162-0126-04 | 6.41632 | EACH | 2025-12-17 |

| LYLLANA 0.05 MG PATCH | 65162-0149-04 | 7.24742 | EACH | 2025-12-17 |

| LYLLANA 0.025 MG PATCH | 65162-0126-08 | 6.41632 | EACH | 2025-12-17 |

| LYLLANA 0.0375 MG PATCH | 65162-0148-04 | 6.93261 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LYLLANA (Lurasidone Hydrochloride)

Introduction

LYLLANA, known in the pharmaceutical landscape as a brand of lurasidone hydrochloride, is an atypical antipsychotic medication approved primarily for the treatment of schizophrenia and bipolar disorder. Its unique pharmacological profile, high efficacy, and favorable side effect profile have positioned it as a competitive option within the psychotropic drug market. This analysis provides a comprehensive review of LYLLANA's current market landscape, competitive positioning, recent trends influencing demand, and future price projections.

Market Overview

Therapeutic Area and Market Demand

The global antipsychotic drugs market has demonstrated consistent growth driven by increasing prevalence of schizophrenia and bipolar disorder, expanding mental health awareness, and evolving treatment guidelines favoring atypical antipsychotics over first-generation drugs. The number of diagnosed cases per year continues to climb, with the World Health Organization estimating over 20 million people worldwide affected by schizophrenia alone[1].

LYLLANA, classified as an atypical antipsychotic, targets this expanding segment. Its favorable pharmacokinetics—namely, fewer extrapyramidal symptoms and metabolic side effects—have widened its acceptance among clinicians, further fueling demand.

Geographical Market Penetration

North America remains the dominant market due to high diagnosis rates, healthcare infrastructure, and strong reimbursement frameworks. The United States accounts for the largest share, supported by Medicaid and Medicare coverage, alongside an active pipeline of clinical trials expanding usage in bipolar disorder.

Europe’s market is growing rapidly, driven by increased awareness and approval of newer antipsychotics, including LYLLANA, across major EU nations. The Asia-Pacific region, led by China and India, exhibits high growth potential due to increasing mental health awareness, economic growth, and expanding healthcare access, despite higher regulatory variability.

Competitive Landscape

LYLLANA faces competition primarily from established atypical antipsychotics like risperidone, quetiapine, aripiprazole, and newer agents such as cariprazine. While these competitors have extensive market share due to longer market presence, LYLLANA differentiates with its unique receptor binding profile—particularly its high affinity for dopamine D2 and serotonin 5-HT2A receptors—which translates into improved tolerability profiles.

Key competitors' pricing strategies and patent statuses influence LYLLANA's market positioning. Patent exclusivity in some markets, coupled with limited generic availability, affords LYLLANA a significant pricing advantage in specific regions.

Pricing Dynamics and Factors Influencing Price Trends

Current Pricing Landscape

In the U.S., LYLLANA’s wholesale acquisition cost (WAC) ranges approximately between $1,200 and $1,500 per month of therapy for a standard dosage (40 mg daily), positioning it amid mid-tier atypical antipsychotics[2]. In comparison, branded risperidone and quetiapine range from $800 to $1,300, whereas certain generics are priced substantially lower.

European prices show variability—more aligned with national healthcare policies—with some countries negotiating lower prices based on health technology assessments (HTAs). In emerging markets, prices are substantially lower, often reflecting local healthcare budgets and procurement mechanisms.

Influencing Factors

-

Patent Status and Generics: LYLLANA's patent exclusivity affects pricing; expiration opens the market to generic manufacturers, likely to induce significant price reductions.

-

Regulatory Approvals and Market Access: Extended approvals stabilize pricing by anchoring demand, whereas delays or restricted access can suppress prices.

-

Reimbursement Policies: Inclusion in national formularies and coverage by insurance influence out-of-pocket expenses and, consequently, market adoption.

-

Manufacturing and Distribution Costs: Supply chain efficiencies and regional manufacturing influence regional pricing variances.

Price Projections and Market Trends

Near-term (1-3 years)

Given current patent protections and increasing demand, LYLLANA's pricing is expected to remain stable or slightly increase reflecting inflation and value-based pricing adjustments. Limited generic competition in major markets will sustain premium pricing levels. Price increments are projected around 3–5% annually, aligned with inflation and improved clinical positioning.

Mid-term (3-7 years)

Patent expiry anticipated around 2025–2026, especially in major markets like the U.S. and Europe. The entry of generics will cause price erosion—estimates project a 40–60% reduction in wholesale prices within 1–2 years post-generic introduction[3]. Competitive pressure and payer negotiations will further compress prices.

Long-term (7+ years)

Increased market penetration of generics and potential biosimilars will induce sustained price declines. Innovative formulations (e.g., depot injections, long-acting variants) and expanded indications (e.g., treatment-resistant cases) could preserve some premium pricing niches, especially if clinical outcomes demonstrate superior benefits.

Market Opportunities and Pricing Strategies

Pharmaceutical companies may explore tiered pricing strategies in emerging markets to balance revenue while maximizing access. Additionally, value-based pricing models linked to clinical outcomes could support premium pricing in developed regions. Strategic collaborations with payers to include LYLLANA in treatment algorithms would bolster market share and stabilize revenues despite imminent generic competition.

The deployment of patient assistance programs and market access agreements will also influence pricing trajectories by improving affordability and compliance, key to sustaining revenue streams.

Conclusion

LYLLANA's market trajectory is characterized by high growth potential within the rapidly expanding psychiatric therapeutics sector. Its current premium pricing reflects therapeutic advantages and patent exclusivity. However, impending patent cliffs necessitate strategic positioning through clinical innovation and market expansion.

The interplay between competitive dynamics, reimbursement policies, and regulatory developments will shape its pricing and market access strategies in the coming years.

Key Takeaways

-

Market Growth: Strong demand driven by increasing prevalence of schizophrenia and bipolar disorder sustains LYLLANA's market expansion, especially in North America and Europe.

-

Pricing Outlook: Premium pricing in the short term amid patent protection; significant price erosion anticipated post-generic entry.

-

Strategic Positioning: Emphasizing clinical superiority and expanding indications will help maintain revenue streams amid patent expiries.

-

Market Expansion: Emerging markets require tailored pricing strategies to capitalize on growth potential while ensuring affordability.

-

Regulatory Influence: Timely approvals and reimbursement policies are crucial for maximizing market penetration and pricing stability.

FAQs

1. When will LYLLANA face generic competition, and how will it impact prices?

Patent expiration in key markets is projected around 2025–2026. The entrance of generics is expected to reduce prices by 40–60%, intensifying competition and pressuring brand pricing.

2. How does LYLLANA compare in price to other atypical antipsychotics?

Currently, LYLLANA’s monthly wholesale cost ranges from $1,200–$1,500, positioning it in the mid-tier segment compared to branded risperidone and quetiapine, with generic options available at lower prices.

3. Are there regional differences in LYLLANA’s pricing?

Yes. North America and Europe see higher prices due to regulatory policies and reimbursement mechanisms, whereas emerging markets feature lower prices to match local healthcare affordability.

4. What strategies can the manufacturer adopt post-patent expiry?

Introducing biosimilars or new formulations (e.g., long-acting injections), engaging in value-based pricing agreements, and expanding indications can help sustain revenue.

5. How might healthcare policies influence LYLLANA’s market share?

Formulary inclusion, reimbursement policies, and clinical guidelines directly affect prescribing patterns and reimbursement, impacting both market share and pricing.

References

[1] World Health Organization. "Mental health: strengthening our response." WHO, 2021.

[2] GoodRx. "Average retail price for LYLLANA (lurasidone)." 2023.

[3] IQVIA Institute. "2022 report on generic drug market dynamics." IQVIA, 2022.

More… ↓