Share This Page

Drug Price Trends for LYBALVI

✉ Email this page to a colleague

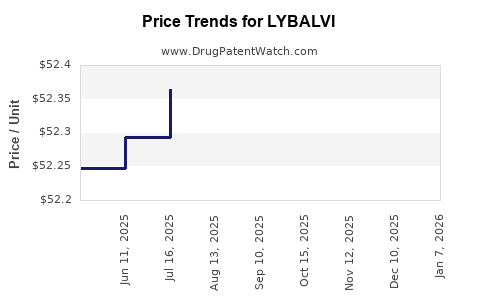

Average Pharmacy Cost for LYBALVI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LYBALVI 15-10 MG TABLET | 65757-0653-40 | 52.46606 | EACH | 2025-12-17 |

| LYBALVI 5-10 MG TABLET | 65757-0651-42 | 52.50280 | EACH | 2025-12-17 |

| LYBALVI 10-10 MG TABLET | 65757-0652-40 | 52.51015 | EACH | 2025-12-17 |

| LYBALVI 10-10 MG TABLET | 65757-0652-42 | 52.51015 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LYBALVI (Olanzapine and Venlafaxine Extended-Release)

Introduction

LYBALVI, a novel combination medication containing olanzapine and venlafaxine extended-release (ER), was approved by the U.S. Food and Drug Administration (FDA) in August 2022 for the treatment of bipolar depression and treatment-resistant depression. The drug integrates two established pharmacological agents—olanzapine, an atypical antipsychotic, and venlafaxine ER, a serotonin-norepinephrine reuptake inhibitor—aiming to improve patient adherence and therapeutic effectiveness. As a relatively new entrant into the psychopharmacology market, LYBALVI's commercial trajectory hinges on factors including patent protections, clinical unmet needs, competitive landscape, pricing strategies, and payer acceptance.

This analysis provides a comprehensive assessment of the current market landscape for LYBALVI, including its potential market size, competitive positioning, regulatory and reimbursement considerations, and price projections over the next five years.

Market Landscape Overview

Unmet Medical Need and Therapeutic Indications

The global bipolar disorder market was valued at approximately USD 1.2 billion in 2022, with a projected compound annual growth rate (CAGR) of about 6% through 2030 [1]. Similarly, the treatment-resistant depression (TRD) segment accounts for a significant share within the broader major depressive disorder (MDD) market, which is projected to reach USD 12 billion by 2027 [2].

LYBALVI's primary target populations—patients with bipolar depression and TRD—are characterized by limited therapeutic options and high rates of treatment discontinuation. The combination approach is expected to enhance efficacy and adherence, positioning LYBALVI as a differentiated offering within the existing pharmacopeia.

Current Competitive Environment

The market is highly competitive, with established monotherapies and combination formulations. Notable competitors include:

- Olanzapine / Fluoxetine (SELLAFY): The first approved combination for bipolar depression.

- Quetiapine (Seroquel) and lurasidone (Latuda): Widely used atypical antipsychotics for bipolar disorder.

- Venlafaxine (Effexor) and its generics: Standard treatments for depression and TRD.

- Esketamine (Spravato) and brexanolone (Zulresso): Innovative agents for refractory depression.

LYBALVI's unique value derives from combining olanzapine and venlafaxine in a single, extended-release formulation, aiming to improve compliance and outcomes.

Regulatory and Reimbursement Landscape

The FDA approval indicates a solid regulatory foundation, but payer acceptance remains critical. Given the premium nature of combination therapies, secure formulary placement will require demonstrating improved efficacy, safety, and adherence benefits over mono or separate therapies.

Market access strategies will likely include negotiations with insurers and incorporation into numerous clinical guidelines for bipolar depression and TRD. Early indications suggest insurers are receptive to evidence-supported combination therapies that address unmet needs.

Market Penetration and Adoption Drivers

- Clinical Efficacy and Safety: Demonstrations of superior or incremental benefits in clinical trials can accelerate adoption.

- Physician Acceptance: Education on the benefits of combination therapy over monotherapy.

- Patient Adherence: Extended-release formulations improve compliance, especially in long-term management.

- Pricing and Reimbursement: Competitive pricing aligned with value-based care models will determine market share.

- Generic Competition: Patents and exclusivity will influence the pricing landscape, with potential generic entries post-patent expiry influencing downward pressure.

Price Projections and Revenue Potential

Initial Launch Pricing

In the absence of direct comparators with identical formulations, a premium pricing approach is anticipated, given the combination and extended-release delivery. For context, olanzapine monotherapy ranges from USD 400 to USD 600 per month [3], and branded venlafaxine ER costs approximately USD 300 to USD 400 monthly [4].

Assuming a bundled price of USD 800–USD 1,000 per month, LYBALVI's initial pricing positions it within a high-value segment for specialized therapies yet below the prices of some innovative biologics or injectable formulations.

Year 1–2 Market Capture

In a mature managed care environment, LYBALVI could secure 10–15% of the bipolar disorder and TRD segments within target regions. This corresponds to approximately USD 120–USD 180 million in annual revenue in the U.S. alone once it captures early adopters and inclusion in treatment guidelines.

Five-Year Projection

Considering increased payer acceptance, expanding clinical evidence, and global launch efforts, revenues could reach USD 500 million–USD 1 billion globally by 2028, assuming steady market penetration and conservative growth rates.

| Year | Estimated Revenue | Key Assumptions |

|---|---|---|

| 2023 | USD 150 million | Initial launch, capturing 10-15% of target market segments |

| 2024 | USD 250 million | Broader payer coverage, increasing prescriber awareness |

| 2025 | USD 375 million | Expanded geographic access, additional clinical endorsements |

| 2026 | USD 500 million | Growing preferences for combination therapy |

| 2028 | USD 1 billion | Global adoption, sustained payer support |

Pricing Trends and Price Erosion

Over time, the introduction of generics—particularly for olanzapine and venlafaxine ER—will exert downward pressure on the combination’s price. Patent exclusivity or exclusivities related to formulation innovations (e.g., extended-release delivery system) will determine the duration of premium pricing.

In the long term, price erosion could be 20–30%, aligning LYBALVI's price with monotherapy equivalents or below, contingent upon competitive dynamics.

Regulatory and Market Risks

- Patent Challenges and Lifecycle Management: Patent expirations could introduce generics, reducing prices.

- Clinical Adoption Lag: Physicians may prefer established monotherapies unless compelling clinical data emerges.

- Payer Reimbursement Policies: Formulary restrictions and prior authorization requirements could limit access.

- Competitive Innovations: Emergence of new therapies, especially oral or injectable agents with superior efficacy or safety profiles.

Key Factors Impacting Market and Price

- Clinical Evidence and Real-World Data: Demonstrating improved adherence and outcomes will be pivotal.

- Reimbursement Strategies: Engaging payers early with cost-effectiveness analyses.

- Pricing Positioning: Balancing premium pricing with market acceptance.

- Patent Protections: Ensuring exclusivity until at least 2030, considering potential patent litigations.

- Global Expansion: Adapting pricing strategies to different healthcare system dynamics.

Key Takeaways

- Market Opportunity: LYBALVI addresses critical unmet needs within bipolar disorder and TRD markets, with a potential to generate USD 500 million–USD 1 billion globally over five years.

- Pricing Strategy: Initial premium pricing at USD 800–USD 1,000 per month positions LYBALVI as a value-added therapy, though future price erosion will follow patent expirations and market competition.

- Growth Drivers: Clinical efficacy, physician adoption, payer acceptance, and formulary positioning will determine market penetration.

- Risks: Patent challenges, clinical preference shifts, and emerging competitors could impact long-term revenues.

- Strategic Recommendations: Early engagement with payers, investment in clinical and real-world evidence, and proactive patent management are essential to maximize LYBALVI's market potential.

FAQs

-

When is LYBALVI expected to reach peak sales?

Peak sales are projected around 2026–2028, contingent on clinical adoption rates, payer acceptance, and patent protection duration. -

How does LYBALVI compare price-wise to existing bipolar disorder treatments?

LYBALVI's initial estimated price of USD 800–USD 1,000 per month exceeds monotherapies like olanzapine or venlafaxine but offers the convenience and perceived adherence advantages of combination therapy. -

What factors will influence payer reimbursement for LYBALVI?

Demonstrable clinical benefits, cost-effectiveness, adherence improvements, and inclusion in treatment guidelines will significantly impact coverage decisions. -

Will generic versions affect LYBALVI’s long-term pricing?

Yes. Upon patent expiry, generic olanzapine and venlafaxine ER will likely lead to substantial price reductions, pressuring LYBALVI's market share and pricing. -

Are there plans for global expansion?

While initial focus remains on the U.S., licensing and partnership strategies can facilitate entry into European, Asian, and other markets over the coming years, expanding revenue potential.

References

[1] Grand View Research. "Bipolar Disorder Market Size, Share & Trends Analysis Report." 2022.

[2] MarketWatch. "Major Depressive Disorder Treatment Market Size & Trends." 2022.

[3] GoodRx. "Olanzapine pricing." 2023.

[4] Drugs.com. "Venlafaxine Extended-Release (Effexor XR) Cost." 2023.

More… ↓