Share This Page

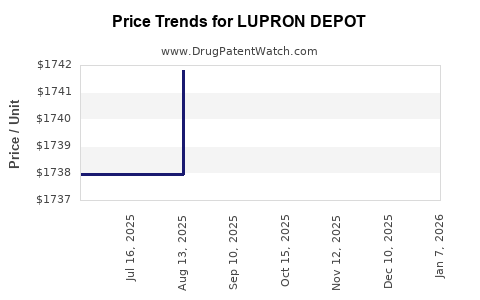

Drug Price Trends for LUPRON DEPOT

✉ Email this page to a colleague

Average Pharmacy Cost for LUPRON DEPOT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LUPRON DEPOT 11.25 MG 3MO KIT | 00074-3663-03 | 5203.86154 | EACH | 2025-12-17 |

| LUPRON DEPOT 7.5 MG KIT | 00074-3642-03 | 2070.63600 | EACH | 2025-12-17 |

| LUPRON DEPOT 3.75 MG KIT | 00074-3641-03 | 1740.66524 | EACH | 2025-12-17 |

| LUPRON DEPOT 3.75 MG KIT | 00074-3641-03 | 1739.37421 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lupron Depot

Introduction

Lupron Depot, a long-acting formulation of leuprolide acetate, is a pivotal drug in hormonal therapy, primarily used in the management of prostate cancer, endometriosis, and central precocious puberty. Its extensive therapeutic indications and substantial market presence render it a significant asset within the pharmaceutical landscape. This analysis delineates the current market dynamics, competitive environment, regulatory factors, and offers price projections that can guide stakeholders in strategic decision-making.

Market Overview

Product Profile and Therapeutic Applications

Lupron Depot operates as a gonadotropin-releasing hormone (GnRH) agonist, suppressing testosterone and estrogen production. Its clinical applications encompass:

- Prostate Cancer: As a first-line androgen deprivation therapy (ADT).

- Endometriosis: To alleviate pain and reduce lesion progression.

- Central Precocious Puberty: To inhibit premature puberty onset.

- Uterine Fibroids: For symptom management, although less prevalent.

The drug's efficacy, convenient dosing schedule (monthly, quarterly, or biannually), and established safety profile sustain its high demand globally [1].

Market Size and Revenue

In 2022, the global market for GnRH agonists, including Lupron Depot, was valued at approximately $1.2 billion, projected to grow at a CAGR of roughly 4% over the next five years [2]. The dominant players include AbbVie, Pfizer, and Ferring Pharmaceuticals, with AbbVie's Lupron Depot representing a significant market share owing to its early entry and brand loyalty.

Competitive Landscape

Key Players and Product Differentiation

- AbbVie: As the originator of Lupron Depot, AbbVie offers various formulations (monthly, quarterly, biannual), leveraging manufacturing expertise and extensive clinical data.

- Ferring Pharmaceuticals: Offers gonadorelin products and alternatives, competing primarily in biosimilar domains.

- Generic Entrants: The expiration of patent protections, notably the US Patents expiring around 2027-2028, paves the way for biosimilar and generic competition, potentially influencing pricing and market share.

Barriers to Entry and Market Dynamics

High manufacturing complexity, stringent regulatory standards, and the significant investment needed for biosimilar development pose barriers for new entrants. However, the impending patent expirations increase market pressure, potentially fostering price reductions [3].

Regulatory Environment and Impact

Regulatory authorities like the FDA and EMA uphold rigorous standards for biosimilar approval, emphasizing equivalence in quality, safety, and efficacy. The approval of biosimilars has historically led to a pricing downward trend. Recent efforts by biosimilar companies to secure fast-track or expedited pathways could influence market penetration timelines [4].

Price Trends and Projections

Historical Pricing Trends

- Brand Price: Historically, Lupron Depot’s annual treatment cost in the U.S. ranged between $30,000 and $50,000, depending on formulation and dosage.

- Biosimilar Impact: The advent of biosimilars has led to initial price discounts of approximately 20-30% in European markets, and similar trends are anticipated in the U.S. upon biosimilar approval.

Future Price Projections (2023-2028)

Considering patent expiry timelines and the increasing presence of biosimilars, the following projections are envisioned:

- Short-term (2023-2025): Prices are expected to stabilize, with minor reductions (~5-10%), as existing supply chains adjust.

- Mid-term (2025-2028): Significant downward pressure (~30-50%) anticipated, primarily driven by biosimilar introduction, competitive pricing strategies, and healthcare cost containment measures.

- Long-term (beyond 2028): Prices may plateau at approximately 40-60% below current levels, with monthly treatment costs potentially falling between $15,000 and $25,000.

Influencing Factors

- Regulatory Approvals: Accelerated biosimilar approvals could expedite price reductions.

- Market Penetration: Higher biosimilar market share correlates with steeper price declines.

- Healthcare Policies: Reimbursement policies favoring cost-effective therapies will influence pricing strategies.

- Manufacturing Costs: Advances in manufacturing efficiency may sustain margins despite lower prices.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Innovator firms should consider value-added services, formulation improvements, and patient adherence programs to maintain market share.

- Biosimilar Manufacturers: To capitalize on upcoming patent expirations, investments in manufacturing scale and market access strategies are vital.

- Healthcare Providers and Insurers: Emphasis on formulary management and affordability initiatives will influence prescribing patterns and reimbursement decisions.

Risks and Challenges

- Regulatory Delays: Lengthy approval pathways for biosimilars could retard price competition.

- Market Entrenchment: Existing brand loyalty and clinical familiarity could slow biosimilar adoption.

- Pricing Wars: Aggressive pricing by competitors may lead to unsustainable margins.

Conclusion and Recommendations

Lupron Depot remains a high-value therapy with stable demand, yet impending patent expirations and biosimilar approvals point toward future price compression. Stakeholders should prepare for an evolving landscape characterized by reduced revenues for brand manufacturers, increased competition, and a shift towards cost-effective therapies. Strategic planning should incorporate timelines for biosimilar entry, regulatory developments, and healthcare policy trends.

Key Takeaways

- Market Size & Growth: The global GnRH agonist market is valued around $1.2 billion with steady growth driven by prostate cancer and endometriosis treatment.

- Competitive Outlook: Patent expirations and biosimilar approvals are expected to reshape pricing and market share dynamics in the coming 3-5 years.

- Price Trajectory: Short-term stability with significant downward pressure from biosimilar competition projected over the next five years.

- Strategic Focus: Innovator firms should diversify value propositions, while biosimilar entrants focus on regulatory approval and market access.

- Regulatory Environment: Expedient approval pathways and healthcare policies emphasizing affordability will be pivotal in shaping pricing strategies.

FAQs

1. When will biosimilars for Lupron Depot likely enter the market?

Biosimilars are anticipated to be approved around 2027-2028, following patent expirations and regulatory approvals, which will accelerate pricing competition.

2. How much could prices for Lupron Depot decrease post-biosimilar entry?

Pricing could decline by 30-50%, accounting for market competition, with treatment costs potentially dropping to $15,000-$25,000 annually.

3. What are the main factors influencing Lupron Depot’s future market share?

Patent expirations, biosimilar approvals, physician acceptance, reimbursement policies, and formulary preferences will determine market share dynamics.

4. How are healthcare policies impacting Lupron Depot pricing?

Policies favoring generic and biosimilar use, cost containment measures, and value-based care initiatives are expected to drive prices downward.

5. What strategies can manufacturers adopt to sustain profitability?

Investing in formulation innovation, expanding indications, optimizing manufacturing efficiencies, and enhancing patient adherence programs are crucial.

References:

[1] American Cancer Society. (2022). Gonadotropin-Releasing Hormone Analogs.

[2] MarketWatch. (2022). Global GnRH Agonists Market Report.

[3] FDA. (2022). Biosimilar Development and Approval.

[4] IMS Health. (2022). Impact of Biosimilar Entry on Market Prices.

More… ↓