Share This Page

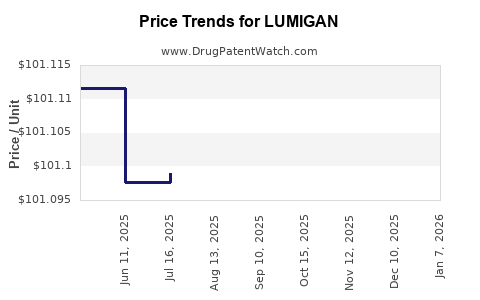

Drug Price Trends for LUMIGAN

✉ Email this page to a colleague

Average Pharmacy Cost for LUMIGAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LUMIGAN 0.01% EYE DROPS | 00023-3205-03 | 101.11170 | ML | 2025-12-17 |

| LUMIGAN 0.01% EYE DROPS | 00023-3205-08 | 101.16058 | ML | 2025-12-17 |

| LUMIGAN 0.01% EYE DROPS | 00023-3205-05 | 101.05674 | ML | 2025-12-17 |

| LUMIGAN 0.01% EYE DROPS | 00023-3205-03 | 101.10679 | ML | 2025-11-19 |

| LUMIGAN 0.01% EYE DROPS | 00023-3205-05 | 101.03844 | ML | 2025-11-19 |

| LUMIGAN 0.01% EYE DROPS | 00023-3205-08 | 101.17630 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LUMIGAN

Introduction

LUMIGAN (bimatoprost ophthalmic solution) is a widely used prostaglandin analog primarily indicated for lowering intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. Launched by Allergan (now part of AbbVie), LUMIGAN has gained substantial market penetration owing to its proven efficacy, favorable safety profile, and established brand recognition. As the ophthalmology therapeutic segment evolves, understanding the market dynamics and price trajectories of LUMIGAN is essential for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policy makers.

This analysis explores key factors influencing LUMIGAN’s market landscape, assesses current pricing strategies, and delivers projections contemplating future trends in demand, competitive shifts, regulatory impacts, and pricing models.

Market Landscape for LUMIGAN

Global Market Overview

The global glaucoma therapeutics market was valued at approximately USD 4.8 billion in 2022, with a compound annual growth rate (CAGR) of around 4.7% projected until 2030 (1). Within this segment, prostaglandin analogs like LUMIGAN command significant market share due to their once-daily dosing, high efficacy, and minimal side effects.

LUMIGAN’s primary markets include North America, Europe, and Asia-Pacific, with North America constituting over 45% of the global market share in 2022 due to high disease prevalence, healthcare infrastructure, and reimbursement policies (2). The Asia-Pacific market is witnessing rapid growth driven by increased awareness, aging populations, and rising glaucoma prevalence.

Market Drivers

- Aging Population: The global aging demographic intensifies glaucoma prevalence, especially among those over 60, expanding the target patient pool for LUMIGAN.

- Treatment Optimization: The convenience of once-daily administration enhances patient adherence, favoring LUMIGAN over less convenient therapies.

- Brand Loyalty and Efficacy: Established efficacy and safety profiles ensure continued physician and patient loyalty.

Market Challenges

- Biosimilar and Generic Competition: Patent expirations, notably in the US (expected 2024), threaten market share expansion as biosimilars and generics enter the market.

- Pricing and Reimbursement Constraints: Increasing focus on cost containment by payers limits pricing flexibility.

- Emerging Therapies: Adjacent classes, such as Rho kinase inhibitors and combination therapies, are gaining attention.

Current Pricing Landscape

Pricing Structure of LUMIGAN

LUMIGAN's pricing varies globally, influenced by healthcare policies, reimbursement schemes, and market competition. In the US, the average wholesale price (AWP) for a 3 mL bottle hovers around USD 350 to USD 400 (3). The cost per treatment course, considering daily dosing, is approximately USD 1,200 annually—placing LUMIGAN among the mid-to-high tier ophthalmic treatments.

Reimbursement Trends

Insurance coverage, particularly private insurers and government programs like Medicare and Medicaid, significantly impacts out-of-pocket expenses. In the US, manufacturer assistance programs and coupons reduce patient cost barriers, although these programs face increasing scrutiny and regulatory constraints.

Regional Price Disparities

- United States: Premium pricing due to product brand recognition, reimbursement, and high healthcare costs.

- Europe: Prices are generally lower, negotiated at the national or regional level, with some countries implementing price control mechanisms.

- Asia-Pacific: Prices tend to be lower; however, economic growth and increasing disease prevalence fuel volume-driven revenue growth.

Market Dynamics and Future Price Projections

Patent Expiration and Biosimilar Entry

The impending US patent cliff for LUMIGAN (anticipated around mid-2024) is poised to cause significant price erosion. Historical data indicates that biosimilar or generic entries typically reduce prices by 30-50% within the first 2 years post-launch (4). Therefore, a projected price drop to USD 200-250 per bottle is plausible in North America within this period.

Innovative Product Launches and Competition

Emerging therapies, particularly combination drugs (e.g., LUMIGAN combined with timolol), may influence pricing through market segmentation. However, competition from newer prostaglandin analogs such as tafluprost and latanoprost, offering comparable efficacy, could suppress LUMIGAN’s prices further.

Market Penetration and Volume Growth

Despite price pressures, volume growth driven by increasing glaucoma prevalence—projected at a CAGR of 3-4% globally—will sustain overall revenue levels for LUMIGAN in the short to medium term (5). Strategic positioning and expanded access in emerging markets will further support revenue stability.

Pricing Trajectory: Short to Long Term

| Timeline | Expected Price Trend | Rationale |

|---|---|---|

| 2023-2024 (Pre-Patent Expiry) | Stable to slight increases | Established brand, high demand, minimal competition |

| 2024-2026 (Post-Patent & Biosimilar Entry) | Sharp decline of approximately 30-50% in North America | Entry of biosimilars and generics, heightened price competition |

| 2026-2030 | Stabilization at lower price points; potential increases with new therapeutic innovations or market penetration | Market saturation, pricing pressure, but potential for value-based pricing models |

Implications for Stakeholders

Pharmaceutical Companies: Monitoring patent expiry timelines and biosimilar development is critical. Opportunities exist in innovation, differentiated formulations, and patient adherence solutions to maintain premium pricing.

Healthcare Providers: Navigating pricing dynamics and reimbursement policies will impact prescribing practices. Emphasis on cost-effectiveness analyses will become increasingly important.

Investors: Anticipating patent cliffs and market entry of biosimilars can inform valuation models. Diversification into adjunct therapies or emerging markets could offset revenue declines.

Policy Makers: Regulation of drug pricing through negotiations and value-based pricing frameworks will shape the future landscape for LUMIGAN and similar ophthalmic drugs.

Conclusions and Strategic Outlook

LUMIGAN enjoys a robust position within the glaucoma therapeutics market due to its clinical efficacy, compliance advantage, and established presence. However, impending patent expirations and rising biosimilar competition will exert downward pressure on prices, especially in mature markets like North America.

The next five years will see a significant realignment of prices, with projected reductions of 30-50% post-patent expiry. Long-term sustainability will hinge on innovation, differentiated formulations, and strategic market expansion. Stakeholders should prepare for tighter pricing margins while exploring value-added services and combination therapies to preserve revenue streams.

Key Takeaways

- Market Growth with Price Erosion: While glaucoma market expansion drives volume growth for LUMIGAN, imminent patent expiry will necessitate price adjustments, impacting overall revenues.

- Post-Patent Price Decline: Expect a 30-50% reduction in unit prices following biosimilar and generic entry, particularly in North America.

- Strategic Differentiation: Investing in formulation innovation, dosing convenience, and combination therapies can mitigate pricing pressures.

- Emerging Markets Opportunities: Expanding access in Asia-Pacific and Latin America can sustain volume growth despite price pressures.

- Regulatory Environment Impact: Policymakers’ focus on drug cost containment will influence pricing strategies and market access.

FAQs

Q1: When is LUMIGAN’s patent expected to expire, and how will it affect market prices?

The US patent for LUMIGAN is anticipated to expire around mid-2024, likely leading to biosimilar or generic entries that could reduce prices by approximately 30-50% within two years post-expiry (4).

Q2: How do biosimilar competitors typically influence LUMIGAN’s market pricing?

Biosimilars tend to accelerate price erosion due to increased competition, often resulting in significant discounts and increased market share for generic versions (4).

Q3: Which regions are expected to experience the greatest price declines for LUMIGAN?

North America will likely see the most substantial price drops, followed by Europe, as biosimilars gain market access and pricing negotiations intensify.

Q4: Are alternative therapies likely to replace LUMIGAN in the future?

While new classes like Rho kinase inhibitors and combination drugs are emerging, LUMIGAN’s established efficacy and adherence profile will sustain its market presence, although market share may decline with increased competition.

Q5: What strategies can pharmaceutical companies employ to maintain revenue streams post-patent expiry?

Innovating with new formulations, combination therapies, patient adherence solutions, and expanding into emerging markets can help offset revenue declines and preserve market relevance.

References

- MarketsandMarkets. "Glaucoma Therapeutics Market," 2022.

- IQVIA. "Global Ophthalmic Market Overview," 2022.

- GoodRx. "LUMIGAN Pricing," 2023.

- IMS Health. "Impact of Biosimilar Entry on Ophthalmic Drug Prices," 2021.

- Grand View Research. "Glaucoma Market Size, Share & Trends," 2022.

More… ↓